Form 497 LORD ABBETT GLOBAL FUND

221 min readGet instant alerts when news breaks on your stocks. Claim your 1-week free trial to StreetInsider Premium here.

|

||||||||||||||

| Lord Abbett Global Fund | ||||||||||||||

| PROSPECTUS | ||||||||||||||

| MAY 1, 2021 | ||||||||||||||

| CLASS | TICKER | CLASS | TICKER | CLASS | TICKER | |||||||||

| LORD ABBETT | A | LDMAX | I | LDMYX | R4 | LDMSX | ||||||||

| EMERGING MARKETS | C | LDMCX | P | LDMPX | R5 | LDMTX | ||||||||

| BOND FUND | F | LDMFX | R2 | N/A | R6 | LDMVX | ||||||||

| F3 | LODMX | R3 | LDMRX | |||||||||||

| LORD ABBETT | A | LCDAX | I | LCDIX | R5 | LCDTX | ||||||||

| EMERGING MARKETS | C | LEDCX | R2 | N/A | R6 | LCDVX | ||||||||

| CORPORATE DEBT FUND | F | LCDFX | R3 | LCDRX | ||||||||||

| F3 | LCDOX | R4 | LCDSX | |||||||||||

| LORD ABBETT | A | LAGGX | I | LGBYX | R5 | LGBVX | ||||||||

| GLOBAL BOND FUND | C | LGFCX | R2 | LGBQX | R6 | LGBWX | ||||||||

| F | LGBFX | R3 | LGBRX | |||||||||||

| F3 | LGBOX | R4 | LGBUX | |||||||||||

| The U.S. Securities and Exchange Commission has not approved or disapproved of these securities or determined whether this prospectus is accurate or complete. Any representation to the contrary is a criminal offense. | ||||||||||||||

| INVESTMENT PRODUCTS: NOT FDIC INSURED–NO BANK GUARANTEE–MAY LOSE VALUE | ||||||||||||||

INVESTMENT OBJECTIVE

The Fund’s investment objective is to seek high total return.

FEES AND EXPENSES

This table describes the fees and expenses that you may pay if you

buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries,

which are not reflected in the tables and examples below. You may qualify for sales charge discounts if you and certain members

of your family invest, or agree to invest in the future, at least $100,000 in the Lord Abbett Family of Funds. More information

about these and other discounts is available from your financial intermediary and in “Sales Charge Reductions and Waivers”

on page 90 of the prospectus, Appendix A to the prospectus, titled “Intermediary-Specific Sales Charge Reductions and Waivers,”

and “Purchases, Redemptions, Pricing, and Payments to Dealers” on page 9-1 of Part II of the statement of additional

information (“SAI”).

| Shareholder Fees(1) (Fees paid directly from your investment) |

|||

| Class | A | C | F, F3, I, P, R2, R3, R4, R5, and R6 |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

2.25% | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

None(2) | 1.00%(3) | None |

| Annual Fund Operating Expenses |

||||||

| (Expenses that you pay each year as a percentage of the value of your investment) |

||||||

| Class | A | C | F | F3 | I | P |

| Management Fees |

0.50% | 0.50% | 0.50% | 0.50% | 0.50% | 0.50% |

| Distribution and Service (12b-1) Fees |

0.20% | 0.83%(4) | 0.10% | None | None | 0.45% |

| Other Expenses |

0.21% | 0.21% | 0.21% | 0.20% | 0.21% | 0.21% |

| Total Annual Fund Operating Expenses |

0.91% | 1.54% | 0.81% | 0.70% | 0.71% | 1.16% |

| Fee Waiver and/or Expense Reimbursement |

None | None | (0.10)%(5) | None | None | None |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

0.91% | 1.54% | 0.71% | 0.70% | 0.71% | 1.16% |

PROSPECTUS – Emerging Markets Bond

Fund

2

| Annual Fund Operating Expenses (continued) |

|||||

| (Expenses that you pay each year as a percentage of the value of your investment) |

|||||

| Class | R2 | R3 | R4 | R5 | R6 |

| Management Fees |

0.50% | 0.50% | 0.50% | 0.50% | 0.50% |

| Distribution and Service (12b-1) Fees |

0.60% | 0.50% | 0.25% | None | None |

| Other Expenses |

0.21% | 0.21% | 0.21% | 0.21% | 0.20% |

| Total Annual Fund Operating Expenses |

1.31% | 1.21% | 0.96% | 0.71% | 0.70% |

| Fee Waiver and/or Expense Reimbursement |

None | None | None | None | None |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

1.31% | 1.21% | 0.96% | 0.71% | 0.70% |

| (1) | A shareholder transacting in share classes without a front-end sales charge may be required to pay a commission to its financial intermediary. Please contact your financial intermediary for more information about whether such a commission may apply to your transaction. |

| (2) | A contingent deferred sales charge (“CDSC”) of 1.00% may be assessed on certain Class A shares purchased or acquired without a sales charge if they are redeemed before the first day of the month of the one-year anniversary of the purchase. |

| (3) | A CDSC of 1.00% may be assessed on Class C shares if they are redeemed before the first anniversary of their purchase. |

| (4) | The 12b-1 fee the Fund will pay on Class C shares will be a blended rate calculated based on (i) 1.00% of the Fund’s average daily net assets attributable to shares held for less than one year and (ii) 0.80% of the Fund’s average daily net assets attributable to shares held for one year or more. All Class C shareholders of the Fund will bear 12b-1 fees at the same rate. |

| (5) | For the period from May 1, 2021 through April 30, 2022, Lord Abbett Distributor LLC (“Lord Abbett Distributor”) has contractually agreed to waive the Fund’s 0.10% Rule 12b-1 fee for Class F shares. This agreement may be terminated only by the Fund’s Board of Directors. |

Example

This Example is intended to help you compare the cost of investing

in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time

periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment

has a 5% return each year and that the Fund’s operating expenses remain the same, giving effect to the fee waiver and expense

reimbursement arrangement described above. Class C shares automatically convert to Class A shares after eight years. The expense

example for Class C shares for the ten-year period reflects the conversion to Class A shares. Although

your actual costs may be higher or lower, based on these assumptions your costs would be:

PROSPECTUS – Emerging Markets Bond

Fund

3

| Class | If Shares Are Redeemed | If Shares Are Not Redeemed | ||||||||||||||||||||||||||||||

| 1 Year | 3 Years |

5 Years |

10 Years |

1 Year |

3 Years |

5 Years |

10 Years |

|||||||||||||||||||||||||

| Class A Shares | $ | 316 | $ | 509 | $ | 718 | $ | 1,319 | $ | 316 | $ | 509 | $ | 718 | $ | 1,319 | ||||||||||||||||

| Class C Shares | $ | 257 | $ | 486 | $ | 839 | $ | 1,665 | $ | 157 | $ | 486 | $ | 839 | $ | 1,665 | ||||||||||||||||

| Class F Shares | $ | 73 | $ | 249 | $ | 440 | $ | 992 | $ | 73 | $ | 249 | $ | 440 | $ | 992 | ||||||||||||||||

| Class F3 Shares | $ | 72 | $ | 224 | $ | 390 | $ | 871 | $ | 72 | $ | 224 | $ | 390 | $ | 871 | ||||||||||||||||

| Class I Shares | $ | 73 | $ | 227 | $ | 395 | $ | 883 | $ | 73 | $ | 227 | $ | 395 | $ | 883 | ||||||||||||||||

| Class P Shares | $ | 118 | $ | 368 | $ | 638 | $ | 1,409 | $ | 118 | $ | 368 | $ | 638 | $ | 1,409 | ||||||||||||||||

| Class R2 Shares | $ | 133 | $ | 415 | $ | 718 | $ | 1,579 | $ | 133 | $ | 415 | $ | 718 | $ | 1,579 | ||||||||||||||||

| Class R3 Shares | $ | 123 | $ | 384 | $ | 665 | $ | 1,466 | $ | 123 | $ | 384 | $ | 665 | $ | 1,466 | ||||||||||||||||

| Class R4 Shares | $ | 98 | $ | 306 | $ | 531 | $ | 1,178 | $ | 98 | $ | 306 | $ | 531 | $ | 1,178 | ||||||||||||||||

| Class R5 Shares | $ | 73 | $ | 227 | $ | 395 | $ | 883 | $ | 73 | $ | 227 | $ | 395 | $ | 883 | ||||||||||||||||

| Class R6 Shares | $ | 72 | $ | 224 | $ | 390 | $ | 871 | $ | 72 | $ | 224 | $ | 390 | $ | 871 | ||||||||||||||||

Portfolio Turnover. The Fund pays transaction costs, such

as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate

may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs,

which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. During the

most recent fiscal year, the Fund’s portfolio turnover rate was 49% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

To pursue its objective, under normal circumstances, the Fund invests

at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in debt securities that are tied economically

to emerging market countries and derivative instruments that are intended to provide economic exposure to such securities. For

purposes of this policy, the Fund considers emerging market countries to include every nation in the world except the United States,

Canada, Japan, Australia, New Zealand, and most countries located in Western Europe.

