Charges mount in Texas energy market place following freeze sends prices soaring

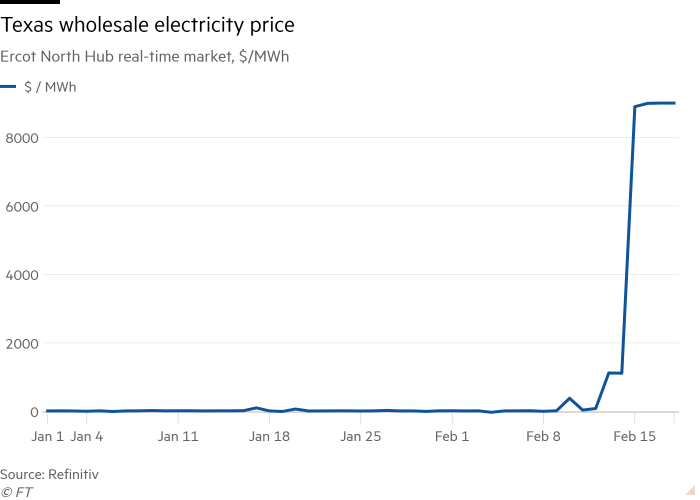

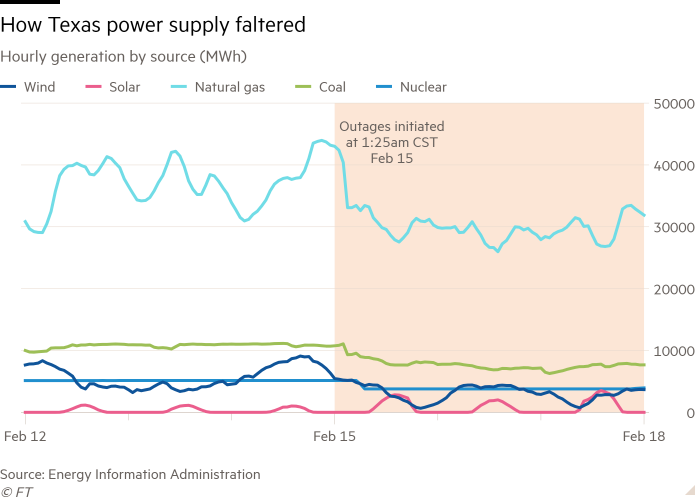

6 min readWhen a deep freeze shut down 50 % the electricity generation capability in Texas this week, the wholesale price of energy exploded 10,000 per cent, with the monetary implications now staying felt all the way from person homes to massive European electrical power businesses.

Astronomical expenditures deal with clients who opted for floating-amount contracts tied to wholesale price ranges in the state’s freewheeling electrical current market.

The organisation that runs the wholesale market is generating individuals write-up much more collateral to include what could be a wave of defaults.

And RWE, the German utility, disclosed a decline on frozen Texas wind farms that could be as much as 15 for every cent of its annual working earnings forecast.

As the lights flicker back on this weekend, the monetary cost is just beginning to be counted.

The wholesale energy selling price was at the maximum allowable $9,000 a megawatt hour for five times from past Sunday. For a household, that translates to a $9 a kilowatt-hour electrical energy price, as opposed with a normal cost of 12 cents.

Governor Greg Abbott held an emergency meeting on Saturday with senior point out officers and legislators to talk about aid for consumers hit by spiking bills. “It is unacceptable for Texans who suffered through times in the freezing cold without the need of electricity or warmth to now be hit with skyrocketing vitality prices,” explained Abbot.

Two times weekly e-newsletter

Vitality is the world’s indispensable company and Power Supply is its publication. Every single Tuesday and Thursday, direct to your inbox, Strength Supply provides you necessary news, ahead-pondering analysis and insider intelligence. Indicator up below.

In Burleson, a suburb of Fort Truly worth, Valerie Williams has been charged more than $6,000 by her electricity retailer Griddy to energy her 1,400 sq ft dwelling more than the previous handful of days. As the storm approached, Griddy explained to its clients to change to a lot more usual fastened-level programs from other suppliers, but not absolutely everyone did, given that there was minor indicator of just how serious rates would become.

Griddy was charging her credit history card a number of periods a day, Williams claimed. She struggled to find a new provider throughout the disaster just before last but not least determining a single that would change her services on Friday.

“I’m guessing it will be close to $7,000 by the time we get moved,” she mentioned of her bill. Griddy did not reply to requests for comment.

Stress on electrical energy stores

Some electricity merchants offering to clients whose neighbourhoods had been spared blackouts now confront money pressure, obtaining been forced to purchase additional electrical power in the location current market to meet up with unforeseen demand from customers.

