Acciona sticks to planned renewables IPO inspite of current market volatility

3 min read

| A wind farm in Spain. Numerous renewables IPOs are prepared in the country. Source: BayWa r.e. |

Spain’s Acciona SA is sticking to a approach to checklist its renewable vitality subsidiary by the conclude of June regardless of a decidedly downbeat photograph for latest renewables IPOs in the place.

José Ángel Tejero, Acciona’s CFO, confirmed the firm’s intention to take its inexperienced vitality company community in the course of an earnings presentation May perhaps 7, two days soon after a different Spanish renewables producer shelved its planned IPO because of to share price tag volatility in the sector.

The firm, Opdenergy Keeping SA, said in a stock market filing on May perhaps 5 that it was postponing a listing, in which it was looking to raise all around €375 million, mainly because of “complicated sector situations,” in specific for renewable electrical power organizations. Orders for the inventory experienced been coming in slowly, according to Reuters, citing a source acquainted with the matter.

Opdenergy’s announcement came right after Grupo Ecoener SA, one more renewables producer based in Spain, saw its share value slip 15% on its first working day of buying and selling May perhaps 4. Shares in the organization have because recovered to a little bit earlier mentioned the listing selling price.

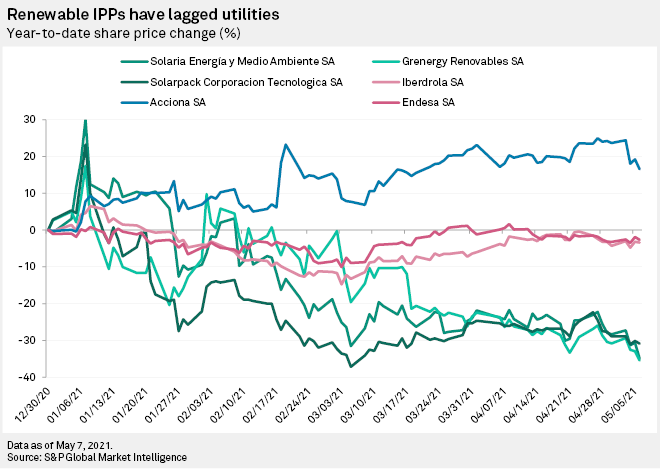

Trader urge for food in specialised renewable electrical power producers has flagged this year following a rally in 2020 drove up rates throughout the industry. In Spain, pure-participate in photo voltaic builders like Solarpack Corporacion Tecnologica SA and Solaria Energía y Medio Ambiente SA have misplaced close to 30% of their value so much in 2021, though diversified utilities that also individual grid networks and other ventures, these kinds of as Endesa SA, have been far more secure.

Acciona, which also has a broader infrastructure company, has outperformed equally segments, observing its share cost climb about 17% so considerably this year. The firm designs to spin off and listing shares of Corporacion Acciona Energias Renovables SL, the dad or mum enterprise of its renewable electrical power subsidiary Acciona Energia SA, which is lively in Spain, the U.S. and much more than a dozen other countries.

“We stay dedicated and pretty fired up about the chance to existing to the industry Acciona Energia as a stand-alone, pure-enjoy renewable power chief,” Tejero instructed analysts on the contact. The new enterprise, he stated, is “decided to be 1 of the winners in this enormous expansion opportunity that lies ahead, pushed by decarbonization.”

Shareholders authorised the approach for the IPO in April, two months soon after it was 1st announced. Acciona intends to free of charge float at least 25% of Acciona Energías Renovables’ money and desires to maintain a stake of 70% adhering to the transaction. A date for the IPO has not been set still, although Acciona claimed the IPO is “on keep track of for completion” in the to start with 50 percent of the year.

Tejero reported Acciona previously capitalized €1.8 billion of intragroup loans throughout the initial quarter, which he reported should really permit Acciona Energia to hit its paying out targets though keeping an investment decision-grade credit profile.

The firm’s vitality business observed initial-quarter product sales increase by a fifth 12 months above yr, with EBITDA up by 22% to account for 82% of the wider group’s earnings. Acciona invested €760 million in the electrical power device in the course of the quarter, additional than twice the prior-yr volume, despite the fact that Tejero mentioned the subsequent quarters must see reduced investments.

Acciona Energia has 280 MW of wind and photo voltaic crops less than development and expects to crack ground on one more 1,600 MW this yr, incorporating to an set up potential that surpassed 11,000 MW in the initial quarter. The company would like to virtually double its renewables ability to 20,000 MW by 2025, focusing on its major markets: the U.S., Australia, Spain, Chile and Mexico.

Acciona Energia’s listing is set to be adopted by supplemental renewables IPOs in Europe, as key firms find to seize a escalating quantity of sustainability-joined investments and capitalize on enthusiasm close to weather targets in a lot of nations around the world. Spanish oil and gasoline producer Repsol SA is thinking about a listing for its small-carbon organization and the board of Eni SpA, an additional oil corporation, lately permitted a related program for 2022.