4 causes why India’s expanding fx heap might be a dilemma

4 min readAt the really minimum we require foreign trade to fork out for importing crude oil, the lifeline of transport and logistics. We are also import-dependent for a range of items, which includes vaccine supplies, metal and auto parts. Is there a downside to owning a substantial war upper body of dollars? It’s intricate, but yes, there are downsides. Initial, some fantastic information nevertheless.

Indication of seem economic climate

As opposed to all the big, greenback hoarding central banks – China, Russia, Saudi Arabia and Japan – we are not an export surplus nation. Considerably of their pile is the accumulation from years of earning a lot more dollars than they spend. For us, it is the opposite. We may be the only large Asian country with a present-day account deficit, i.e., we import a great deal much more than we export, and however have huge overseas trade reserves. That is creditable.

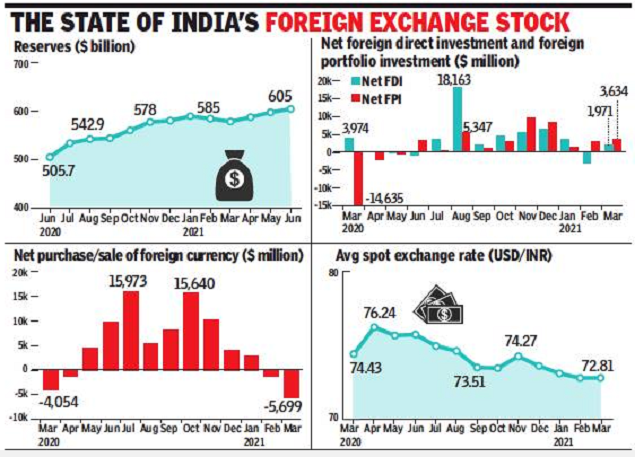

If each and every 12 months we tumble shorter of bucks, how come our currency trading inventory keeps mounting? The rationale is the present account deficit is offset by a big inflow of money flows. Pounds stream into India by overseas portfolio investors (FPI) or as foreign direct expenditure (FDI). This influx from the buy of assets like shares demonstrates the confidence of international investors in India’s advancement prospective clients.

In the past a few many years, India has captivated just about $500 billion as FDI. Over and above FPI and FDI inflows into the inventory marketplace are loans. These are known as exterior commercial borrowings. The complete outstanding overseas financial loans are $560 billion, or about 93% of our international trade reserves. That is a downside.

Fickle close friends

The inventory market place inflows, in particular FPI, can effortlessly and abruptly make an about-switch. Such investors can be fickle, or nervous, or basically riskaverse, and will pull out money at the drop of a hat, even though pulling out FDI is not that quick. Likewise, Indian firms acquiring substantial dollar obligations of limited- and lengthy-term financial loans are also a warning indication. We require sufficient bucks to at the very least fork out off the limited-expression money owed.

Even NRIs can withdraw big greenback deposits quickly. Which is what they did in 1990 when there was stress in advance of the to start with Iraq war. Also, if India’s score drops underneath financial investment grade, no international loan company would be prepared to refinance our aged loans. Our coffers will develop into empty repaying financial loans. Which is why India’s significant forex trading stock, to the extent it has fickle flows, need to not make us complacent. Unless of course our exports exceed imports, we will remain vulnerable.

Idle dollars rocks the rupee

The next draw back to a huge dollar pile is that it earns really minor curiosity. If it signifies a countrywide asset, is there a much better use for it? Third, significant overseas holdings in India’s inventory current market make its price vulnerable to ebbs and flows of foreign exchange. In truth, the rupee commonly receives stronger on times when the stock sector rises, and vice versa. Is it healthy that the acquiring power of our importers is dependent on fickle overseas traders?

‘Free money’ habit

The fourth downside is that a significant foreign exchange pile means RBI’s balance sheet will get bloated. Since the harmony sheet is calculated in rupees, it expands whenever the rupee weakens. This is “free” gain to RBI, which it can then pass on as dividends to the Centre. A quite huge equilibrium sheet sizing suggests even a slight weakening interprets into “notional” gains of thousands of crores, or financial gain for RBI.

When forex fluctuates, the gains and losses ought to commonly not be encashed. But substantial revaluation gains on rupee weakening could turn out to be a continuing source of fiscal funding for a central authorities in determined want. This can guide to fiscal “addiction” or even dilution of RBI’s independence.

Search over and above US dollar

The greenback is not our forex. Too a lot of it can turn out to be a headache. Unlike rupee credit card debt we are unable to forgive our greenback financial debt. Nations like Russia, irrespective of having substantial international reserves, are transferring away from the greenback. There are geopolitical tensions with the US, and Russia does not want to depend on New York clearing banking institutions (dollar transactions can only be cleared by US financial institutions). India should also search to diversify its forex trading holding away from the dollar, and examine the ideal size of overseas reserves for our needs.