7 Promoting & Promoting Developments in Banking for 2021

7 min readSubscribe to The Financial Model by using e mail for Absolutely free!

Financial institutions and credit history unions face far more opposition than ever right before, not only from each and every other but from the spate of fintechs, neobanks and other choice monetary vendors that have produced substantial inroads. In a time when it is more durable than at any time to capture the consumer’s eye, effective advertising and marketing and promotion go a prolonged way in client acquisition and retention. With that in thoughts, right here are seven money internet marketing tendencies to be mindful of for this calendar year and past.

1. ‘The Revolution Will be To some degree Televised’

With far more persons slicing the cable cord than at any time ahead of, as effectively as an rising variety of services that permit viewers to skip by commercials, it is no shock that advertisement paying out on tv has been steadily slipping the past numerous yrs.

In its location, advertisers are significantly throwing dollars at electronic channels, and that is what banking companies and credit rating unions must be executing too. Even throughout a pandemic, electronic promotion investing grew 12.2% yr over calendar year in 2020, in accordance to a report commissioned by the Interactive Promotion Bureau and executed by PwC.

Which is not to say fiscal establishments should be abandoning Tv set, but with much more buyers than at any time before undertaking study on items through electronic channels, it is crucial for economic entrepreneurs to target this place.

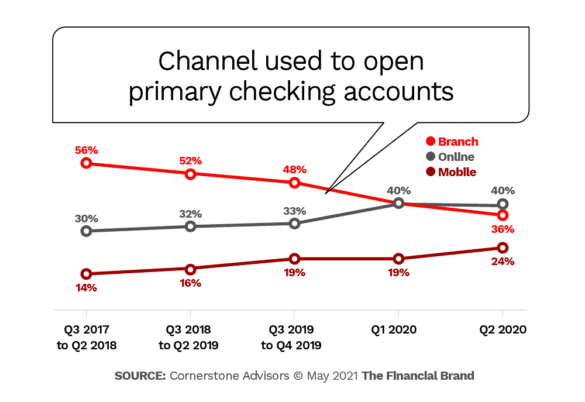

The chart under demonstrates the expanding importance of digital channels. Customers now open up accounts on the web additional usually than in-department. That implies digital promoting will be a important cog in supporting likely new customers obtain you.

2. Harnessing Significant Info

With all the facts that economical institutions have (and can receive) on their consumers, they need to be equipped to anticipate and meet up with their needs. That is the guarantee of massive data, and resources exist now to deploy it more successfully than at any time.

Financial institutions and credit unions can effectively use transaction knowledge to spot shopper habits trends. When that takes place in real-time, as is significantly feasible, the establishment can present the correct kind of assets wanted at any provided second. It is a balancing act, of training course, among hugely personalized and timely delivers and a consumer’s privateness wishes.

By relying largely on first-celebration facts, financial marketers can be extra probable to keep the proper balance. It is essential to get it proper because customers significantly assume personalised gives and communications — anything of price, in other text — in trade for use of their knowledge.

Vital Takeaway:

The more banking institutions and credit unions can use customized messaging, the extra they will stand out from the relaxation of the advertising and marketing noise.

Study More:

3. Enlightening, Interactive Material

Everybody examining this knows how significant articles internet marketing is. Nonetheless, basically building bland articles for the sake of it will not go the needle. Instead, financial entrepreneurs will need articles that can help remedy issues and breaks down complicated economical items into easy to understand bites.

Working with web research insights and investigation facts to obtain out which finance subjects consumers are having difficulties to understand “is arguably the most highly effective setting up point when setting up finance written content,” in accordance to Sensible Insights.

Accomplishing so means you will not only be helping customers and opportunity new clients, but developing search-friendly material as nicely. Building information interactive is also a huge additionally. Interactive written content allows users personalize and take part in it, which can make it extra partaking and effective, and provides it a for a longer time lifespan as properly, in accordance to the Material Promoting Institute.

Register FOR THIS Free of charge WEBINAR

Flipping the Script on Vendor Accountability to Reach New Expansion

In the next installment of the New Starts off Now collection, we discover what a new accountability product looks like in this shifting digital landscape.

Wednesday, Might 26th at 2pm (ET)

4. Social Ads Skyrocketing

Economical institutions have anything of a like-dislike partnership with social media. They know they ought to be on these platforms, but generally never know the ideal way to interact on them. When it comes to promoting on social media, banking institutions and credit score unions have to have to target the platforms that will reach the most prospective new consumers. If they do that they absolutely will have plenty of business.