The Fund may invest in all types of debt securities and derivative

instruments, including, among others, corporate debt securities, government securities (including sovereign and quasi-sovereign

bonds), loans, convertible securities, mortgage-related and other asset-backed securities, inflation-linked investments, structured

notes, hybrid or “indexed” securities, event-linked bonds, and derivatives based on the return of debt securities.

The Fund may invest in derivatives, consisting principally of swaps, options, forwards, and futures, for hedging or non-hedging

purposes as a substitute for investing directly in emerging market debt securities.

The Fund may invest without limit in securities denominated in non-U.S.

currencies.

The Fund may invest in securities of any credit quality, maturity,

or duration. The Fund may invest without limitation in high-yield debt securities (commonly referred to as “below investment

grade” or “junk” bonds). High-yield debt securities are rated

PROSPECTUS – Emerging Markets Bond

Fund

4

BB/Ba or lower at the time of purchase by an independent rating

agency, or are unrated but deemed by Lord, Abbett & Co. LLC (“Lord Abbett”) to be of comparable quality.

The Fund’s assets will be invested across different industries,

sectors, countries, and regions. However, the Fund’s portfolio management team may invest a significant percentage of the

Fund’s assets in issuers in a single industry, sector, country, or region. The Fund is non-diversified under the Investment

Company Act of 1940, as amended (the “1940 Act”), and may invest a greater percentage of its assets in a single issuer

or in fewer issuers than a diversified mutual fund.

The portfolio management team buys and sells securities using a

relative value-oriented investment process and combines bottom-up and top-down analysis to construct its portfolio. In selecting

securities, the portfolio management team may overweight or underweight individual issuers, industries, sectors, countries, or

regions relative to the benchmark. In evaluating a particular country, the portfolio management team may evaluate the country’s

internal political, market, and economic factors, such as public finances, monetary policy, financial markets, foreign investment

regulations, exchange rate policy and labor conditions, among others. The investment team may also consider the risks and return

potential presented by environmental, social, and governance (ESG) factors in investment decisions. The Fund may engage in active

and frequent trading of its portfolio securities.

The Fund may sell a security when the Fund believes the security

is less likely to benefit from the current market and economic environment, or shows signs of deteriorating fundamentals, among

other reasons. The Fund may deviate from the investment strategy described above for temporary defensive purposes. The Fund may

miss certain investment opportunities if defensive strategies are used and thus may not achieve its investment objective.

PRINCIPAL RISKS

As with any investment in a mutual fund, investing in the Fund involves

risk, including the risk that you may receive little or no return on your investment. When you redeem your shares, they may be

worth more or less than what you paid for them, which means that you may lose a portion or all of the money you invested in the

Fund. The principal risks of investing in the Fund, which could adversely affect its performance, include:

| · | Portfolio Management Risk: If the strategies used and investments selected by the Fund’s portfolio management team fail to produce the intended result, the Fund may suffer losses or underperform other funds with the same investment objective or strategies, even in a favorable market. | |

| · | Market Risk: The market values of securities will fluctuate, sometimes sharply and unpredictably, based on overall economic conditions, governmental actions or intervention, market disruptions caused by trade disputes or other factors, |

PROSPECTUS – Emerging Markets Bond

Fund

5

| political developments, and other factors. Prices of equity securities tend to rise and fall more dramatically than those of debt securities. |

| · | Fixed Income Securities Risk: The Fund is subject to the general risks and considerations associated with investing in debt securities, including the risk that issuers will fail to make timely payments of principal or interest or default altogether. Lower-rated securities in which the Fund may invest may be more volatile and may decline more in price in response to negative issuer developments or general economic news than higher rated securities. In addition, as interest rates rise, the Fund’s investments typically will lose value. |

|

| · | Foreign and Emerging Market Company Risk: Investments in foreign companies and in U.S. companies with economic ties to foreign markets generally involve special risks that can increase the likelihood that the Fund will lose money. For example, as compared with companies organized and operated in the U.S., these companies may be more vulnerable to economic, political, and social instability and subject to less government supervision, lack of transparency, inadequate regulatory and accounting standards, and foreign taxes. In addition, the securities of foreign companies also may be subject to inadequate exchange control regulations, the imposition of economic sanctions or other government restrictions, higher transaction and other costs, reduced liquidity, and delays in settlement to the extent they are traded on non-U.S. exchanges or markets. Foreign company securities also include American Depositary Receipts (“ADRs”). ADRs may be less liquid than the underlying shares in their primary trading market. Foreign securities also may subject the Fund’s investments to changes in currency exchange rates. Emerging market securities generally are more volatile than other foreign securities, and are subject to greater liquidity, regulatory, and political risks. Investments in emerging markets may be considered speculative and generally are riskier than investments in more developed markets because such markets tend to develop unevenly and may never fully develop. Emerging markets are more likely to experience hyperinflation and currency devaluations. Securities of emerging market companies may have far lower trading volumes and less liquidity than securities of issuers in developed markets. Companies with economic ties to emerging markets may be susceptible to the same risks as companies organized in emerging markets. |

| · | Foreign Currency Risk: Investments in securities denominated in foreign currencies are subject to the risk that those currencies will decline in value relative to the U.S. dollar, or, in the case of hedged positions, that the U.S. dollar will decline in value relative to the currency being hedged. Foreign currency exchange rates may fluctuate significantly over short periods of time. |

| · | Derivatives Risk: The risks associated with derivatives may be different from and greater than the risks associated with directly investing in securities and other investments. Derivatives may increase the Fund’s volatility and reduce its |

PROSPECTUS – Emerging Markets Bond

Fund

6

| returns. The risks associated with derivatives include, among other things, the following: |

| · | The risk that the value of a derivative may not correlate with the value of the underlying asset, rate, or index in the manner anticipated by the portfolio management team and may be more sensitive to changes in economic or market conditions than anticipated. |

| · | Derivatives may be difficult to value, especially under stressed or unforeseen market conditions. |

| · | The risk that the counterparty may fail to fulfill its contractual obligations under the derivative contract. Central clearing of derivatives is intended to decrease counterparty risk but does not eliminate it. |

| · | The Fund may be required to segregate permissible liquid assets to cover its obligations under these transactions and may have to liquidate positions before it is desirable to do so to fulfill its segregation requirements. |

| · | The risk that there may not be a liquid secondary trading market for the derivative, or that the Fund may otherwise be unable to sell or otherwise close a derivatives position when desired, exposing the Fund to additional losses. |

| · | Because derivatives generally involve a small initial investment relative to the risk assumed (known as leverage), derivatives can magnify the Fund’s losses and increase its volatility. |

| · | The Fund’s use of derivatives may affect the amount, timing, and character of distributions, and may cause the Fund to realize more short-term capital gain and ordinary income than if the Fund did not use derivatives. |

Derivatives may not perform as expected

and the Fund may not realize the intended benefits. Whether the Fund’s use of derivatives is successful will depend on, among

other things, the portfolio managers’ ability to correctly forecast market movements and other factors. If the portfolio

managers incorrectly forecast these and other factors, the Fund’s performance could suffer. In addition, given their complexity,

derivatives are subject to the risk that improper or misunderstood documentation may expose the Fund to losses.

