A Stock Market Crash May Be Coming: 3 Resilient Stocks to Buy Now

5 min readMarket crashes happen. The unfortunate fact is that there’s no getting around it. If your investing experience is longer than a few years, you’ve probably experienced a couple of crashes already. Once investors recognize this truth, however, the fear of waiting for it — let alone the actual occurrence — becomes a lot less foreboding. With time to prepare and fortify their portfolios, investors can weather the storm of a market downturn a lot more comfortably than if they had neglected to prep altogether.

But how do you get ready for the market to dip? No need to worry about hitting the supermarket to buy canned goods and bottled water for this event. Instead, you’ll want to consider buying stocks that can buttress your portfolio — stocks such as American Water Works (NYSE: AWK), Royal Gold (NASDAQ: RGLD) and Waste Management (NYSE: WM).

Image source: Getty Images.

1. American Water Works

For those who are wet behind the ears regarding how to gird their portfolios against market downturns, American Water Works deserves attention. Often recognized as go-to choices for investors seeking conservative options to strengthen their portfolios, utility stocks frequently operate in regulated markets that provide them with good visibility into future cash flows. This is certainly the case with American Water Works.

Over the past three years, for example, the company’s regulated businesses segment has accounted for an average 86% of the company’s overall operating revenue. Keeping the water flowing to these customers — about 3.5 million customers in more than 1,700 communities — American Water Works is confident in forecasting how much green will flow into its coffers in the next few years. Specifically, the company expects to grow EPS at a compound annual growth rate of 7% to 10% through 2025 from the $3.91 in EPS it reported in 2020. Management’s basis for this forecast is predicated on the expectation that $9 billion in capital expenditures for its regulated businesses over the next five years will account for 5% to 7% of the projected EPS growth. The balance of the EPS growth will presumably come from the company’s market-based businesses segment and acquisitions.

2. Royal Gold

While investors often turn to utility stocks during times of market turbulence, they’re far from the only choice. Investors also dig gold stocks, for instance, as another way to bolster their portfolios. Inexperienced investors in the metals markets may assume that investing in gold requires taking a trip to the local coin gallery to pick up some bullion or buying shares of a gold mining company. This is hardly the case, though. In fact, the best opportunity for investors to gain gold exposure is by investing in a royalty and streaming company such as Royal Gold.

Whereas mining companies are the ones actually digging the yellow stuff out of the ground, royalty and streaming companies such as Royal Gold provide upfront capital to the mining companies to help finance the capital-intensive projects. Royalty and streaming companies, consequently, retain the rights to purchase a present quantity of gold (or other metal) at a reduced price, or to receive a percentage of the asset’s mineral production.

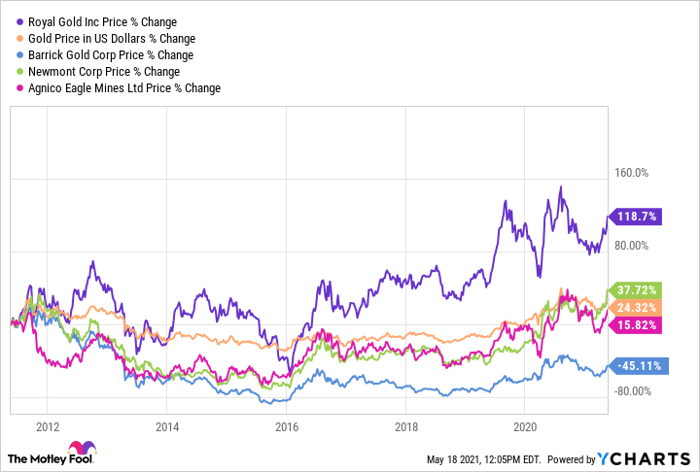

The allure of Royal Gold compared to simply buying gold coins and bars or investing in a mining company is undeniable. Over the past 10 years, for example, Royal Gold has convincingly outperformed the price of gold and leading mining companies Barrick Gold, Newmont, and Agnico Eagle Mines.

Although Royal Gold relies on the yellow metal for the majority of its revenue — about 79% in 2020 — the company also benefits from exposure to other metals, including silver and copper. Investors, therefore, could also benefit in upticks from the prices in these other commodities.

And for investors who are especially focused on companies that are in solid gold financial health, Royal Gold will glitter brightly in their eyes. The company is not overly reliant on leverage; in fact, it has a net cash position of $220 million as of the end of fiscal Q3 2021.

3. Waste Management

Obviously, it’s not only utilities that provide indispensable services to its customers. Picking up the trash of residential, commercial, and industrial customers, Waste Management is the largest publicly traded waste-management company in the United States. During a market downturn, companies will surely pinch their purse strings, but it’s highly unlikely that suspending their trash collection services are some of the ways in which they expect to cut expenses.

Starting 2021 off strong, Waste Management beat analysts’ expectations on both the top and bottom lines, reporting revenue of $4.1 billion and adjusted EPS of $1.06 in Q1 2021, while Wall Street expected the company to report sales of $4 billion and adjusted EPS of $1.01. In fact, the company exceeded its own expectations — based largely on better-than-expected synergies with recently acquired company Advanced Disposal. Based on Waste Management’s impressive performance, management upwardly revised its 2021 guidance. Whereas it had originally forecast year-over-year revenue growth of about 11%, it now expects to grow revenue approximately 13%. But wait — there’s more. Management also raised 2021 free cash flow guidance to about $2.4 billion, up from the original forecast of about $2.3 billion.

Recapping the reasons to consider these resilient names

Because market downturns occur regularly, savvy investors know the importance of finding robust stocks that can help assuage the challenges of a market crash. While utility and gold stocks like American Water Works and Royal Gold represent traditional approaches to protecting against market volatility, they’re far from the only sectors investors can consider. An industrial stock like Waste Management — providing a critical service to residential and commercial customers alike — can also buffer investors’ portfolios from market turbulence.

10 stocks we like better than Waste Management

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now… and Waste Management wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

*Stock Advisor returns as of May 11, 2021

Scott Levine has no position in any of the stocks mentioned. The Motley Fool recommends Waste Management. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.