Deconstructing Push Observe 3 (2020 Series) of the FDI Plan: Stability, Clarity and Exiguity

7 min readThe Federal government of India (“GOI”) revised its overseas direct financial investment (FDI) plan vis-à-vis its neighbours, primarily China, to reduce opportunistic takeovers of Indian companies throughout the world-wide pandemic, vide Press Observe No. 3 (2020 Series) dated April 17, 2020 (“PN3”) which was reiterated in the Consolidated FDI Coverage, 2020, helpful from October 15, 2020 (“FDI Plan”).

As per the FDI Plan, FDI might be received possibly under automated route or approval/governing administration route, dependent upon the sector in which the entity acquiring FDI is engaged. Prior to PN3, only FDI proposals from Bangladesh and Pakistan demanded the approval of GOI. The sweeping change created by the GOI mandates that FDI would be permitted from all neighbouring international locations to India (with whom India shares a land border) only immediately after obtaining acceptance of the GOI, even in sectors exactly where “automatic” clearances were formerly permitted. PN3 also extends to people investors from nations around the world that do not share a land border with India if this sort of traders have immediate or indirect useful owners resident in a place that shares a land border with India. Also, investment by citizens of Pakistan and entities included in Pakistan in defence, room, atomic power and other sectors/actions prohibited for international expenditure remains entirely prohibited as earlier. Even though PN3 does not assault existing FDI, any improvements in the ownership of the existing FDI – irrespective of quantum – would also have to have clearance from the GOI.

Rule 6(a) of the Overseas Trade Management (Non-Debt Instruments) Policies, 2019 (“NDI Principles”) was amended to give outcome to PN3. PN3 and the modification to the NDI Policies mirror that investments from any country sharing a land border with India or useful proprietor of any these types of entity positioned in these kinds of countries have to get hold of prior approval of GOI for FDI.

In this posting, we endeavor to deconstruct and critically analyse PN3, the consequent modification to the NDI Rules and the procedure for filing an FDI acceptance software in this respect. Provided down below is an extract of the operative portion of PN3:

3.1.1(a) A non-resident entity can commit in India, topic to the FDI Plan apart from in those sectors/pursuits which are prohibited. However, an entity of a place, which shares land border with India or in which the advantageous owner of an financial commitment into India is located in or is a citizen of any these kinds of country, can devote only under the Govt route. Additional, a citizen of Pakistan or an entity integrated in Pakistan can make investments, only under the Governing administration route, in sectors/actions other than defence, house, atomic power and sectors/activities prohibited for international financial commitment.

3.1.1(b) In the function of the transfer of ownership of any current or upcoming FDI in an entity in India, instantly or indirectly, ensuing in the beneficial possession falling inside of the restriction/purview of para 3.1.1(a), this sort of subsequent adjust in valuable ownership will also involve Federal government approval. (emphasis presented)

Transfer

The expression ‘transfer’ has not been described precisely for the objective of PN3. This being the circumstance, one has to refer to the definition for the phrase presented beneath Segment 2(ze) of the International Trade Management Act (“FEMA”), which defines a transfer to suggests sale, obtain, trade, home finance loan, pledge, gift, bank loan or any other type of transfer of appropriate, title, possession or lien. On applying this definition for ‘transfer’ to the context in which the expression is utilized in PN3, not only a sale of shares but also a pledge of shares ensuing in a improve in effective ownership would need GOI approval.

An additional pertinent point to notice is that oblique transfer of possession is also protected by PN3. For illustration, if ‘A’ is a international entity (not being a resident of the land bordering region) that owns much more than 51% of the shares in an Indian entity, but far more than 50% of shares in A are being bought to ‘B’, a international specific (who is a resident or citizen of a land bordering state) or a foreign entity (which is a resident of a land bordering state), there would be an oblique transfer of ownership of the present FDI in Indian entity from A to B.

Valuable Ownership

The NDI regulations contain references to useful possession but do not define valuable possession. Nonetheless, the Organizations Act, 2013, under the Companies (Sizeable Valuable House owners) Rules 2018 (“Corporations Rules”) prescribes a threshold of 10% possession for determining useful holding, and the Prevention of Funds Laundering Act, 2002 (PMLA), less than Prevention of Income-laundering (Servicing of Data) Policies, 2005 prescribes a threshold of 25% ownership for analyzing the useful holding for organizations and a threshold of 15% for other unincorporated entities.

Since NDI guidelines do not prescribe any threshold for determining helpful possession, even nominal or minuscule ownership held beneficially by an entity in, or a citizen of a place that shares a land border with India, could be pressured to slide within the approval route. Though the GOI has clarified that valuable possession is to be interpreted in line with the PMLA in the context of community procurement, clarity in respect of PN3, is still awaited.