| · | Convertible Securities Risk: Convertible securities are subject to the risks affecting both equity and fixed income securities, including market, credit, liquidity, and interest rate risk. Convertible securities tend to be more volatile than other fixed income securities, and the markets for convertible securities may be less liquid than markets for common stocks or bonds. To the extent that the Fund invests in convertible securities and the investment value of the convertible security is greater than its conversion value, its price will likely increase when interest rates fall and decrease when interest rates rise. If the conversion value exceeds the investment value, the price of the convertible security will tend to fluctuate directly with the price of the underlying equity |

|

PROSPECTUS – Emerging Markets Bond

Fund

7

| security. A significant portion of convertible securities have below investment grade credit ratings and are subject to increased credit and liquidity risks. |

| · | Sovereign Debt Risk: Sovereign debt securities are subject to the risk that the relevant sovereign government or governmental entity may delay or refuse to pay interest or repay principal on its debt, due to, for example, cash flow problems, insufficient foreign currency reserves, political considerations, the size of its debt relative to the economy, or the failure to put in place economic reforms required by the International Monetary Fund or other multilateral agencies. There is no legal process for collecting sovereign debt that is not repaid, nor are there bankruptcy proceedings through which all or part of the unpaid sovereign debt may be collected. |

| · | Loan Risk: Investments in floating or adjustable rate loans are subject to increased credit and liquidity risks. Loan prices also may be adversely affected by supply-demand imbalances caused by conditions in the loan market or related markets. Below investment grade loans, like high-yield debt securities, or junk bonds, usually are more credit sensitive than interest rate sensitive, although the value of these instruments may be affected by interest rate swings in the overall fixed income market. Loans may be subject to structural subordination and may be subordinated to other obligations of the borrower or its subsidiaries. |

| · | Government Securities Risk: The Fund invests in securities issued or guaranteed by the U.S. Government or its agencies and instrumentalities (such as the Government National Mortgage Association (“Ginnie Mae”), the Federal National Mortgage Association (“Fannie Mae”), or the Federal Home Loan Mortgage Corporation (“Freddie Mac”)). Unlike Ginnie Mae securities, securities issued or guaranteed by U.S. Government-related organizations, such as Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. Government and no assurance can be given that the U.S. Government would provide financial support. |

| · | Mortgage-Related and Other Asset-Backed Securities Risk: Mortgage-related securities, including commercial mortgage-backed securities and other privately issued mortgage-related securities, and other asset-backed securities may be particularly sensitive to changes in prevailing interest rates and economic conditions, including delinquencies and defaults. The prices of mortgage-related and other asset-backed securities, depending on their structure and the rate of payments, can be volatile. They are subject to prepayment risk (higher than expected prepayment rates of mortgage obligations due to a fall in market interest rates) and extension risk (lower than expected prepayment rates of mortgage obligations due to a rise in market interest rates). These risks increase the Fund’s overall interest rate risk. Some mortgage-related securities receive government or private support, but there is no assurance that such support will remain in place. |

|

PROSPECTUS – Emerging Markets Bond

Fund

8

| · | Commercial Mortgage-Backed Securities Risk: Commercial mortgage-backed securities (“CMBS”) include securities that reflect an interest in, and are secured by, mortgage loans on commercial real property. Many of the risks of investing in CMBS reflect the risks of investing in the real estate securing the underlying mortgage loans. These risks reflect the effects of local and other economic conditions on real estate markets, the ability of tenants to make loan payments, and the ability of a property to attract and retain tenants. CMBS may be less liquid and exhibit greater price volatility than other types of mortgage- or asset-backed securities. |

| · | High Yield Securities Risk: High yield securities (commonly referred to as “junk” bonds) typically pay a higher yield than investment grade securities, but may have greater price fluctuations and have a higher risk of default than investment grade securities. The market for high yield securities may be less liquid due to such factors as interest rate sensitivity, negative perceptions of the junk bond markets generally, and less secondary market liquidity. This may make such securities more difficult to sell at an acceptable price, especially during periods of financial distress, increased market volatility, or significant market decline. |

| · | Non-Diversification Risk: The Fund is a non-diversified mutual fund under the 1940 Act. This means that the Fund may invest a greater portion of its assets in, and own a greater amount of the voting securities of, a single issuer or guarantor than a diversified fund. As a result, the value of the Fund’s investments may be more adversely affected by a single economic, political or regulatory event than the value of the investments of a diversified mutual fund. |

| · | Geographic Focus Risk: To the extent the Fund focuses its investments in a single country or only a few countries in a particular geographic region, economic, political, regulatory or other conditions affecting such region may have a greater impact on Fund performance. |

| · | Leverage Risk: Certain of the Fund’s transactions (including, among others, forward foreign currency contracts and other derivatives, reverse repurchase agreements, and the use of when-issued, delayed delivery or forward commitment transactions) may give rise to leverage risk. Leverage may increase volatility in the Fund by magnifying the effect of changes in the value of the Fund’s holdings. The use of leverage may cause the Fund to lose more money in adverse environments than would have been the case in the absence of leverage. There is no assurance that the Fund will be able to employ leverage successfully. |

| · | Credit Risk: Debt securities are subject to the risk that the issuer or guarantor of a security may not make interest and principal payments as they become due or may default altogether. In addition, if the market perceives a deterioration in the creditworthiness of an issuer, the value and liquidity of securities issued by that issuer may decline. To the extent that the Fund holds below investment |

|

PROSPECTUS – Emerging Markets Bond

Fund

9

| grade securities, these risks may be heightened. Insured debt securities have the credit risk of the insurer in addition to the credit risk of the underlying investment being insured. |

| · | Interest Rate Risk: As interest rates rise, prices of bonds (including tax-exempt bonds) generally fall, typically causing the Fund’s investments to lose value. Additionally, rising interest rates or lack of market participants may lead to decreased liquidity in fixed income markets. Interest rate changes generally have a more pronounced effect on the market value of fixed-rate instruments, such as corporate bonds, than they have on floating rate instruments, and typically have a greater effect on the price of fixed income securities with longer durations. A wide variety of market factors can cause interest rates to rise, including central bank monetary policy, rising inflation, and changes in general economic conditions. To the extent the Fund invests in floating rate instruments, changes in short-term market interest rates may affect the yield on those investments. If short-term market interest rates fall, the yield on the Fund’s shares will also fall. Conversely, when short-term market interest rates rise, because of the lag between changes in such short- term rates and the resetting of the floating rates on the floating rate debt in the Fund’s portfolio, the impact of rising rates may be delayed. To the extent the Fund invests in fixed rate instruments, fluctuations in the market price of such investments may not affect interest income derived from those instruments, but may nonetheless affect the Fund’s net asset value (“NAV”), especially if the instrument has a longer maturity. Substantial increases in interest rates may cause an increase in issuer defaults, as issuers may lack resources to meet higher debt service requirements. In recent years, the U.S. has experienced historically low interest rates, increasing the exposure of bond investors to the risks associated with rising interest rates. |

| · | Liquidity/Redemption Risk: The Fund may lose money when selling securities at inopportune times to fulfill shareholder redemption requests. The risk of loss may increase depending on the size and frequency of redemption requests, whether the redemption requests occur in times of overall market turmoil or declining prices, and whether the securities the Fund intends to sell have decreased in value or are illiquid. The Fund may be less able to sell illiquid securities at its desired time or price. It may be more difficult for the Fund to value its investments in illiquid securities than more liquid securities. |

| · | Potential Changes in Tax Treatment Risk: The Fund intends to continue to qualify as a “regulated investment company” under subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Under subchapter M, at least 90% of the Fund’s gross income for each taxable year must be “qualifying income.” The Fund believes that its investment strategies with respect to foreign currencies will generate qualifying income under current U.S. federal income tax law. The Code, however, expressly provides the U.S. Treasury Department with authority to issue regulations that would exclude foreign currency gains |

|

PROSPECTUS – Emerging Markets Bond

Fund

10

| from qualifying income if such gains are not directly related to the Fund’s business of investing in stock or securities (or options and futures with respect thereto). As of the date of this prospectus, the U.S. Treasury Department has not exercised this regulatory authority; however, there can be no assurance that it will not issue regulations in the future (possibly with retroactive effect) that would treat some or all of the Fund’s foreign currency gains as nonqualifying income. |

| · | High Portfolio Turnover Risk: High portfolio turnover may result in increased transaction costs, reduced investment performance, and higher taxes resulting from increased realized capital gains, including short-term capital gains taxable as ordinary income when distributed to shareholders. |

An investment in the Fund is not a deposit of any bank and is not

insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. For more information on the

principal risks of the Fund, please see the “More Information About the Funds – Principal Risks”

section in the prospectus.

