Fractional shares: Experts weigh in amid exploding retail buying and selling volumes

4 min readDiminishing return in Fx investing and US regulatory tension on one stock CFDs pave the way for US inventory choices with fractional shares.

The trading industry in no way sleeps. A great deal has altered since international exchange buying and selling initial moved to the internet and new phenomenons have emerged with the mass adoption of know-how and recent innovations from fintech companies.

Amid them is the introduction of fractional shares trading into the mainstream as the Fx business has gone multi-asset with traders increasingly fascinated in the inventory marketplace.

In short, people employed to be expected to specify how numerous shares they preferred to order. Fractional shares altered all that. Now, traders get their positions centered on the volume of money regardless of the range of shares. Not remarkably, this approach has promptly developed in reputation.

In November of 2019, Interactive Brokers grew to become the 1st of the significant on-line brokers to provide fractional shares buying and selling. This was three many years immediately after DriveWealth initially launched its investing technological know-how and a customizable suite of APIs for brokers to provide an avenue to trade US stocks. In 2021, access to fractional shares trading appears to be to have develop into a offer-breaker for lots of buyers who choose their future broker.

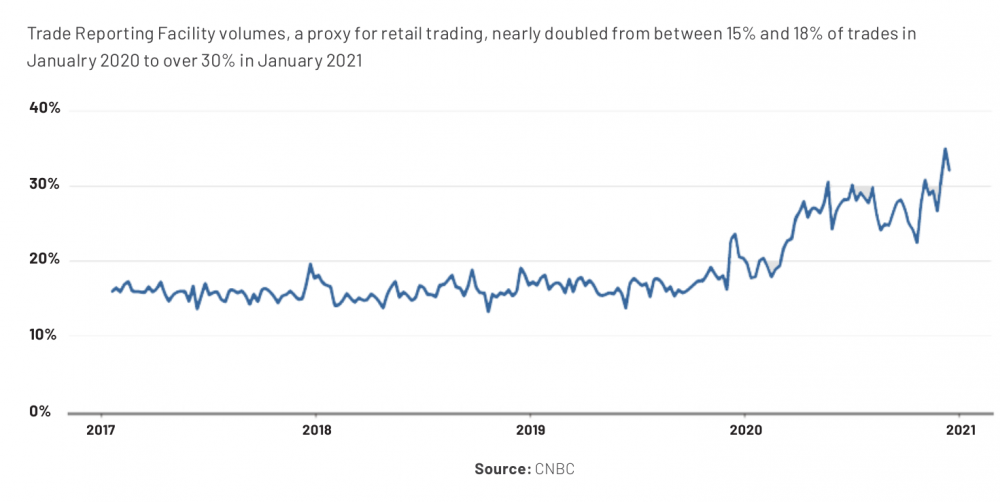

Retail investing volumes have just about doubled due to the fact the pandemic, but how a great deal is likely by means of fractional shares offerings?

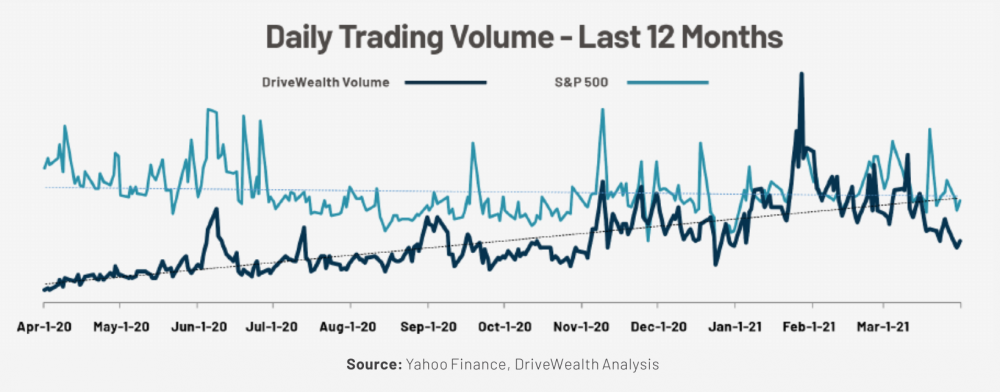

A comparison concerning DriveWealth volumes and S&P 500 provides a clearer image. Whilst the latter has remained relatively stable through the calendar year considering that April 2020, the fractional shares trading giving from DriveWealth offers a growth sample.

In 2021, DriveWealth buying and selling volume rose 45% in the first quarter, when compared to a 13% rise in quantity on the S&P 500 and 50% on NASDAQ. Whilst DriveWealth’s January quantity spiked, complete quantity ranges held continuous through February and March.

Marketplace investing quantity spiked in January thanks to the GameStop brief squeeze, with the tech-hefty NASDAQ experiencing a a lot more severe spike.

An additional scenario in level is Equiti Group. The company launched fractional shares in Q4 2020 – reducing the bare minimum trade dimensions of US and EU single stocks to one particular-tenth of a share, complementing its fee no cost US stock presenting.

“Following the introduction of fractional shares, in Could 2021, Equiti mentioned a YoY maximize of 1406% in investing volumes on equities, from which launching fractional shares and enabling Equiti to increase its one stocks enterprise would have been a contributing factor”, mentioned George Moore, product analyst at Equiti.

But how significant is it that brokers update their providing and insert this innovation? We spoke to Roman Nalivayko, Chief Government Officer of white label buying and selling software package TraderEvolution, to much better comprehend the effects of fractionalization inside the area.

“We see fractional investing as a new sector regular in the retail place and before long it will develop into a will have to-have service. The absence of these kinds of an solution will develop a big hole among brokerage firms equivalent to 1 between cellular phone working and digital trading”, reported the executive from TraderEvolution.

“This also opens new options for advertising and marketing and companies applying a portion of inventory as a present in certain or scheduled automated purchasing, etcetera. As for portfolio management business, this operation opens obtain to high priced stocks to a significantly wider auditory. So now, investors can have top corporations in their portfolio no matter of their account dimensions.”

Brokers are undeniably struggling with a diminishing return in Forex trading. In the meantime, single stock CFDs are under regulatory force from the United states of america authorities. This context paves the way for the explosive growth of US inventory offerings with fractional shares as we’ve seen with Robinhood and other neobrokers.

Fractional shares also handle the needs of younger generations as the marketplace activities a transform in demographics with the rise of social buying and selling. “How can a 20-calendar year previous child trade the Berkshire Hathaway (BRK.A) stock, really worth $432,800.00 now? Now, they do have entry to it”, reported Joseph O’Mara, CEO at Markets Direct, who showcased the firm’s Gateway Hub at iFX EXPO Dubai previous 7 days.

Oksana Remez, Business Enhancement Govt at Finalto, reminded us that fractionalization of trading was how the CFD marketplace started and how other items, like micro futures, also function.

Still, fractional trading is “quite beneficial due to the fact it will catch the attention of retail” and “that’s why we commenced the DMA and funds crypto featuring – since we see there will be a deviation from the OTC market to the DMA market”, explained Ms. Remez.

While the awareness has generally gone in direction of US stocks, fractionalization can in theory be utilized to any offered asset. There is wherever fintech corporations enter the photograph.

Brokeree, a expert in MetaTrader answers, has been asked for by a couple of brokers to build fractional investing products and solutions, particularly for Gold symbols, said Anton Sokolov, Marketing Manager at Brokeree. “Interesting craze but it’s tricky to take care of sometimes.”

Practically nothing superior comes without having a obstacle. It was not easy to build, but fractional shares buying and selling is now mainstream. They are listed here to remain and undoubtedly cannot be ignored.