Change in Effective Possession

With respect to the construction of language in 3.1.1(b), there is scope for a lot more than a single interpretation. There is no use of the words and phrases ‘change in advantageous ownership’ in the 1st element of 3.1.1(b). Nevertheless, the next aspect of 3.1.1(b) works by using the terms ‘these subsequent modify in useful ownership’. Frequently, ‘such’ would be referring to conditions utilized earlier in the provision and in this situation staying the ‘result of the helpful proprietor remaining positioned in or currently being a citizen of a country, which shares a land border with India’. There is no mention of ‘change’ in advantageous possession before in the provision.

On the a single hand, it can be interpreted that a GOI acceptance will be expected only if there is a improve in valuable ownership ensuing in the advantageous operator being a resident or citizen of a land bordering country, pursuant to the transfer of ownership of present FDI or long run FDI. On the other hand, it can be interpreted that if the useful proprietor is positioned in or a citizen of a place sharing a land border with India, then these transfer of ownership will require GOI acceptance, even in a circumstance where there is no ‘change’ in advantageous ownership simply because of this kind of transfer. It would be safer to adopt the latter interpretation thinking about the intention of GOI to assemble a rigid expense regime with respect to land bordering international locations, pushed by countrywide safety fears.

Procedure of generating software for FDI

Programs for FDI trying to find prior approval of the GOI that have to be addressed by the involved Ministries/Departments of the GOI (“Capable Authority”) within just 8-10 weeks immediately after acquiring an software as for each the Regular Working Procedure dated November 09, 2020, may virtually just take everywhere between 6-10 months for getting acceptance, relying upon the Proficient Authority processing the software, through a one built-in window i.e. Foreign Investment Facilitation Portal (“FIFP”). The FIFP is administered by the Section of Promotion of Field and Interior Trade, Ministry of Commerce and Market, Authorities of India (“DPIIT”). DPIIT procedures the apps received beneath the acceptance route and coordinates with the Knowledgeable Authority that has the main duty for the relevant sector to jointly critique these kinds of purposes. Pursuant to PN3, transactions falling beneath the scope of PN3 (however it may possibly not contain financial investment in delicate sectors) have been grouped along with expenditure in delicate sectors like civil aviation, defence, telecom, non-public security, details and broadcasting in becoming subject matter to an extra layer of stability clearance from the Ministry of Dwelling Affairs (MHA), that have to be resolved in just 2 weeks of clearance from the Competent Authority processing the application, which might acquire added 1-2 months.

Amendments to FIFP Website vis-à-vis PN3

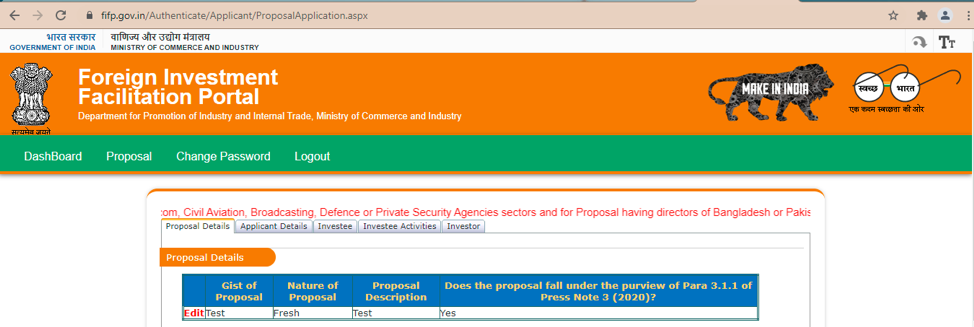

Pursuant to PN3, the FIFP site has been a little modified to consist of at the threshold itself, a qualifier that segregates applications according to no matter if the software falls within just the ambit of PN3.