PERFORMANCE

The bar chart and table below provide some indication of the risks

of investing in the Fund by illustrating the variability of the Fund’s returns. Each assumes reinvestment of dividends and

distributions. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will

perform in the future. No performance is shown for Class P and R2 shares because the Fund has no Class P and R2 shares outstanding.

Class R2 shares of the Fund are not currently offered.

The bar chart shows changes in the performance of the Fund’s

Class A shares from calendar year to calendar year. This chart does not reflect the sales charge applicable to Class A shares.

If the sales charge were reflected, returns would be lower. Performance for the Fund’s other share classes will vary due

to the different expenses each class bears. Updated performance information is available at www.lordabbett.com or by calling 888-522-2388.

The Fund implemented its present investment strategy effective August

1, 2018. Performance for earlier periods reflects the Fund’s prior investment strategy.

PROSPECTUS – Emerging Markets Bond

Fund

11

|

Bar Chart (per calendar year) – Class A Shares

Best Quarter 2nd Q 2020 +14.01% Worst Quarter 1st Q 2020 -15.41% |

The table below shows how the Fund’s average annual total

returns compare to the returns of a securities market index with investment characteristics similar to those of the Fund. The Fund’s

average annual total returns include applicable sales charges.

The after-tax returns of Class A shares included in the table below

are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state

and local taxes. In some cases, the return after taxes on distributions and sale of Fund shares may exceed the return before taxes

due to a tax benefit resulting from realized losses on a sale of Fund shares at the end of the period that is used to offset other

gains. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The after-tax returns

shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements such as 401(k) plans or Individual

Retirement Accounts (“IRAs”). After-tax returns for other share classes are not shown in the table and will vary from

those shown for Class A shares.

PROSPECTUS – Emerging Markets Bond

Fund

12

| Average Annual Total Returns |

||||||

| (for the periods ended December 31, 2020) |

||||||

| Class | 1 Year |

5 Years |

10 Years |

Life of Class |

Inception Date for Performance |

|

| Class A Shares | ||||||

| Before Taxes | 2.66% | 5.39% | 1.21% | – | ||

| After Taxes on Distributions | 0.80% | 3.33% | -0.20% | – | ||

| After Taxes on Distributions and Sale of Fund Shares |

1.49% | 3.19% | 0.28% | – | ||

| Class C Shares(1) |

3.13% | 5.22% | 0.81% | – | ||

| Class F Shares |

5.17% | 6.02% | 1.57% | – | ||

| Class F3 Shares |

5.01% | – | – | 5.15% | 4/4/2017 | |

| Class I Shares |

5.19% | 6.09% | 1.65% | – | ||

| Class R3 Shares |

4.68% | 5.57% | 1.16% | – | ||

| Class R4 Shares |

4.74% | 5.80% | – | 3.99% | 6/30/2015 | |

| Class R5 Shares |

5.22% | 6.11% | – | 4.29% | 6/30/2015 | |

| Class R6 Shares |

5.01% | 6.14% | – | 4.32% | 6/30/2015 | |

| Index | ||||||

| JPMorgan EMBI Global Diversified Index |

5.26% | 7.08% | 6.22% | 6.32% | 6/30/2015 | |

| (reflects no deduction for fees, expenses, or taxes) |

5.66% | 4/4/2017 | ||||

| (1) | Class C shares convert to Class A shares eight years after purchase. Class C share performance does not reflect the impact of such conversion to Class A shares. |

MANAGEMENT

Investment Adviser. The Fund’s investment adviser is

Lord Abbett.

Portfolio Managers.

| Portfolio Managers/Title | Member of the Portfolio Management Team Since |

| John J. Morton, Portfolio Manager and Director of Investments | 2018 |

| Steven F. Rocco, Partner and Co-Head of Taxable Fixed Income | 2018 |

| Mila Skulkina, Portfolio Manager | 2020 |

PURCHASE AND SALE OF FUND SHARES

The minimum initial and additional amounts shown below vary depending

on the class of shares you buy and the type of account. Certain financial intermediaries may impose different restrictions than

those described below. For Class I shares, the

PROSPECTUS – Emerging Markets Bond

Fund

13

minimum investment shown below applies to certain types of institutional

investors, but does not apply to registered investment advisers or retirement and benefit plans otherwise eligible to invest in

Class I shares. Class P shares are closed to substantially all new investors See “Choosing a Share Class – Investment

Minimums” in the prospectus for more information. Class R2 shares of the Fund are not currently offered.

| Investment Minimums — Initial/Additional Investments | |||

| Class | A and C(1) | F, F3, P, R2, R3, R4, R5, and R6 | I |

| General and IRAs without Invest-A-Matic Investments | $1,000/No minimum |

N/A | $1 million/No minimum |

| Invest-A-Matic Accounts(2) | $250/$50 | N/A | N/A |

| IRAs, SIMPLE and SEP Accounts with Payroll Deductions | No minimum | N/A | N/A |

| Fee-Based Advisory Programs and Retirement and Benefit Plans | No minimum | No minimum | No minimum |

|

(1) There is (2) There is |

|||

You may sell (redeem) shares through your securities broker, financial

professional or financial intermediary on any business day the Fund calculates its NAV. If you have direct account access privileges,

you may redeem your shares by contacting the Fund in writing at P.O. Box 219336, Kansas City, MO 64121, by calling 888-522-2388

or by accessing your account online at www.lordabbett.com.

PROSPECTUS – Emerging Markets Bond

Fund

14

OTHER IMPORTANT INFORMATION REGARDING FUND SHARES

For important information about taxes and payments to broker-dealers

and other financial intermediaries, please turn to the “Tax Information” and “Payments to

Broker-Dealers and Other Financial Intermediaries” sections of the prospectus.

PROSPECTUS – Emerging Markets Bond

Fund

15

Emerging Markets Corporate Debt Fund

INVESTMENT OBJECTIVE

The Fund’s investment objective is total return.

FEES AND EXPENSES

This table describes the fees and expenses that you may pay if you

buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries,

which are not reflected in the tables and examples below. You may qualify for sales charge discounts if you and certain members

of your family invest, or agree to invest in the future, at least $100,000 in the Lord Abbett Family of Funds. More information

about these and other discounts is available from your financial intermediary and in “Sales Charge Reductions and Waivers”

on page 90 of the prospectus, Appendix A to the prospectus, titled “Intermediary-Specific Sales Charge Reductions and Waivers,”

and “Purchases, Redemptions, Pricing, and Payments to Dealers” on page 9-1 of Part II of the statement of additional

information (“SAI”).

| Shareholder Fees(1) (Fees paid directly from your investment) | ||||

| Class | A | C | F, F3, I, R2, R3, R4, R5, and R6 | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

2.25% | None | None | |

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

None(2) | 1.00%(3) | None | |

| Annual Fund Operating Expenses | |||||

| (Expenses that you pay each year as a percentage of the value of your investment) | |||||

| Class | A | C | F | F3 | I |

| Management Fees | 0.70% | 0.70% | 0.70% | 0.70% | 0.70% |

| Distribution and Service (12b-1) Fees | 0.20% | 0.86%(4) | 0.10% | None | None |

| Other Expenses | 0.57% | 0.57% | 0.57% | 0.40% | 0.57% |

| Total Annual Fund Operating Expenses | 1.47% | 2.13% | 1.37% | 1.10%(5) | 1.27% |

| Fee Waiver and/or Expense Reimbursement(6) | (0.42)% | (0.42)% | (0.42)% | (0.42)% | (0.42)% |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement(6) | 1.05% | 1.71% | 0.95% | 0.68% | 0.85% |

