Cell household dwellers hit even harder when struggling with eviction

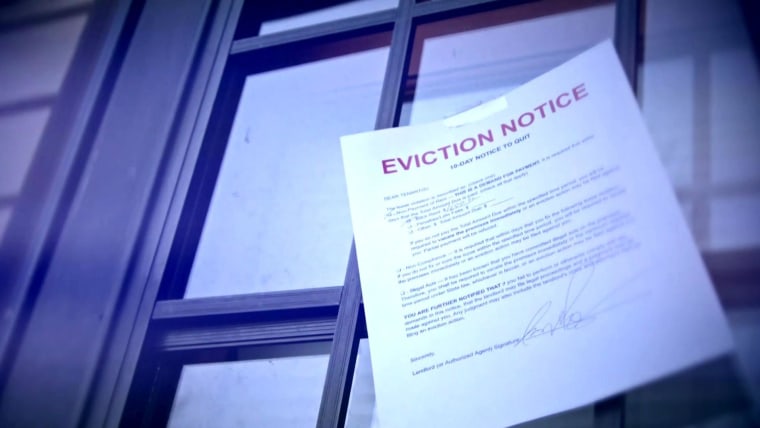

4 min readChris Larson was preparing lasagna for Xmas Eve meal previous 12 months when somebody knocked on the door of the cell property he owns with his fiancée, Kirsten Brokaw, and three little ones in Exceptional, Wisconsin. An apologetic person dressed in jeans and a jacket stood at the doorway, handed him a stack of papers and said he was being evicted. He reported the family members had to depart by Jan. 20.

“We had been utilizing up all the money we had to pay back down our ton rent,” Larson stated. “We tried to preserve up the finest we could until then.”

Like hundreds of thousands of other folks nationwide, Larson and his soon-to-be wife fell behind on hire final yr as the coronavirus ripped across the place. The family’s financial troubles started when Brokaw suffered a stroke in March, leaving her not able to do the job. A few of months afterwards, Larson misplaced his career as a truck driver. By December, the family members experienced fallen 4 months driving on rent and owed more than $4,700 in overdue whole lot payments, taxes and late charges to the cellular dwelling park’s owner, called Homecroft Cell Residence Park, according to court files reviewed by NBC News.

“I’m going to drop my property in excess of a several months of lot hire,” Brokaw reported. “I come to feel like we are dropping it all and all the really hard operate we did that obtained us to this place.”

Homecroft Mobile Residence Park, which is shown on the web-site FostoriaReserve.com as a person of its 3 communities in Ohio and Wisconsin, declined to remark on the situation.

Economical housing advocates have celebrated the Biden administration’s extension of the Facilities for Ailment Control and Prevention’s moratorium on evictions as a essential go that could assistance people today fight to stay in their houses as the pandemic continues to intestine the overall economy. But the buy involves loopholes that fiscally stretched landlords have been able to use to clear away tenants who drop driving on hire. Housing advocates say just one of the most difficult-strike teams has been mobile household park dwellers like Brokaw and Larson, who were being currently surviving with a constrained security internet to drop back on. Ahead of the pandemic, lots of cell residence residents, like Brokaw and Larson, experienced juggled shelling out for their cell homes and for the lots they sat on. When they locate themselves struggling with eviction, they danger shedding not only the large amount but also their dwelling equity.

“In many situations, the tenant has 30 days to leave the ton. But how do you expect anyone to fork out a tow business $5,000 to $10,000 to detach their home from the house and reinstall it someplace else?” stated Stuart Campbell, a staff members attorney at Authorized Help of NorthWest Texas, who has been performing on a steady stream of cell property eviction circumstances by way of the pandemic. “Frequently when they are evicted for great deal rent, they’re forfeiting the equity on the home. You could get rid of your household for $1.”

Starter households

Just before the pandemic, created homes, the fashionable expression for cellular homes, had develop into progressively well-known housing solutions for family members with confined signifies who were being searching for the features of the suburbs on modest budgets, Campbell mentioned. For an typical of fewer than $1,000 a thirty day period in most pieces of the place, a spouse and children can reside in a 1,400-square-foot, pet-friendly residence with a driveway, a property and, possibly, a group swimming pool or a park, in accordance to the Manufactured Housing Institute, an sector trade business. With extensive backlogs for inexpensive housing, a lot of households having difficulties fiscally have identified manufactured homes to be compelling alternatives.

“You get much more bang for your buck,” Campbell explained.

There are 8.5 million created households in the U.S., practically 10 percent of the country’s housing stock, in accordance to the Created Housing Institute. The median family revenue of a loved ones living in a manufactured housing park is $30,000 a 12 months, in accordance to the institute.

“There are quite a few determinants on where by you dwell — I want to be near to family, I want to be near to my work,” said Kevin Borden, government director of MHAction, a nonprofit that advocates for made housing tenants. “And there also all all those non-aspirational determinants — suppressed wages, absence of entry to credit history for females and females of colour. Made dwelling communities definitely are this exceptional very affordable landing place no matter what fuels your choice.”

Discovering space

The Exceptional property marked a new commencing for Larson and Brokaw. The couple had been living in a a few-bedroom condominium with their small children in Carlton, Minnesota. But Brokaw was identified to obtain a bigger dwelling for the relatives. She worked 100 to 120 hrs a 7 days as a home health aide right up until she was 38 months pregnant with her youngest daughter to help you save income.

When Brokaw and Larson identified the Fostoria Reserve Homecroft Mobile Household Park, they had been hopeful. They moved into a four-bedroom, two-tub household in a harmless and handy neighborhood in a sound school district. The great deal payment was about $525 a thirty day period, and the park offered financing to obtain the $52,000 home by means of 21st House loan at $525 a thirty day period.

But what seemed like a steady economic path to possess their household quickly unraveled in the pandemic-stricken economy. If they are evicted, they will have tiny recourse to get better the roughly $12,000 they have by now invested in paying out for their dwelling.