Their credit history has worn slim with the electrical power traders that give them obtain to the market, these as BP, Royal Dutch Shell, the French utility EDF and Macquarie, the Australian bank, sector executives claimed.

The stress is hinted at in data presented to the Financial Occasions from the Electric powered Dependability Council of Texas (Ercot), which operates the wholesale electrical power marketplace and serves as the central counterparty for transactions.

It demanded firms write-up much more collateral as selling prices soared. Cash held in its collateral pool arrived at $4.2bn on Monday, up from $600m two months right before, as its calculation of credit history exposure soared.

$50bn

Texas wholesale energy sales this 7 days

Ercot declined to supply extra the latest data, but the price was probably to have developed sharply more than the 7 days, considering the fact that it is based on a system that encompasses ordinary costs above the previous many times, traders mentioned. Ercot hosted a document $50bn in income throughout the week, mentioned BloombergNEF, a study team.

On Friday, the town council in Denton, Texas, met to approve unexpected emergency borrowing to cover $300m the metropolis-owned utility would fork out Ercot this week — additional than quadruple its buys in whole-yr 2020.

No matter if the collateral demands have pushed any teams to the fiscal brink will only emerge in the coming days and months.

Late on Friday, Ercot introduced it would modify collateral for investing counterparties on a scenario-by-scenario basis, “in an attempt to defend the over-all integrity of the Ercot market place by mitigating the disruption of defaults”.

‘You might have super-winners’

As properly as monetary casualties, there will also be winners, though.

Stores whose prospects were amid the hundreds of thousands who suffered outages may possibly have scored a windfall if they had purchased ability in advance of time when selling prices ended up lessen, stated Trent Crow, main executive of Authentic Straightforward Electrical power, a Houston-centered household electric power broker. They might have sold offer they did not will need back again to the wholesale marketplace this week at a big revenue.

“You could possibly have merchants that go bankrupt, but perversely, you may have retailers that occur out tremendous-winners. We will not know that for a couple weeks,” Crow explained.

7%

NRG Strength share rate decrease this 7 days

Some organizations individual both electrical energy vendors and electric power vegetation, balancing the challenges. Inventory market place investors have been having to pay certain focus to Vistra and NRG Electricity, large merchant electricity producers that in between them very own the the greater part of Texas’s electric power retailers.

Irving-based mostly Vistra owns 18 normal fuel, coal and nuclear-fuelled power plants in the Texas market accounting for practically 19 gigawatts of output. It claimed crops totalling 1GW of potential have been “not able” to develop electric power and other folks have been “capacity constrained” due to lower gas supplies. But traders, optimistic the firm was however capable to promote sufficient electrical energy into the restricted market, drove Vistra’s shares up 6 for every cent this week.

NRG, which owns a dozen Texas gas, coal and nuclear producing units with a capacity of 12GW, mentioned that “power generation from fossil, renewable, and nuclear resources were being all impacted by the cold”. NRG’s shares fell 7 per cent on the 7 days.

Casualties in wind power

Some wind energy producers ended up between the fiscal casualties of the crisis. Turbines accrued ice as they spun in cold, sleet-loaded skies — missing the heating kits that are conventional difficulty further more north — and their energy creation fell.

That was a individual trouble for wind farms that have contracts with Wall Street banks requiring them to deliver a set amount of money of energy each hour, explained Joan Hutchinson, managing director at Marathon Money, an strength and infrastructure investment bank. Those people not able to make it have to have to acquire it on the open industry.

RWE stated some of its Texas wind fleet went offline on February 9 mainly because of ice and grid difficulties. Possessing offered a portion of power production in advance, the outages intended “the enterprise experienced to invest in these volumes to fulfil its supply obligations” at charges of up to $9,000 a MWh.

The estimated price of €100m- €500m would account for a major chunk of earnings, which RWE forecast in the range of €2.7bn-€3bn for 2020, according to S&P World Marketplace Intelligence.

Canada-based Innergex Renewable Strength warned of a C$44m-C$60m strike to its Texas wind farms owing to “contractual obligations to source a pre-determined day by day generation”. The business was exploring pressure majeure, a clause that can break a deal by invoking incredible circumstances such as pure disasters.

Wind projects ordinarily have credit rating strains from banking companies to enable them to go over unexpected costs, Hutchinson said, but for many companies these ended up now stretched. “They’re truly caught in a bit of a credit history crunch,” she claimed.

Some regular Texans also felt pressure. As Valerie Williams place it: “We now have to figure out how on earth to pay this monthly bill.”