PROSPECTUS – Emerging Markets Corporate

Debt Fund

16

| Annual Fund Operating Expenses (continued) | |||||

| (Expenses that you pay each year as a percentage of the value of your investment) | |||||

| Class | R2 | R3 | R4 | R5 | R6 |

| Management Fees | 0.70% | 0.70% | 0.70% | 0.70% | 0.70% |

| Distribution and Service (12b-1) Fees | 0.60% | 0.50% | 0.25% | None | None |

| Other Expenses | 0.57% | 0.57% | 0.57% | 0.57% | 0.40% |

| Total Annual Fund Operating Expenses | 1.87% | 1.77% | 1.52% | 1.27% | 1.10% |

| Fee Waiver and/or Expense Reimbursement(6) | (0.42)% | (0.42)% | (0.42)% | (0.42)% | (0.42)% |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement(6) | 1.45% | 1.35% | 1.10% | 0.85% | 0.68% |

| (1) | A shareholder transacting in share classes without a front-end sales charge may be required to pay a commission to its financial intermediary. Please contact your financial intermediary for more information about whether such a commission may apply to your transaction. |

| (2) | A contingent deferred sales charge (“CDSC”) of 1.00% may be assessed on certain Class A shares purchased or acquired without a sales charge if they are redeemed before the first day of the month of the one-year anniversary of the purchase. |

| (3) | A CDSC of 1.00% may be assessed on Class C shares if they are redeemed before the first anniversary of their purchase. |

| (4) | The 12b-1 fee the Fund will pay on Class C shares will be a blended rate calculated based on (i) 1.00% of the Fund’s average daily net assets attributable to shares held for less than one year and (ii) 0.80% of the Fund’s average daily net assets attributable to shares held for one year or more. All Class C shareholders of the Fund will bear 12b-1 fees at the same rate. |

| (5) | This amount has been updated from fiscal year amounts to reflect current fees and expenses. |

| (6) | For the period from May 1, 2021 through April 30, 2022, Lord, Abbett & Co. LLC (“Lord Abbett”) has contractually agreed to waive its fees and reimburse expenses to the extent necessary to limit total net annual operating expenses, excluding any applicable 12b-1 fees, acquired fund fees and expenses, interest-related expenses, taxes, expenses related to litigation and potential litigation, and extraordinary expenses, to an annual rate of 0.68% for each of Class F3 and R6 shares and to an annual rate of 0.85% for each other class. This agreement may be terminated only by the Fund’s Board of Directors. |

Example

This Example is intended to help you compare the cost of investing

in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time

periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment

has a 5% return each year and that the Fund’s operating expenses remain the same, giving effect to the fee waiver and expense

reimbursement arrangement described above. Class C shares automatically convert to Class A shares after eight years. The expense

example for Class C shares for the ten-year period reflects the conversion to Class A shares. Although

your actual costs may be higher or lower, based on these assumptions your costs would be:

PROSPECTUS – Emerging Markets Corporate Debt Fund

17

| Class | If Shares Are Redeemed | If Shares Are Not Redeemed | ||||||||||||||||||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||

| Class A Shares | $ | 330 | $ | 639 | $ | 971 | $ | 1,908 | $ | 330 | $ | 639 | $ | 971 | $ | 1,908 | ||||||||||||||||

| Class C Shares | $ | 274 | $ | 627 | $ | 1,106 | $ | 2,260 | $ | 174 | $ | 627 | $ | 1,106 | $ | 2,260 | ||||||||||||||||

| Class F Shares | $ | 97 | $ | 392 | $ | 710 | $ | 1,610 | $ | 97 | $ | 392 | $ | 710 | $ | 1,610 | ||||||||||||||||

| Class F3 Shares | $ | 69 | $ | 308 | $ | 566 | $ | 1,302 | $ | 69 | $ | 308 | $ | 566 | $ | 1,302 | ||||||||||||||||

| Class I Shares | $ | 87 | $ | 361 | $ | 657 | $ | 1,497 | $ | 87 | $ | 361 | $ | 657 | $ | 1,497 | ||||||||||||||||

| Class R2 Shares | $ | 148 | $ | 547 | $ | 972 | $ | 2,156 | $ | 148 | $ | 547 | $ | 972 | $ | 2,156 | ||||||||||||||||

| Class R3 Shares | $ | 137 | $ | 516 | $ | 920 | $ | 2,049 | $ | 137 | $ | 516 | $ | 920 | $ | 2,049 | ||||||||||||||||

| Class R4 Shares | $ | 112 | $ | 439 | $ | 789 | $ | 1,777 | $ | 112 | $ | 439 | $ | 789 | $ | 1,777 | ||||||||||||||||

| Class R5 Shares | $ | 87 | $ | 361 | $ | 657 | $ | 1,497 | $ | 87 | $ | 361 | $ | 657 | $ | 1,497 | ||||||||||||||||

| Class R6 Shares | $ | 69 | $ | 308 | $ | 566 | $ | 1,302 | $ | 69 | $ | 308 | $ | 566 | $ | 1,302 | ||||||||||||||||

Portfolio Turnover. The Fund pays transaction costs, such

as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate

may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs,

which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. During the

most recent fiscal year, the Fund’s portfolio turnover rate was 66% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

To pursue its investment objective, under normal circumstances,

the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in corporate debt securities

that are tied economically to emerging market countries and derivative instruments that are intended to provide economic exposure

to such securities. For purposes of this policy, the Fund considers emerging market countries to include every nation in the world

except the United States, Canada, Japan, Australia, New Zealand, and most countries located in Western Europe.

The Fund may invest in U.S. dollar-denominated or non-U.S. dollar

denominated securities without limit. The Fund may invest in derivatives consisting principally of swaps, options, forwards, and

futures, for hedging or non-hedging purposes, or as a substitute for investing directly in emerging market debt securities.

The Fund may invest in all types of emerging market debt securities

and derivative instruments, including corporate debt securities, government securities, loans, convertible securities, mortgage-backed

and other asset-backed securities, inflation-linked investments, sovereign and quasi-sovereign bonds, structured notes, hybrid

or “indexed” securities, event-linked bonds, and government-sponsored enterprises, debentures, and derivatives based

on the return of debt securities.

The Fund may invest in securities of any credit quality, maturity,

or duration. Although Lord Abbett expects to maintain an average duration for the Fund that generally is consistent with those

of intermediate- to long-term debt funds, there are

PROSPECTUS – Emerging Markets Corporate Debt Fund

18

no duration restrictions on the Fund’s individual investments or its

overall portfolio. The Fund may invest without limitation in high-yield debt securities (commonly referred to as “below investment

grade” or “junk” bonds). High-yield debt securities are rated BB/Ba or lower at the time of purchase by an independent

rating agency, or are unrated but deemed by Lord Abbett to be of comparable quality.

Under normal circumstances, the Fund will invest in securities economically

tied to at least three emerging market countries. However, from time to time the Fund may invest more than 25% of its assets in

securities tied economically to one country, including the U.S., to respond to adverse market, economic, political, or other conditions.

The portfolio management team buys and sells securities using a

relative value-oriented investment process and combines bottom-up and top-down analysis to construct its portfolio. In selecting

securities, the portfolio management team may overweight or underweight individual issuers, industries, sectors, countries, or

regions relative to the benchmark. The investment team may also consider the risks and return potential presented by environmental,

social, and governance (ESG) factors in investment decisions. The Fund may engage in active and frequent trading of its portfolio

securities.

The Fund may sell a security when the Fund believes the security

is less likely to benefit from the current market and economic environment, or shows signs of deteriorating fundamentals, among

other reasons. The Fund may deviate from the investment strategy described above for temporary defensive purposes. The Fund may

miss certain investment opportunities if defensive strategies are used and thus may not achieve its investment objective.

