Funds gains tax hikes and inventory current market overall performance

2 min readPresident pushes approach for the rich to shell out their truthful share in taxes in Wednesday night’s remarks to joint session of Congress

No query President Biden’s proposed bigger 39.6% cash gains tax level on individuals earning above $1 million is making numerous inventory traders queasy, but the stock marketplace impact may well be much more muted than some anticipated, according to Goldman Sachs.

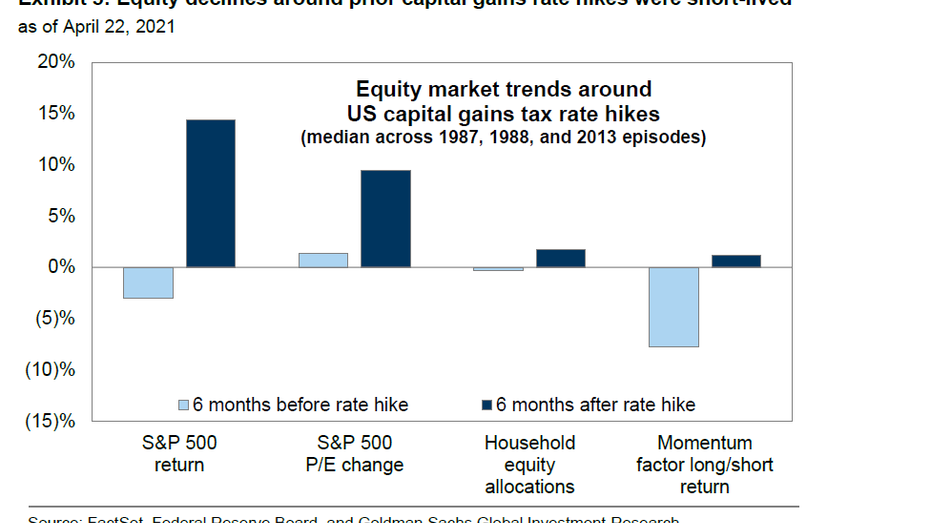

“S&P 500 returns have also been weak in advance of earlier cash gains tax hikes, but providing was quick-lived and reversed afterward” the group, led by David Kostin, wrote to purchasers previously this 7 days.

(Courtesy Goldman Sachs/US Weekly Kickstart 4/23/2021)

The workforce also observed, for the duration of the past hike in 2013, even though superior earners were being the “largest net sellers of equities,” the blip was temporary.

“Although the wealthiest homes offered 1% of their property prior to the price hike, they purchased 4% of starting equity property in the quarter just after the alter and as a result only temporarily reduced their fairness exposures in purchase to notice gains at the lower charge,” the workforce claimed. The company pointed out the motion with the prior two hikes was “very similar.”

In addition, these individuals are possible to plow funds back into shares when the dust settles. “We forecast net equity getting by homes will overall $350 billion in 2021 and be driven by the wealthiest 1%,” the group reported.

Simply click Here TO Read through Far more ON FOX Organization

U.S. shares are investing just under all-time highs as traders gauge the long-time period effect.

| Ticker | Stability | Final | Change | Adjust % |

|---|---|---|---|---|

| SP500 | S&P 500 | 4178.52 | -4.66 | -.11% |

| I:DJI | DOW JONES AVERAGES | 33756.6 | -63.78 | -.19% |

| I:COMP | NASDAQ COMPOSITE INDEX | 13954.030535 | -97.00 | -.69% |

Biden, on Wednesday, during his very first handle to Congress stressed the amount will impression just .3% of the population. “I’m not seeking to punish everyone” Biden discussed introducing, “I think what I proposed is fair.”

Not everybody agrees. According to assessment by the Tax Basis, a better level will crimp financial advancement by clipping .1% off GDP and “minimize federal revenue by $124 billion in excess of 10 a long time.”

APPLE CFO HOPES BIDEN TAX Approach Won’t Set US Organizations ‘AT A DISADVANTAGE’

BMO Capital Markets main investment decision strategist Brian Belski gives perception into the achievable marketplace and financial effects of elevating the capital gains tax, the Federal Reserve and earnings.

Brian Belski, BMO’s chief marketplace strategists and other folks, say a increased corporate tax price, proposed to go to 28% from 21%, is a even larger threat.

“These are businesses are the ones paying these individuals in terms of employment if you do see far more of a leap, primarily in the smaller businesses…if you see a company tax enhance you are heading to see employment really sluggish down” he warned all through an visual appeal on FOX Business’ Mornings With Maria.