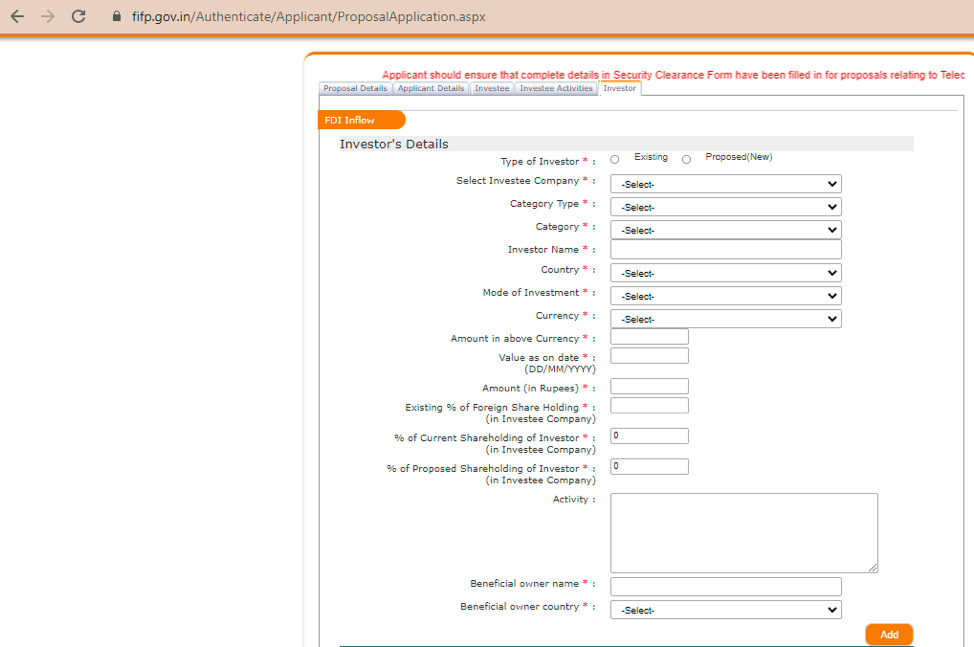

Upon deciding on “Yes” in the qualifier as explained previously mentioned, the software kind also mandates that the facts pertaining to the Useful Proprietor be disclosed in this regard.

Upon deciding on “Yes” in the qualifier as explained previously mentioned, the software kind also mandates that the facts pertaining to the Useful Proprietor be disclosed in this regard.

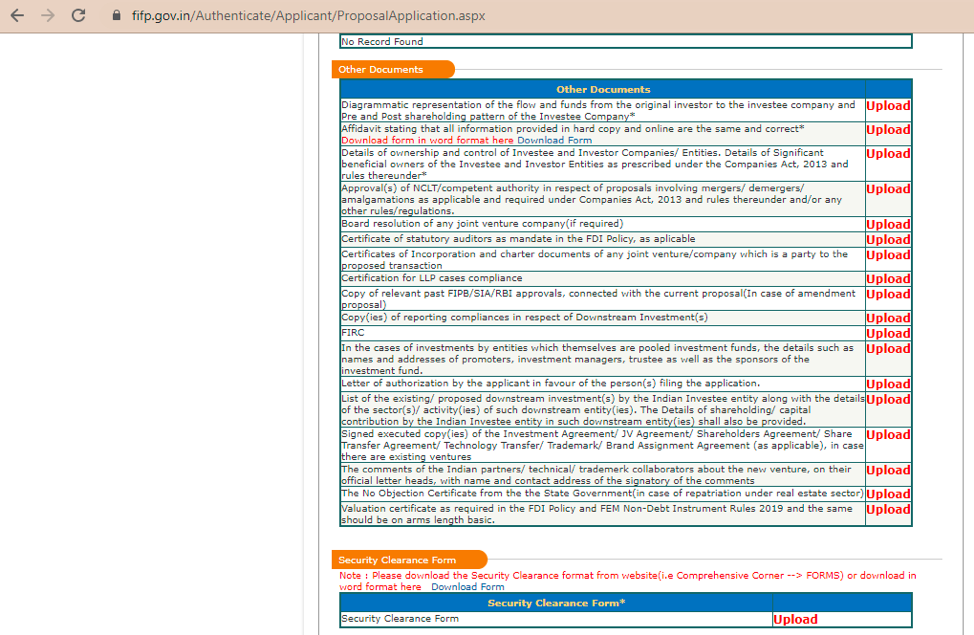

Even further, the software form also mandatorily involves that the details of ‘Significant Advantageous Owners’ of the Trader Company and the Investee Company be furnished.

Even further, the software form also mandatorily involves that the details of ‘Significant Advantageous Owners’ of the Trader Company and the Investee Company be furnished.

Aside from the over, there are no other alterations effected to the FIFP vis-à-vis PN3. The modifications effected to the FIFP vis-à-vis PN3 as of now may perhaps not be adequate looking at there could be proposals wherein the applicant may perhaps not be the investee or direct investor as these and the place the subject matter of the proposal is the transfer in ownership (immediate or oblique) of current FDI.

Conclusion

PN3 was introduced by the GOI and brought into power quickly shortly just after the pandemic hit India activated by national stability good reasons. Nevertheless, when deconstructed, there seems to be substantially scope for clarification with respect to the meanings that would have to be attributed to ‘transfer’, ‘beneficial ownership’ and ‘change in useful ownership’ along with the need for the FIFP to provide about a in depth updation in the application filing system for numerous kind of transactions falling less than the scope of PN3 to overcome the exiguity the existing FIFP showcases.