PRINCIPAL RISKS

As with any investment in a mutual fund, investing in the Fund involves

risk, including the risk that you may receive little or no return on your investment. When you redeem your shares, they may be

worth more or less than what you paid for them, which means that you may lose a portion or all of the money you invested in the

Fund. The principal risks of investing in the Fund, which could adversely affect its performance, include:

| · | Portfolio Management Risk: If the strategies used and investments selected by the Fund’s portfolio management team fail to produce the intended result, the Fund may suffer losses or underperform other funds with the same investment objective or strategies, even in a favorable market. |

|

| · | Market Risk: The market values of securities will fluctuate, sometimes sharply and unpredictably, based on overall economic conditions, governmental actions or intervention, market disruptions caused by trade disputes or other factors, political developments, and other factors. Prices of equity securities tend to rise and fall more dramatically than those of debt securities. |

PROSPECTUS – Emerging Markets Corporate Debt Fund

19

| · | Fixed Income Securities Risk: The Fund is subject to the general risks and considerations associated with investing in debt securities, including the risk that issuers will fail to make timely payments of principal or interest or default altogether. Lower-rated securities in which the Fund may invest may be more volatile and may decline more in price in response to negative issuer developments or general economic news than higher rated securities. In addition, as interest rates rise, the Fund’s investments typically will lose value. |

|

| · | Foreign and Emerging Market Company Risk: Investments in foreign companies and in U.S. companies with economic ties to foreign markets generally involve special risks that can increase the likelihood that the Fund will lose money. For example, as compared with companies organized and operated in the U.S., these companies may be more vulnerable to economic, political, and social instability and subject to less government supervision, lack of transparency, inadequate regulatory and accounting standards, and foreign taxes. In addition, the securities of foreign companies also may be subject to inadequate exchange control regulations, the imposition of economic sanctions or other government restrictions, higher transaction and other costs, reduced liquidity, and delays in settlement to the extent they are traded on non-U.S. exchanges or markets. Foreign company securities also include American Depositary Receipts (“ADRs”). ADRs may be less liquid than the underlying shares in their primary trading market. Foreign securities also may subject the Fund’s investments to changes in currency exchange rates. Emerging market securities generally are more volatile than other foreign securities, and are subject to greater liquidity, regulatory, and political risks. Investments in emerging markets may be considered speculative and generally are riskier than investments in more developed markets because such markets tend to develop unevenly and may never fully develop. Emerging markets are more likely to experience hyperinflation and currency devaluations. Securities of emerging market companies may have far lower trading volumes and less liquidity than securities of issuers in developed markets. Companies with economic ties to emerging markets may be susceptible to the same risks as companies organized in emerging markets. |

|

| · | Foreign Currency Risk: Investments in securities denominated in foreign currencies are subject to the risk that those currencies will decline in value relative to the U.S. dollar, or, in the case of hedged positions, that the U.S. dollar will decline in value relative to the currency being hedged. Foreign currency exchange rates may fluctuate significantly over short periods of time. |

|

| · | Sovereign Debt Risk: Sovereign debt securities are subject to the risk that the relevant sovereign government or governmental entity may delay or refuse to pay interest or repay principal on its debt, due to, for example, cash flow problems, insufficient foreign currency reserves, political considerations, the size of its debt relative to the economy, or the failure to put in place economic reforms required by the International Monetary Fund or other multilateral agencies. There is no legal process for collecting sovereign debt that is not |

PROSPECTUS – Emerging Markets Corporate Debt Fund

20

| repaid, nor are there bankruptcy proceedings through which all or part of the unpaid sovereign debt may be collected. |

||

| · | Derivatives Risk: The risks associated with derivatives may be different from and greater than the risks associated with directly investing in securities and other investments. Derivatives may increase the Fund’s volatility and reduce its returns. The risks associated with derivatives include, among other things, the following: |

|

| · | The risk that the value of a derivative may not correlate with the value of the underlying asset, rate, or index in the manner anticipated by the portfolio management team and may be more sensitive to changes in economic or market conditions than anticipated. |

|

| · | Derivatives may be difficult to value, especially under stressed or unforeseen market conditions. | |

| · | The risk that the counterparty may fail to fulfill its contractual obligations under the derivative contract. Central clearing of derivatives is intended to decrease counterparty risk but does not eliminate it. |

|

| · | The Fund may be required to segregate permissible liquid assets to cover its obligations under these transactions and may have to liquidate positions before it is desirable to do so to fulfill its segregation requirements. |

|

| · | The risk that there may not be a liquid secondary trading market for the derivative, or that the Fund may otherwise be unable to sell or otherwise close a derivatives position when desired, exposing the Fund to additional losses. |

|

| · | Because derivatives generally involve a small initial investment relative to the risk assumed (known as leverage), derivatives can magnify the Fund’s losses and increase its volatility. |

|

| · | The Fund’s use of derivatives may affect the amount, timing, and character of distributions, and may cause the Fund to realize more short-term capital gain and ordinary income than if the Fund did not use derivatives. |

|

Derivatives may not perform as expected

and the Fund may not realize the intended benefits. Whether the Fund’s use of derivatives is successful will depend on, among

other things, the portfolio managers’ ability to correctly forecast market movements and other factors. If the portfolio

managers incorrectly forecast these and other factors, the Fund’s performance could suffer. In addition, given their complexity,

derivatives are subject to the risk that improper or misunderstood documentation may expose the Fund to losses.

| · | High Yield Securities Risk: High yield securities (commonly referred to as “junk” bonds) typically pay a higher yield than investment grade securities, but may have greater price fluctuations and have a higher risk of default than investment grade securities. The market for high yield securities may be less |

PROSPECTUS – Emerging Markets Corporate Debt Fund

21

| liquid due to such factors as interest rate sensitivity, negative perceptions of the junk bond markets generally, and less secondary market liquidity. This may make such securities more difficult to sell at an acceptable price, especially during periods of financial distress, increased market volatility, or significant market decline. |

||

| · | Convertible Securities Risk: Convertible securities are subject to the risks affecting both equity and fixed income securities, including market, credit, liquidity, and interest rate risk. Convertible securities tend to be more volatile than other fixed income securities, and the markets for convertible securities may be less liquid than markets for common stocks or bonds. To the extent that the Fund invests in convertible securities and the investment value of the convertible security is greater than its conversion value, its price will likely increase when interest rates fall and decrease when interest rates rise. If the conversion value exceeds the investment value, the price of the convertible security will tend to fluctuate directly with the price of the underlying equity security. A significant portion of convertible securities have below investment grade credit ratings and are subject to increased credit and liquidity risks. |

|

| · | Credit Risk: Debt securities are subject to the risk that the issuer or guarantor of a security may not make interest and principal payments as they become due or may default altogether. In addition, if the market perceives a deterioration in the creditworthiness of an issuer, the value and liquidity of securities issued by that issuer may decline. To the extent that the Fund holds below investment grade securities, these risks may be heightened. Insured debt securities have the credit risk of the insurer in addition to the credit risk of the underlying investment being insured. |

|

| · | Interest Rate Risk: As interest rates rise, prices of bonds (including tax-exempt bonds) generally fall, typically causing the Fund’s investments to lose value. Additionally, rising interest rates or lack of market participants may lead to decreased liquidity in fixed income markets. Interest rate changes generally have a more pronounced effect on the market value of fixed-rate instruments, such as corporate bonds, than they have on floating rate instruments, and typically have a greater effect on the price of fixed income securities with longer durations. A wide variety of market factors can cause interest rates to rise, including central bank monetary policy, rising inflation, and changes in general economic conditions. To the extent the Fund invests in floating rate instruments, changes in short-term market interest rates may affect the yield on those investments. If short-term market interest rates fall, the yield on the Fund’s shares will also fall. Conversely, when short-term market interest rates rise, because of the lag between changes in such short- term rates and the resetting of the floating rates on the floating rate debt in the Fund’s portfolio, the impact of rising rates may be delayed. To the extent the Fund invests in fixed rate instruments, fluctuations in the market price of such investments may not affect interest income derived from those instruments, but may nonetheless affect the |