Marketing spending overall on social media platforms was on a tear in Q4 of 2020. In accordance to Socialbakers, social advert paying out around the globe enhanced 50.3% compared with the same interval in 2019.

Startling Actuality:

North American brands invested in social media adverts like in no way prior to, publishing a whopping 92% raise in fourth quarter 2020.

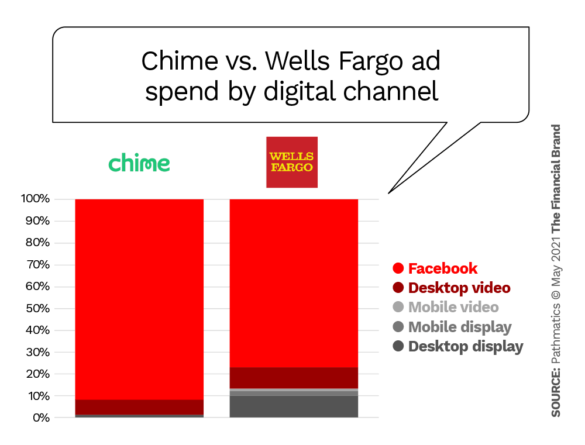

One main U.S. neobank – Chime – is using Fb to fantastic results. While Facebook in current many years has modified how financial institutions can market on its platform, Chime has succeeded applying a particular method: Focusing on girls around males, focusing on people from states with substantial populations, and Android end users in excess of iOS end users, with adverts showcasing links straight to a sign-up web page. The chart down below exhibits how Chime focuses an too much to handle portion of its social strategy on Fb, even far more than Wells Fargo, itself a massive consumer.

5. Cookie Crumbles

Major tech has not been very well known with the govt in new periods. It looks like each individual other day some tech govt is being dragged prior to a Property subcommittee to be interrogated. The most important purpose guiding this is privacy worries, even however people nonetheless willingly throng to these megasites. But privateness is a developing worry, which Google acknowledged by announcing in 2020 it will halt supporting 3rd-occasion cookies in its Chrome world-wide-web browser, and that it will develop much more privateness-minded advertisement-focusing on instruments.

This signifies fiscal marketers no more time will be able to use third-occasion knowledge to target advertisements through Google technologies, although advertisers can however use their have 1st-party knowledge with Google’s existing Consumer Match merchandise, in accordance to The Wall Road Journal. That merchandise ingests facts a buyer presents to a brand, this sort of as an email tackle, and determines no matter if it matches facts Google already has.

( Read Much more: How Google Keeps Changing Monetary Marketing )

This can be a boon to marketers, who will want to turn into additional impressive and get to consumers without having relying intensely on cookies, hyper-qualified adverts, or mass amounts of facts.

6. Out of Sight, Out of Brain?

Concerning subway adverts, Twitter promos, Television set commercials and additional, it appears you can’t go anyplace without coming across an advertisement for a fintech or neobank. Varo Lender even acquired a Super Bowl ad. But what about classic banking institutions and credit score unions?

It could be that additional set up names have a have to have to advertise fewer due to brand name recognition, and that, conversely, neobanks, have to build manufacturer recognition, normally nationally, in an progressively crowded field. Neos normally have deep pools of investor money to draw upon, as nicely.

Even now, banking vendors simply cannot rely on brand recognition or a substantial branch network to do their advertising for them. With much more fintechs ingraining by themselves in the consumer’s brain, typically with exclusive names, the harder it will be for financial establishments to gain that mindshare back.

7. Range & Inclusion

With the existing social climate in The usa now, the value of range and inclusion really should be obvious to any marketer. And it almost certainly is. But do banking institutions and credit score unions do sufficient in their promoting in this regard? According to a College of Houston review, the respond to is no. The study discovered that payday creditors are much more very likely to element persons of color on advertising and marketing products, whilst mainstream banking companies and credit score unions are more most likely to attribute white clients.

The research notes that, “while African Us citizens make up roughly 12% of the Texas population, almost 35% of the photos on payday and title-loan provider sites were being of African American versions. … On the other hand, at mainstream banks, just about 30% of the sites did not have a solitary picture of an African American model. Almost 75% of mainstream financial institutions did not attribute a single image of a Latino individual.”

Although the knowledge is only for just one state, even so, for monetary entrepreneurs, figures like this clearly show there is a wonderful option to achieve a substantial, untapped phase of the populace that is now currently being underserved.