Best stock trading platforms in 2021

7 min readHigh investment minimums and transaction fees were once major barriers to entry for new investors, but the rise of online trading platforms has made investing more accessible than ever. Contemporary investing tools offer affordable trading and a variety of helpful features for both novice and expert traders.

In this article, we’ll take a look at five of the best stock trading platforms for investors to consider in 2020 and beyond. While each one provides unique pros and cons compared to the others, you can’t go wrong with any of these services.

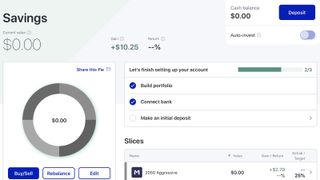

M1 Finance is one of the most popular online investment platforms, and it’s easy to see why so many users prefer it over more traditional options. Along with powerful free investment tools, the platform also has checking accounts, debit cards, loans, and other financial services.

You can access M1 Finance through the web client or the mobile app, available for both iOS and Android devices. Regardless of the device you’re using, M1 Finance has a clear, simple design that makes it easy to find what you’re looking for.

Furthermore, most of M1 Finance’s features can be used for free. There are no transaction fees, most accounts can be opened with as little as $100, and the platform even offers fractional shares. That said, retirement accounts do require a minimum initial investment of $500.

M1 Finance also provides an optional premium subscription for $125 per year. M1 Plus comes with 1% cashback and 1% APY on checking accounts, 1.5% off the typical loan rate, and access to the afternoon trade window for investors. None of these features are necessary to use the service, so you can always start with a free account until you decide whether to upgrade.

The M1 Finance investing tool makes things simpler for all investors, regardless of their experience. Portfolios are visualized through a pie chart, and it’s easy to adjust the relative size of each asset. Users can develop their own “pies” using stocks and funds or choose from a variety of pre-built expert pies, including target-date funds and various stock/bond allocations. All things considered, M1 Finance is an excellent option for most investors in 2020.

Robinhood is the most popular investing app on the App Store, and it can also be downloaded through Google Play or accessed online. While it’s a functional platform for experienced investors, its features are generally designed for people who are relatively new to investing.

The service is introducing the ability to invest in fractional shares, which can be extremely convenient for more expensive stocks. Robinhood is currently in early access and should receive a full rollout in the near future.

Users can open an account without any investment minimums. Like M1 Finance, Robinhood doesn’t charge fees on buys or sells. Furthermore, the website provides helpful articles on a wide range of basic trading topics. These factors make it one of the most accessible options for people who are just getting started with investing.

Robinhood isn’t limited to stocks, ETFs, and options. In contrast to M1 Finance and many other services, Robinhood has decent options for people who want to invest in cryptocurrencies. The platform currently supports the following currencies:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin SV (BSV)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

However, one of the key downsides of Robinhood compared to other investing platforms is that it doesn’t offer 401(k)s, IRAs, or any other retirement accounts. These accounts provide substantial tax benefits, so they’re often the most cost-effective way for new investors to get started. Furthermore, there’s no support for foreign exchange trading or certain common assets, such as bonds and mutual funds.

Unlike M1 Finance and Robinhood, Fidelity is a brick and mortar brokerage firm with more than 100 locations throughout the United States. That said, it still offers highly competitive investing features for online users, and it’s another excellent option for all investors.

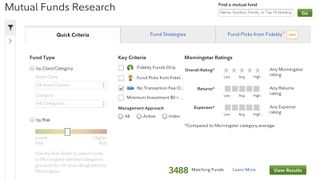

Fidelity has a generally reasonable fee schedule, with no minimum investment for many account types, including IRAs and brokerage accounts. It also offers support for fractional shares and a wide range of assets, such as stocks and bonds, mutual funds, CDs, ETFs, and forex. Unfortunately, Fidelity doesn’t enable users to invest in cryptocurrencies.

Market research is one of the main benefits of Fidelity, compared to platforms that focus on providing a simple investment platform. Along with collecting news from a variety of sources, Fidelity also offers deep research tools for several asset types.

Although Fidelity doesn’t specifically target newer investors like Robinhood, its interface is still clear enough for any trader to learn quickly. Both the website and mobile app do an excellent job of simplifying a wide range of tools and options into a relatively simple design.

Furthermore, while Fidelity is a perfectly functional option for online users, you can get even more benefits if you live near a physical location. It’s easy to set up an appointment for financial advising or a variety of other services, and Fidelity runs a wide range of seminars and other educational events for investors. That said, you can also learn the basics of investing through the FAQs located on the website.

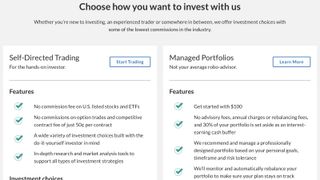

Ally is an online bank with numerous financial services, including checking accounts, savings accounts, and loans. Ally Invest offers accessible investing tools with self-directed and managed accounts available for both novice and experienced traders.

The bank’s investment platform supports many common asset types, including commission-free stocks, ETFs, and options, as well as bonds and mutual funds. It’s also compatible with several retirement accounts, such as Traditional, Roth, and SEP IRAs.

Unlike M1 Finance and Robinhood, Ally Invest provides full support for forex trading 24 hours a day on weekdays. Along with its deep selection of assets, this feature makes Ally Invest substantially more flexible than many other online stock trading platforms.

Managed portfolio users can quickly find the perfect portfolio for them based on their unique financial goals and risk tolerance. Similarly, Ally Invest offers powerful market research features to help traders make the right choices and identify smart investments. It’s easy to find past performance, company data, and other critical information before making any investment decisions. Managed portfolios are charged an annual advisory fee of 0.3%, and the minimum balance is $100.

E*Trade is an established online stock platform that’s designed to help new investors get started and make the right decisions. There are no fees on buying or selling stocks, and users can start investing without any account minimums. While E*Trade doesn’t support crypto or forex trading, it still has a decent selection of assets, including stocks, futures, options, and ETFs.

E*Trade offers professionally managed accounts called Core Portfolios. These require a minimum deposit of at least $500. Like Ally Invest managed portfolios, Core Portfolios give investors the opportunity to customize their investments depending on their financial priorities. They also come with an identical advisory fee of 0.3% per year.

Furthermore, E*Trade provides excellent resources for novice investors, including a deep Knowledge section that covers everything from trading basics to planning for taxes. Even if you want to manage your own account, you can still get investment advice by contacting E*Trade directly.

With competitive pricing, a varied selection of assets, and educational tools for new traders, E*Trade is the perfect way to start investing. That said, users interested in crypto or forex trading will need to look elsewhere.