PROSPECTUS – Emerging Markets Corporate Debt Fund

22

| Fund’s net asset value (“NAV”), especially if the instrument has a longer maturity. Substantial increases in interest rates may cause an increase in issuer defaults, as issuers may lack resources to meet higher debt service requirements. In recent years, the U.S. has experienced historically low interest rates, increasing the exposure of bond investors to the risks associated with rising interest rates. |

||

| · | Liquidity/Redemption Risk: The Fund may lose money when selling securities at inopportune times to fulfill shareholder redemption requests. The risk of loss may increase depending on the size and frequency of redemption requests, whether the redemption requests occur in times of overall market turmoil or declining prices, and whether the securities the Fund intends to sell have decreased in value or are illiquid. The Fund may be less able to sell illiquid securities at its desired time or price. It may be more difficult for the Fund to value its investments in illiquid securities than more liquid securities. |

|

| · | Loan Risk: Investments in floating or adjustable rate loans are subject to increased credit and liquidity risks. Loan prices also may be adversely affected by supply-demand imbalances caused by conditions in the loan market or related markets. Below investment grade loans, like high-yield debt securities, or junk bonds, usually are more credit sensitive than interest rate sensitive, although the value of these instruments may be affected by interest rate swings in the overall fixed income market. Loans may be subject to structural subordination and may be subordinated to other obligations of the borrower or its subsidiaries. |

|

| · | Leverage Risk: Certain of the Fund’s transactions (including, among others, forward foreign currency contracts and other derivatives, reverse repurchase agreements, and the use of when-issued, delayed delivery or forward commitment transactions) may give rise to leverage risk. Leverage may increase volatility in the Fund by magnifying the effect of changes in the value of the Fund’s holdings. The use of leverage may cause the Fund to lose more money in adverse environments than would have been the case in the absence of leverage. There is no assurance that the Fund will be able to employ leverage successfully. |

|

| · | Geographic Focus Risk: To the extent the Fund focuses its investments in a single country or only a few countries in a particular geographic region, economic, political, regulatory or other conditions affecting such region may have a greater impact on Fund performance. |

|

| · | Potential Changes in Tax Treatment Risk: The Fund intends to continue to qualify as a “regulated investment company” under subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Under subchapter M, at least 90% of the Fund’s gross income for each taxable year must be “qualifying income.” The Fund believes that its investment strategies with respect to foreign currencies will generate qualifying income under current U.S. federal income |

PROSPECTUS – Emerging Markets Corporate Debt Fund

23

| tax law. The Code, however, expressly provides the U.S. Treasury Department with authority to issue regulations that would exclude foreign currency gains from qualifying income if such gains are not directly related to the Fund’s business of investing in stock or securities (or options and futures with respect thereto). As of the date of this prospectus, the U.S. Treasury Department has not exercised this regulatory authority; however, there can be no assurance that it will not issue regulations in the future (possibly with retroactive effect) that would treat some or all of the Fund’s foreign currency gains as nonqualifying income. |

||

| · | High Portfolio Turnover Risk: High portfolio turnover may result in increased transaction costs, reduced investment performance, and higher taxes resulting from increased realized capital gains, including short-term capital gains taxable as ordinary income when distributed to shareholders. |

|

An investment in the Fund is not a deposit of any bank and is not

insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. For more information on the

principal risks of the Fund, please see the “More Information About the Funds – Principal Risks”

section in the prospectus.

PERFORMANCE

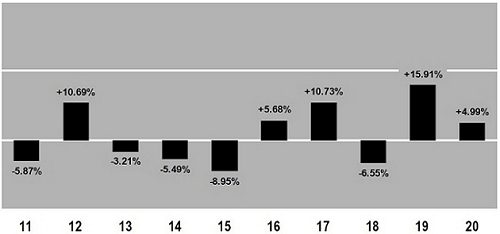

The bar chart and table below provide some indication of the risks

of investing in the Fund by illustrating the variability of the Fund’s returns. Each assumes reinvestment of dividends and

distributions. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will

perform in the future. No performance is shown for Class R2 shares because the Fund has no Class R2 shares outstanding. Class R2

shares of the Fund are not currently offered.

The bar chart shows changes in the performance of the Fund’s

Class A shares from calendar year to calendar year. This chart does not reflect the sales charge applicable to Class A shares.

If the sales charge were reflected, returns would be lower. Performance for the Fund’s other share classes will vary due

to the different expenses each class bears. Updated performance information is available at www.lordabbett.com or by calling 888-522-2388.

PROSPECTUS – Emerging Markets Corporate Debt Fund

24

|

Bar Chart (per calendar year) – Class A Shares

Best Quarter 2nd Q 2020 +12.02% Worst Quarter 1st Q 2020 -12.98% |

The table below shows how the Fund’s average annual total

returns compare to the returns of a securities market index with investment characteristics similar to those of the Fund. The Fund’s

average annual total returns include applicable sales charges.

The after-tax returns of Class A shares included in the table below

are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state

and local taxes. In some cases, the return after taxes on distributions and sale of Fund shares may exceed the return before taxes

due to a tax benefit resulting from realized losses on a sale of Fund shares at the end of the period that is used to offset other

gains. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The after-tax returns

shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements such as 401(k) plans or Individual

Retirement Accounts (“IRAs”). After-tax returns for other share classes are not shown in the table and will vary from

those shown for Class A shares.

PROSPECTUS – Emerging Markets Corporate Debt Fund

25

| Average Annual Total Returns | |||||

| (for the periods ended December 31, 2020) | |||||

| Class | 1 Year | 5 Years | Life of Class | Inception Date for Performance |

|

| Class A Shares | 12/31/2013 | ||||

| Before Taxes | 3.38% | 6.01% | 5.50% | ||

| After Taxes on Distributions | 1.68% | 4.04% | 3.34% | ||

| After Taxes on Distributions and Sale of Fund Shares | 1.93% | 3.73% | 3.23% | ||

| Class C Shares(1) | 4.09% | 5.79% | 5.12% | 12/31/2013 | |

| Class F Shares | 5.87% | 6.58% | 5.93% | 12/31/2013 | |

| Class F3 Shares | 6.16% | – | 5.70% | 4/4/2017 | |

| Class I Shares | 5.90% | 6.67% | 6.03% | 12/31/2013 | |

| Class R3 Shares | 5.46% | 6.50% | 5.91% | 12/31/2013 | |

| Class R4 Shares | 5.74% | 6.43% | 5.57% | 6/30/2015 | |

| Class R5 Shares | 5.99% | 6.71% | 5.85% | 6/30/2015 | |

| Class R6 Shares | 6.16% | 6.86% | 5.98% | 6/30/2015 | |

| Index | |||||

| 7.13% | 7.12% | 5.96% | 12/31/2013 | ||

| J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified (CEMBI BD) | 6.00% | 6/30/2015 | |||

| (reflects no deduction for fees, expenses, or taxes) | 6.08% | 4/4/2017 | |||

| (1) | Class C shares convert to Class A shares eight years after purchase. Class C share performance does not reflect the impact of such conversion to Class A shares. |

MANAGEMENT

Investment Adviser. The Fund’s investment adviser is

Lord Abbett.

PROSPECTUS – Emerging Markets Corporate Debt Fund

26

Portfolio Managers.

| Portfolio Managers/Title | Member of the Portfolio Management Team Since |

| John J. Morton, Portfolio Manager and Director of Investments | 2016 |

| Steven F. Rocco, Partner and Co-Head of Taxable Fixed Income | 2017 |

| Mila Skulkina, Portfolio Manager | 2020 |

PURCHASE AND SALE OF FUND SHARES

The minimum initial and additional amounts shown below vary depending

on the class of shares you buy and the type of account. Certain financial intermediaries may impose different restrictions than

those described below. For Class I shares, the minimum investment shown below applies to certain types of institutional investors,

but does not apply to registered investment advisers or retirement and benefit plans otherwise eligible to invest in Class I shares.

See “Choosing a Share Class – Investment Minimums” in the prospectus for more information. Class R2 shares of

the Fund are not currently offered.

| Investment Minimums — Initial/Additional Investments | |||

| Class | A and C(1) | F, F3, R2, R3, R4, R5, and R6 | I |

| General and IRAs without Invest-A-Matic Investments | $1,000/No minimum |

N/A | $1 million/No minimum |

| Invest-A-Matic Accounts(2) | $250/$50 | N/A | N/A |

| IRAs, SIMPLE and SEP Accounts with Payroll Deductions | No minimum | N/A | N/A |

| Fee-Based Advisory Programs and Retirement and Benefit Plans | No minimum | No minimum | No minimum |

|

(1) There is (2) There is |

|||

You may sell (redeem) shares through your securities broker, financial

professional or financial intermediary on any business day the Fund calculates its NAV. If you have direct account access privileges,

you may redeem your shares by contacting the Fund in writing at P.O. Box 219336, Kansas City, MO 64121, by calling 888-522-2388

or by accessing your account online at www.lordabbett.com.

