Edwards Lifesciences (EW) at a 52-Week Superior: What is actually Driving It?

4 min readEdwards Lifesciences Corporation EW scaled a new 52-week large of $100.10 on Jun 11, prior to closing the session marginally reduce at $99.99.

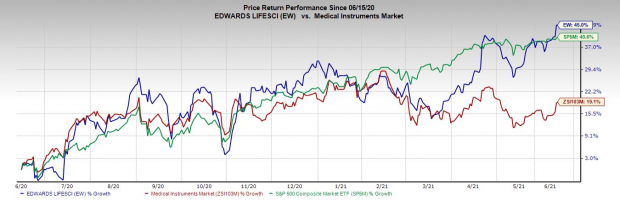

The company’s shares have charted a sound trajectory in new moments, appreciating 45% in excess of the previous 12 months, forward of 19.1% development of the market it belongs to and 40.6% surge of the S&P 500 composite.

The firm is witnessing an upward development in its inventory selling price, prompted by its promising Surgical Structural Heart business. The company’s prolonged-term growth technique to sustain management posture in the worldwide TAVR marketplace seems encouraging. More, the greater-than-expected earnings outlook for the second quarter and upbeat entire-calendar year steering buoy optimism. Nevertheless, reimbursement reduce and international exchange woes remain concerns.

Let us delve further.

Vital Advancement Catalysts

Surgical Structural Coronary heart, a Promising Business: Buyers are optimistic about the potent adoption of the top quality RESILIA tissue valves, like the INSPIRIS RESILIA aortic surgical valve and KONECT aortic valve conduit, during the initial quarter. Edwards Lifesciences’ administration is also upbeat about favorable individual results with speedier surgical treatment and recovery situations with the HARPOON Beating Coronary heart Mitral Valve Restore Procedure, which is a minimally-invasive treatment.

Extended-Term Growth System Buoys Optimism: Edwards Lifesciences expects to preserve its leadership place in the worldwide TAVR sector via greater concentrate on expanding affected individual access by actively leveraging recent valve platforms for more indications. This contains creating subsequent-generation valve platforms and sustaining trustworthy interactions with clinicians, payers and regulators.

Edwards Lifesciences expects the global TAVR opportunity to exceed $7 billion by 2024. Also, management tasks TMTT possibility to access $3 billion by 2024. Further more, administration expects Surgical Structural Heart option to increase mid-single digits by 2026.

Upbeat Assistance: The bullish next-quarter 2021 and lifted whole-yr 2021 steering offered by the company through its initially-quarter earnings update instill trader self confidence in the inventory. For the 2nd quarter of 2021, Edwards Lifesciences expects altered earnings per share in the vary of 54-60 cents although 2nd-quarter 2021 revenues are projected in the vary of $1.25-$1.33 billion.

For 2021, the organization elevated its projection of altered earnings for every share to the vary of $2.07-$2.27 from $2-$2.20. Nevertheless, for the 12 months, the organization reiterated its anticipation of revenue at the assortment of $4.9-$5.3 billion.

Downsides

On the flip facet, there are some things deterring the stock’s rally of late.

International Trade Headwinds: The important troubles Edwards Lifesciences had to experience owing to unfavorable foreign forex influence have been influencing the company’s gross margin around the earlier couple of quarters. For every administration, major forex fluctuations could have a content impact on revenues, value of sales and operational final results.

Reimbursement Cut to Increase Fees: The U.S. government’s legislation connected to the wellness care procedure incorporates provisions that, among other things, reduce or limit Medicare reimbursement, call for all persons to have well being coverage (with constrained exceptions) and impose elevated taxes. This in switch puts stress on companies’ price structure in the clinical sector.

Zacks Rank and Key Picks

At present, Edwards Lifesciences carries a Zacks Rank #3 (Keep).

A couple much better-rated shares from the broader medical space are Envista Holdings Company NVST, Inogen, Inc INGN and IDEXX Laboratories, Inc. IDXX, just about every carrying a Zacks Rank #2 (Invest in). You can see the entire record of Zacks #1 Rank (Potent Buy) shares here.

Envista Holdings has an estimated long-expression earnings progress amount of 26%.

Inogen has an approximated very long-time period earnings progress level of 33%.

IDEXX Laboratories has a projected very long-time period earnings progress level of 20%.

Bitcoin, Like the Net Alone, Could Alter All the things

Blockchain and cryptocurrency has sparked just one of the most thrilling discussion subjects of a technology. Some contact it the “Internet of Money” and forecast it could improve the way money functions eternally. If true, it could do to banking companies what Netflix did to Blockbuster and Amazon did to Sears. Industry experts agree we’re continue to in the early phases of this know-how, and as it grows, it will make many investing options.

Zacks’ has just disclosed 3 businesses that can support investors capitalize on the explosive earnings likely of Bitcoin and the other cryptocurrencies with substantially fewer volatility than shopping for them right.

See 3 crypto-linked stocks now >>

Click on to get this no cost report

Edwards Lifesciences Company (EW): Totally free Stock Investigation Report

IDEXX Laboratories, Inc. (IDXX): Totally free Inventory Evaluation Report

Inogen, Inc (INGN): Cost-free Stock Examination Report

Envista Holdings Corporation (NVST): Free Inventory Analysis Report

To study this report on Zacks.com simply click listed here.

Zacks Investment decision Study

The sights and opinions expressed herein are the views and views of the writer and do not essentially replicate all those of Nasdaq, Inc.