4 motives why India’s developing forex trading heap may well be a dilemma

4 min readAt the incredibly the very least we need to have foreign trade to pay out for importing crude oil, the lifeline of transport and logistics. We are also import-dependent for a selection of objects, which includes vaccine provides, metal and car factors. Is there a draw back to getting a huge war upper body of bucks? It’s intricate, but indeed, there are downsides. Very first, some fantastic news although.

Indication of seem financial state

Contrary to all the key, dollar hoarding central banking institutions – China, Russia, Saudi Arabia and Japan – we are not an export surplus state. A great deal of their pile is the accumulation from yrs of earning extra dollars than they expend. For us, it is the reverse. We may perhaps be the only huge Asian state with a recent account deficit, i.e., we import significantly far more than we export, and nevertheless have large foreign exchange reserves. That is creditable.

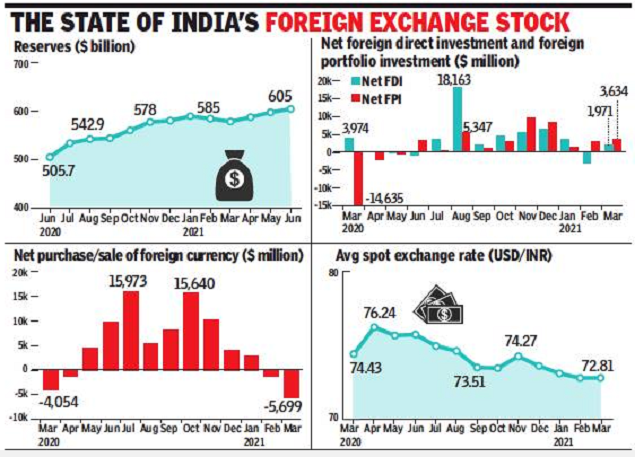

If just about every calendar year we drop quick of bucks, how come our fx inventory keeps increasing? The motive is the recent account deficit is offset by a big influx of capital flows. Dollars circulation into India via international portfolio buyers (FPI) or as overseas direct expense (FDI). This inflow from the acquire of belongings like shares exhibits the self confidence of foreign traders in India’s growth prospective buyers.

In the previous 3 decades, India has captivated almost $500 billion as FDI. Past FPI and FDI inflows into the inventory sector are loans. These are called exterior industrial borrowings. The total fantastic international loans are $560 billion, or about 93% of our overseas exchange reserves. That’s a downside.

Fickle good friends

The inventory industry inflows, specially FPI, can simply and abruptly make an about-flip. These kinds of investors can be fickle, or nervous, or basically riskaverse, and will pull out money at the drop of a hat, while pulling out FDI is not that straightforward. Likewise, Indian companies possessing massive dollar obligations of quick- and long-phrase financial loans are also a warning sign. We need plenty of bucks to at the very least pay back off the limited-phrase money owed.

Even NRIs can withdraw substantial dollar deposits out of the blue. That is what they did in 1990 when there was worry right before the initially Iraq war. Also, if India’s ranking drops underneath expense quality, no international loan company would be keen to refinance our aged financial loans. Our coffers will grow to be vacant repaying loans. That is why India’s substantial fx inventory, to the extent it has fickle flows, really should not make us complacent. Except our exports exceed imports, we will continue being susceptible.

Idle funds rocks the rupee

The second draw back to a large dollar pile is that it earns extremely minor fascination. If it signifies a countrywide asset, is there a greater use for it? Third, large overseas holdings in India’s stock current market make its benefit susceptible to ebbs and flows of forex. Without a doubt, the rupee typically gets much better on times when the inventory current market rises, and vice versa. Is it wholesome that the paying for energy of our importers is dependent on fickle international investors?

‘Free money’ addiction

The fourth downside is that a huge foreign exchange pile usually means RBI’s balance sheet receives bloated. Considering the fact that the equilibrium sheet is measured in rupees, it expands any time the rupee weakens. This is “free” gain to RBI, which it can then move on as dividends to the Centre. A very massive equilibrium sheet sizing implies even a slight weakening translates into “notional” gains of hundreds of crores, or gain for RBI.

When forex fluctuates, the gains and losses really should usually not be encashed. But large revaluation gains on rupee weakening could become a continuing supply of fiscal financing for a central authorities in determined require. This can guide to fiscal “addiction” or even dilution of RBI’s independence.

Glimpse beyond US greenback

The greenback is not our forex. Way too a great deal of it can become a headache. As opposed to rupee personal debt we cannot forgive our dollar personal debt. Countries like Russia, even with getting substantial foreign reserves, are transferring absent from the greenback. There are geopolitical tensions with the US, and Russia doesn’t want to depend on New York clearing banking institutions (greenback transactions can only be cleared by US financial institutions). India really should also seem to diversify its forex holding absent from the greenback, and study the ideal dimensions of overseas reserves for our demands.