Asia-Pacific economical institutions M&A fascination tracker

3 min readThis tracker addresses attainable promotions noted by media throughout Asia-Pacific in excess of a specific period of time. The information and facts is collected from a variety of news sources, excludes confirmed offers and is restricted to prospective acquisitions or revenue involving businesses or functions in the location. Click listed here to read the previous month’s report.

Australia and New Zealand emerged as dazzling spots for likely deals in Asia-Pacific’s fiscal sector in March, as Westpac Banking Corp. kicked off a evaluation of its New Zealand organization and suitors lined up for the probable order of Commonwealth Lender of Australia’s standard insurance plan company.

Westpac, Australia’s third-largest financial institution by property, said it was looking at a doable demerger of its New Zealand business enterprise as component of its overview about an suitable structure for the company. The bank’s March 24 announcement came soon after the New Zealand central lender flagged considerations around Westpac New Zealand Ltd.’s possibility governance procedures and demanded it to fee two unbiased reviews to handle the concern.

Westpac stated it was in the pretty early phases of its assessment and that it has manufactured no selections but.

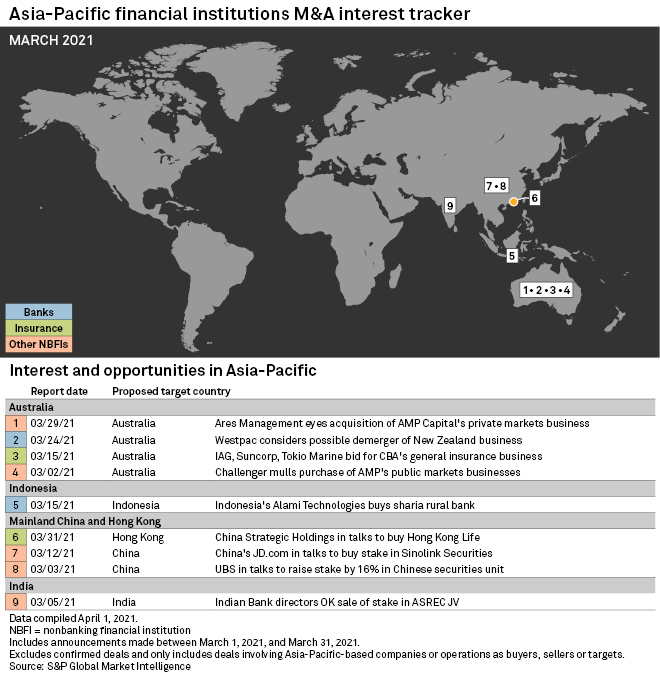

Below is a snapshot of March experiences of possible deals compiled by S&P World Market place Intelligence

On the insurance policy aspect in Australia, Coverage Australia Group Ltd. and Suncorp Team Ltd. are said to be leading the race among the shortlisted suitors for CBA’s standard insurance coverage enterprise, Insurance Business NZ described, citing a report from The Australian. Japan’s Tokio Maritime Holdings Inc. is also between the shortlisted suitors. Closing bids are because of in April. The report also cited, with fewer certainty, QBE Insurance policy Group Ltd. as a shortlisted bidder.

Independently, Australia’s AMP Ltd. garnered deal-relevant headlines through the thirty day period. U.S.-based Ares Management Corp. expressed interest in attaining 100% of AMP Capital’s non-public business markets business following the end of the company’s 30-day exclusivity time period with AMP. The March 29 announcement arrived after Ares in late February agreed to acquire 60% of the personal marketplaces firms of AMP Capital for A$1.35 billion. It also followed The Australian Fiscal Critique‘s report that Challenger Ltd. was looking at purchasing AMP Capital’s public markets enterprises.

Meanwhile, owners of Hong Kong Everyday living Insurance Ltd. are said to be producing their 3rd endeavor to obtain a consumer for the enterprise. Hong Kong Lifetime has captivated possible suitors, and Bloomberg Information cited unnamed resources as declaring China Strategic Holdings Ltd. was in talks to get the business enterprise, which could be valued amongst $400 million to $500 million. The discussions ended up explained to be ongoing and no closing choice had been manufactured.

In China, JD.com Inc. was said to be in early-stage conversations to receive a portion or all of Yongjin Group’s 27% stake in Sinolink Securities Co. Ltd. A 27% stake in Sinolink was truly worth all over 10 billion yuan, centered on the brokerage’s sector worth of 39 billion yuan on March 11.

In Southeast Asia, wherever opportunity deal action remained reasonably muted in March, Indonesian peer-to-peer loan company PT Alami Fintek Sharia, or Alami Technologies, reportedly obtained Sharia-compliant rural bank PT BPRS Cempaka Al-Amin in a transaction valued at a lot less than $10 million, DealStreetAsia described.

Even further content about other offer possibilities

UBS in talks to elevate stake by 16% in Chinese securities unit

Indian Bank directors Ok sale of stake in ASREC JV