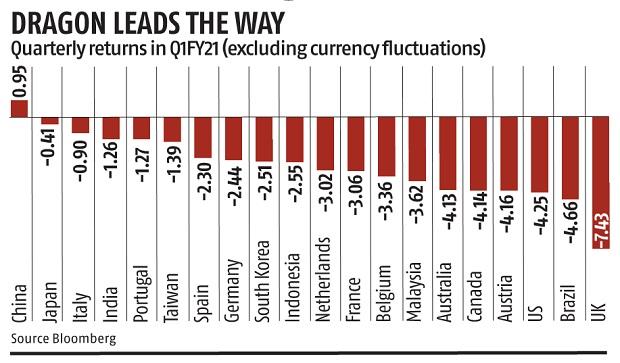

China’s governing administration bonds only one to acquire among the largest markets in rout

3 min readChina’s government bonds outpaced their competition in the very first quarter, as their haven standing helped them stand out as a bulwark amid the global slump. Japan’s securities led among produced nations, although nonetheless handing investors a narrow decline.

The two north Asian markets helped investors preserve price as indications of a burgeoning global restoration amid the rollout of vaccines pushed up financial debt yields around the planet.

A Bloomberg Barclays index of world-wide bonds slid 5.5 for every cent in the very first a few months of the calendar year — the worst quarter in four several years.

China and Japan experienced one more matter in their favour — they had the lowest volatility among 44 financial debt marketplaces tracked by Bloomberg.

Chinese sovereign bonds rose 1 for each cent in the first quarter, the only ones to increase between the 20 most significant global financial debt markets, primarily based on details on the Bloomberg Barclays indices.

Their deficiency of correlation with overseas bonds worked in their favour as it made an different for investors to park cash in, amid the financial debt sell-off.

The securities built the bulk of their quarterly get in March, when they rose .9 for each cent, as they bounced again from before weak spot brought about by problem about probable tighter funding.

“The financial debt tumbled as well immediately right before the Lunar New Calendar year getaway, as traders bet the People’s Lender of China would tighten liquidity,” explained Tommy Xie, head of Higher China investigation at Oversea-Chinese Banking Corp in Singapore.

“Now, with tighter monetary plan being priced in, the bonds have develop into resilient and steady.”

BOJ backing

Japan’s bonds handed traders a decline of .4 for every cent, but that put them easily at next spot. Declines were being restricted by the Bank of Japan’s motivation to hold yields minimal and steady. They were being also supported by the nation’s top-quality external equilibrium.

“Japan and China equally have large latest-account surpluses, which give stable nearby funding for authorities expenses and continue to keep bond industry volatility in check,” claimed Kiyoshi Ishigane, main fund supervisor at Mitsubishi UFJ Kokusai Asset Administration Co in Tokyo.

Expensive Reader,

Expensive Reader,

Organization Common has generally strived tough to supply up-to-day information and facts and commentary on developments that are of desire to you and have wider political and financial implications for the region and the globe. Your encouragement and consistent responses on how to increase our featuring have only made our solve and dedication to these ideals stronger. Even throughout these tricky times arising out of Covid-19, we keep on to stay fully commited to retaining you informed and up to date with credible news, authoritative views and incisive commentary on topical problems of relevance.

We, nonetheless, have a request.

As we battle the financial effect of the pandemic, we need to have your aid even additional, so that we can carry on to offer you you additional quality material. Our membership model has viewed an encouraging response from numerous of you, who have subscribed to our on line content. Much more membership to our on the net information can only enable us obtain the ambitions of giving you even greater and extra suitable content. We imagine in free, reasonable and credible journalism. Your aid as a result of extra subscriptions can aid us practise the journalism to which we are fully commited.

Aid good quality journalism and subscribe to Enterprise Conventional.

Digital Editor