PROSPECTUS – Emerging Markets Corporate Debt Fund

27

OTHER IMPORTANT INFORMATION REGARDING FUND SHARES

For important information about taxes and payments to broker-dealers

and other financial intermediaries, please turn to the “Tax Information” and “Payments to

Broker-Dealers and Other Financial Intermediaries” sections of the prospectus.

PROSPECTUS – Emerging Markets Corporate Debt Fund

28

INVESTMENT OBJECTIVE

The Fund’s investment objective is total return.

FEES AND EXPENSES

This table describes the fees and expenses that you may pay

if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial

intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts if you and

certain members of your family invest, or agree to invest in the future, at least $100,000 in the Lord Abbett Family of Funds.

More information about these and other discounts is available from your financial intermediary and in “Sales Charge Reductions

and Waivers” on page 90 of the prospectus, Appendix A to the prospectus, titled “Intermediary-Specific Sales Charge

Reductions and Waivers,” and “Purchases, Redemptions, Pricing, and Payments to Dealers” on page 9-1 of Part II

of the statement of additional information (“SAI”).

| Shareholder Fees(1) (Fees paid directly from your investment) | ||||

| Class | A | C | F, F3, I, R2, R3, R4, R5, and R6 | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

2.25% | None | None | |

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

None(2) | 1.00%(3) | None | |

| Annual Fund Operating Expenses | |||||

| (Expenses that you pay each year as a percentage of the value of your investment) | |||||

| Class | A | C | F | F3 | I |

| Management Fees | 0.43% | 0.43% | 0.43% | 0.43% | 0.43% |

| Distribution and Service (12b-1) Fees | 0.20% | 0.81%(4) | 0.10% | None | None |

| Other Expenses | 1.81% | 1.81% | 1.81% | 1.80% | 1.81% |

| Total Annual Fund Operating Expenses | 2.44% | 3.05% | 2.34%(5) | 2.23% | 2.24% |

| Fee Waiver and/or Expense Reimbursement(6) | (1.66)% | (1.66)% | (1.76)%(7) | (1.66)% | (1.66)% |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement(6) | 0.78% | 1.39% | 0.58% | 0.57%(5) | 0.58% |

| PROSPECTUS – Global Bond Fund 29 |

| Annual Fund Operating Expenses (continued) | |||||

| (Expenses that you pay each year as a percentage of the value of your investment) | |||||

| Class | R2 | R3 | R4 | R5 | R6 |

| Management Fees | 0.43% | 0.43% | 0.43% | 0.43% | 0.43% |

| Distribution and Service (12b-1) Fees | 0.60% | 0.50% | 0.25% | None | None |

| Other Expenses | 2.40% | 1.81% | 1.81% | 1.81% | 1.80% |

| Total Annual Fund Operating Expenses | 3.43% | 2.74% | 2.49% | 2.24% | 2.23% |

| Fee Waiver and/or Expense Reimbursement(6) | (2.25)% | (1.66)% | (1.66)% | (1.66)% | (1.66)% |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement(6) | 1.18% | 1.08% | 0.83% | 0.58% | 0.57%(5) |

| (1) | A shareholder transacting in share classes without a front-end sales charge may be required to pay a commission to its financial intermediary. Please contact your financial intermediary for more information about whether such a commission may apply to your transaction. |

| (2) | A contingent deferred sales charge (“CDSC”) of 1.00% may be assessed on certain Class A shares purchased or acquired without a sales charge if they are redeemed before the first day of the month of the one-year anniversary of the purchase. |

| (3) | A CDSC of 1.00% may be assessed on Class C shares if they are redeemed before the first anniversary of their purchase. |

| (4) | The 12b-1 fee the Fund will pay on Class C shares will be a blended rate calculated based on (i) 1.00% of the Fund’s average daily net assets attributable to shares held for less than one year and (ii) 0.80% of the Fund’s average daily net assets attributable to shares held for one year or more. All Class C shareholders of the Fund will bear 12b-1 fees at the same rate. |

| (5) | This amount has been updated from fiscal year amounts to reflect current fees and expenses. |

| (6) | For the period from May 1, 2021 through April 30, 2022, Lord, Abbett & Co. LLC (“Lord Abbett”) has contractually agreed to waive its fees and reimburse expenses to the extent necessary to limit total net annual operating expenses, excluding any applicable 12b-1 fees, acquired fund fees and expenses, interest-related expenses, taxes, expenses related to litigation and potential litigation, and extraordinary expenses, to an annual rate of 0.57% for each of Class F3 and R6 shares and to an annual rate of 0.58% for each other class. This agreement may be terminated only by the Fund’s Board of Directors. |

| (7) | For the period from May 1, 2021 through April 30, 2022, Lord Abbett Distributor LLC (“Lord Abbett Distributor”) has contractually agreed to waive the Fund’s 0.10% Rule 12b-1 fee for Class F shares. This agreement may be terminated only by the Fund’s Board of Directors. |

Example

This Example is intended to help you compare the cost of investing

in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time

periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment

has a 5% return each year and that the Fund’s operating expenses remain the same, giving effect to the fee waiver and expense

reimbursement arrangement described above. Class C shares automatically convert to Class A shares after eight years. The expense

example for Class C shares for the ten-year period reflects the conversion to Class A shares. Although

your actual costs may be higher or lower, based on these assumptions your costs would be:

| PROSPECTUS – Global Bond Fund 30 |

| Class | If Shares Are Redeemed | If Shares Are Not Redeemed | ||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||

| Class A Shares | $ | 303 | $ | 813 | $ | 1,349 | $ | 2,815 | $ | 303 | $ | 813 | $ | 1,349 | $ | 2,815 |

| Class C Shares | $ | 242 | $ | 786 | $ | 1,456 | $ | 3,104 | $ | 142 | $ | 786 | $ | 1,456 | $ | 3,104 |

| Class F Shares | $ | 59 | $ | 561 | $ | 1,090 | $ | 2,540 | $ | 59 | $ | 561 | $ | 1,090 | $ | 2,540 |

| Class F3 Shares | $ | 58 | $ | 537 | $ | 1,043 | $ | 2,435 | $ | 58 | $ | 537 | $ | 1,043 | $ | 2,435 |

| Class I Shares | $ | 59 | $ | 540 | $ | 1,048 | $ | 2,445 | $ | 59 | $ | 540 | $ | 1,048 | $ | 2,445 |

| Class R2 Shares | $ | 120 | $ | 844 | $ | 1,590 | $ | 3,561 | $ | 120 | $ | 844 | $ | 1,590 | $ | 3,561 |

| Class R3 Shares | $ | 110 | $ | 693 | $ | 1,302 | $ | 2,949 | $ | 110 | $ | 693 | $ | 1,302 | $ | 2,949 |

| Class R4 Shares | $ | 85 | $ | 617 | $ | 1,176 | $ | 2,700 | $ | 85 | $ | 617 | $ | 1,176 | $ | 2,700 |

| Class R5 Shares | $ | 59 | $ | 540 | $ | 1,048 | $ | 2,445 | $ | 59 | $ | 540 | $ | 1,048 | $ | 2,445 |

| Class R6 Shares | $ | 58 | $ | 537 | $ | 1,043 | $ | 2,435 | $ | 58 | $ | 537 | $ | 1,043 | $ | 2,435 |

Portfolio Turnover. The Fund pays transaction costs,

such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover

rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These

costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. During

the most recent fiscal year, the Fund’s portfolio turnover rate was 239% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund seeks to achieve its investment objective by investing

across multiple sectors in developed and emerging markets located throughout the world. To pursue its objective, under normal conditions,

the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in bonds and other

fixed income securities and derivative instruments intended to provide economic exposure to such securities.

Under normal conditions, the Fund’s investments consist

of the following types of U.S. and foreign (including emerging market) securities and other financial instruments:

| · | investment grade fixed income securities; |

| · | mortgage-backed, mortgage-related, and other asset-backed securities; |

| · | high-yield fixed income securities (commonly referred to as “below investment grade” or “junk” bonds); |