Foodstuff and agritech companies race to faucet community marketplaces

4 min readFoodstuff and agritech corporations are beginning to look for public cash, riding the wave of green investing and switching shopper tastes.

Organizations lately mentioned on inventory markets include things like a superior-tech greenhouses undertaking that grows tomatoes with 90 for each cent fewer h2o, a plant-centered creamer company founded by a massive-wave surfer and a firm that will make sustainable plastic making use of a kind of rapeseed.

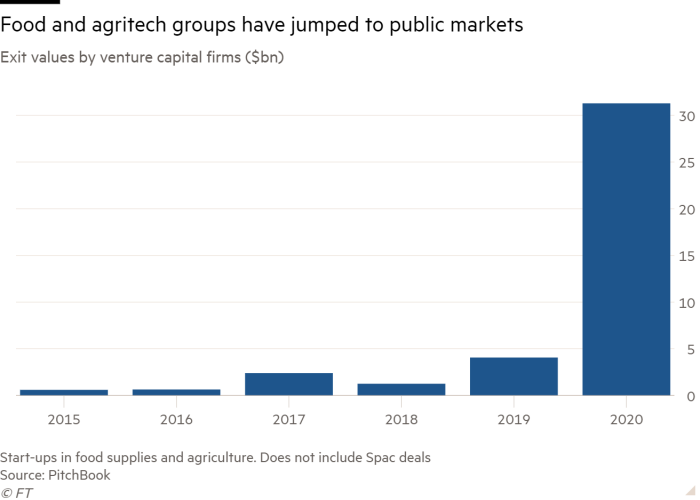

Early-phase investors and enterprise capitalists have been putting their income into meals and agritech start-ups for many yrs in lookup of disrupters. But inventory-industry listings in the sector grew nearly eight-fold to extra than $31bn in 2020, in accordance to corporate information firm PitchBook.

Weighty need for sustainable investments, coupled with a US craze for specific goal acquisition providers that invest in targets to take them public, indicates this is possible to accelerate in 2021.

“A great deal of my portfolio organizations are remaining approached by Spacs at the instant,” mentioned Sanjeev Krishnan, chief investment officer at S2G Ventures, a food items and agritech VC company. Spac offers offer you capital-hungry food and agritech start-ups access to funding. “Public [sustainable investment] money dwarfs personal cash,” he added.

Now, public-market place cash elevating has crept ahead of financial investment from undertaking capitalists and early-phase investors in this sector, which is assumed to have reached $30bn very last calendar year, up 35 for every cent from the yr before, according to venture capitalist AgFunder.

Plant-primarily based protein group Further than Meat’s stock sector debut in 2019 proved that buyers ended up inclined to set funds to perform in the sector. Its shares have pulled back again from their highs, but are nevertheless additional than 5 periods from their listing selling price.

The shift on to stock markets can, having said that, examination investors’ nerves. Shares in US significant-tech greenhouse firm AppHarvest, which accomplished its Spac offer past thirty day period, just about halved past week as the lock-up period finished for early buyers. Shares in Oregon-based mostly Laird Superfood, a plant-centered coffee creamer co-launched by surfer Laird Hamilton have also been on a rollercoaster, underlining the volatility of early-phase companies’ stocks.

Its market capitalisation may have halved from its peak in February to about $1.9bn, but AppHarvest explained its “business technique and fundamentals stay strong”.

The business, which operates a higher-tech greenhouse in Kentucky the sizing of 60 football fields, cuts water usage by 90 for each cent in contrast with open up-air agriculture.

It ideas to establish a further 11 such greenhouses by 2025. “What’s taking place in agriculture is what we saw in the early 2000s when persons begun speaking about autos not operating on fossil fuels,” claimed Jonathan Webb, the company’s founder and a former renewable energy developer.

Other begin-ups that have turned to promotions with blank cheque organizations incorporates Danimer Scientific, which creates biodegradable, renewable and sustainable plastic utilizing canola oil. All-natural Buy Acquisition Corp, a Spac looking to get a plant-dependent protein food and drink organization, commenced investing on Nasdaq late very last year.

Food and agritech investment enterprise Eat Outside of went public on the Canadian Securities Exchange previous November. Its portfolio includes California-based mostly substitute protein start-up Try to eat Just, which has begun providing its cultivated chicken in Singapore, and TurtleTree Labs, a commence-up seeking to produce lab-grown human breast milk.

Also in Canada, Farmers Edge, a crop knowledge firm, floated on the Toronto industry last 7 days, whilst Swedish oat-based mostly milk business Oatly past thirty day period submitted a private submitting for an original general public providing in the US.

Whilst the bull operate in fairness markets has meant that investors are prepared to turn to early-phase businesses, community firm buyers will need to realize that the mother nature of start off-ups is this kind of that “some [investments] are heading to close badly”, stated one particular VC investor.

Spacs offer you short-cuts for start off-ups to access community money, but seasoned investors warn that some of all those organizations might not be prepared for general public markets. “You need some kind of maturity [to do an IPO],” claimed Eric Archambeau, a previous Silicon Valley entrepreneur who founded Benchmark’s Europe operations and now operates agritech VC Astanor.

Jim Mellon, co-founder of Agronomics, an agri and food stuff tech expenditure company mentioned on the London Inventory Exchange’s Intention, categorises the fate of start off-ups as “fold, sold or bold”. Some early stage firms will fail, or fold, though others will be offered to set up players in the foods and agricultural sectors. Some “bold” results tales could obtain world-wide arrive at and offer traders the most returns, he stated.

Archambeau stated that like the investors in the late 1990s who acquired shares in technological innovation organizations, the current market for food stuff and agritech organizations was “still relatively indiscriminate”, major to superior valuations.

“Because agri-food tech organizations move additional than just bits and electrons, it could get for a longer period for quite a few of them to get to ‘escape velocity’ than the pure on the web service businesses these types of as Google or Facebook did,” he cautioned.