Exxon adds two board directors in wake of activist strain

ExxonMobil appointed two new board directors on Monday, its most recent shift to placate activist shareholders pushing for a strategic overhaul following the US oil supermajor suffered its worst calendar year on history.

The organization declared that Michael Angelakis, chief government of investment decision agency Atairos and a previous chairman of the Philadelphia Federal Reserve, and Jeff Ubben, head of Inclusive Cash Partners, a further fund, would sign up for the board. Ubben previously ran ValueAct Money Associates, a well-regarded activist trader.

Describing the additions as component of an “ongoing board refreshment”, Darren Woods, Exxon’s chief government, said: “Michael and Jeff’s expertise in capital allocation and system improvement has served businesses navigate sophisticated transitions for the profit of shareholders and broader stakeholders.”

Woods indicated they would not be the final modifications to the board, noting the obligatory board-retirement age of 72 — four customers are both at retirement age or will be this year.

“The board is in evolution as effectively,” he instructed the Fiscal Moments. “That will be a continuum of bringing on the ideal kind of abilities to regulate in the company.”

The appointments appear 48 hours right before Exxon’s annual investor day, the construct-up to which has been dominated by an activist campaign launched in December by Engine No 1, a newly set up fund. Wall Road hedge fund DE Shaw, which owns a stake in Exxon, has also been pushing the oil producer to slice back its capital investing.

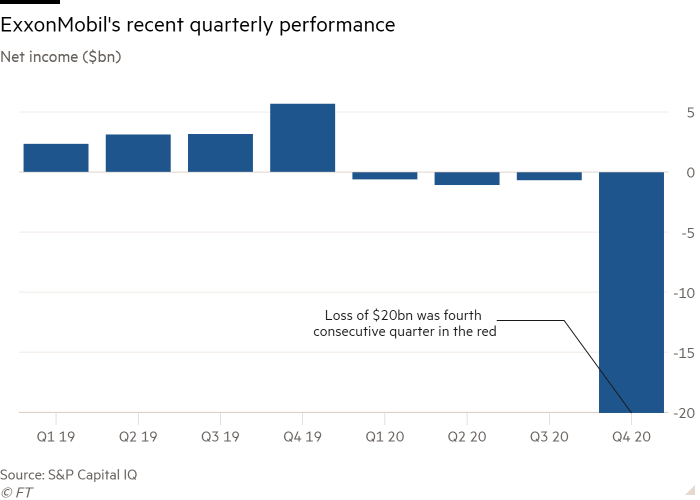

The growing trader disquiet follows the worst annual financial overall performance in Exxon’s record, such as 4 consecutive quarterly losses and the writedown of practically $20bn of assets it now deems non-strategic.

Local climate Money

Exactly where weather transform meets company, markets and politics. Investigate the FT’s protection here

Like its friends, Exxon slashed prepared cash spending final year subsequent the crash in the oil rate. But it is sticking with designs to improve crude generation in the coming several years, hoping a rebound in the oil value and a dearth of supply prompted by rivals’ upstream less than-expenditure will reward the tactic.

Motor No 1 in January nominated four unbiased administrators to sign up for Exxon’s board, every single with energy expertise, and explained its nominees would “ensure a clear split from a approach and frame of mind that have led to many years of value destruction and inadequately positioned the corporation for the future”.

In an interview, Woods explained Exxon experienced considered some of Motor No 1’s nominees for board positions just before the fund nominated them, and re-evaluated them once more later on. Ubben and Angelakis “brought much more strength” to the company’s efforts to strengthen capital allocation and guide its firms by means of changeover, he mentioned.

Motor No 1 claimed on Monday that the appointments introduced by the oil team showed Exxon “has now conceded the have to have for board adjust, what is missing are administrators with various track information of results in the electricity industry”.

DE Shaw welcomed the appointments, hailing them as “significant good developments for all shareholders”.

Edwin Jager, a controlling director at DE Shaw, said the new executives “will convey significant cash marketplaces and money allocation knowledge to the boardroom and will provide meaningful value to the business as it focuses on its financial commitment priorities even though navigating the transition to a small-carbon future”.

The appointments occur virtually a thirty day period soon after Exxon added Tan Sri Wan Zulkiflee, the former main executive of Malaysia’s condition oil firm Petronas, to its board in a different concession to the activists.

Exxon also in February announced the formation of a new minimal-carbon business, and in January began reporting its scope 3 emissions (greenhouse gas pollution from solutions it sells), moves that have also adopted trader tension but have been in the works right before the activist strategies turned community previous calendar year.

Critics say Exxon has been slower than its peers in producing a tactic for a transition to cleaner fuels.

Andrew Logan, a senior director at Ceres, which co-ordinates trader motion on weather modify, stated that “this go could in fact backfire on the organization, as it looks as nevertheless it is packing the board to dilute the potential impression of the alternative director slate”.

2 times weekly e-newsletter

Power is the world’s indispensable enterprise and Strength Resource is its publication. Each and every Tuesday and Thursday, direct to your inbox, Electricity Supply delivers you vital news, ahead-pondering investigation and insider intelligence. Indication up listed here