GameStop share frenzy starts yet again as platforms simplicity constraints | Business News

4 min readShares in US retailer GameStop have surged as soon as extra as on-line investing platforms elevate restrictions briefly positioned on the military of armchair buyers battling hedge money and other limited-sellers.

The stock jumped by extra than 80% at Friday’s open – triggering a safety system that halted investing temporarily – adhering to sharp falls the working day just before as fee-free of charge brokerages struggled to cope with the volumes of trading and new purchaser requests.

Platforms together with Robinhood, Investing212 and Interactive Brokers prepared a return to usual operations on Friday as the assault on Wall St, which has witnessed retail investors collaborate in their thousands and thousands via social media discussion boards, continued apace.

Beginner buyers have been obtaining the shares this month to try out to experience quick gains and impose losses on hedge cash and other so-referred to as small-sellers who betted billions on the firm’s benefit falling.

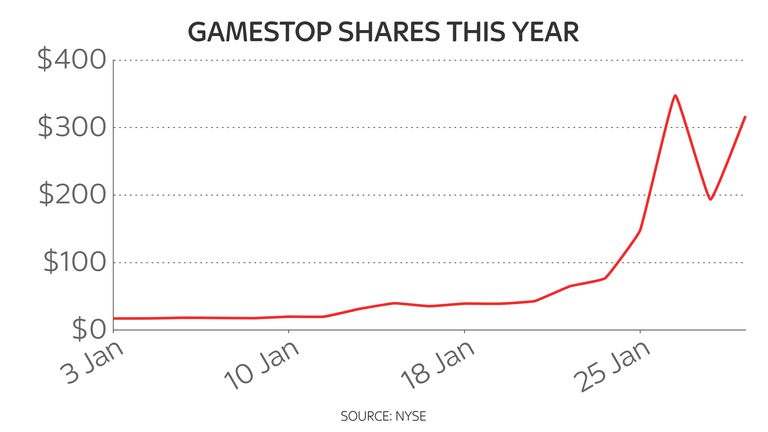

Shares in the video activity chain were up 1,744% by near of buying and selling in New York on Wednesday – going from underneath $20 previously in January to around $350.

But they slipped by 40% on Thursday as limitations have been imposed by the on the web platforms.

The rate rose to $354 in advance of the so-known as circuit breaker was implemented in early Friday specials as brokerages bought to grips with a flood of recommendations.

Having said that, a single London-based mostly brokerage Freetrade claimed that it had disabled buy orders for US stocks simply because its foreign trade company and bank had unexpectedly requested it to limit trade volumes.

The firm had before utilized an interview with Sky News to say it was busy “educating” traders on the current marketplace challenges.

Robinhood, which was amongst those to confront an offended backlash from consumers when it pulled investing, was documented by the New York Occasions to have lifted $1bn in crisis funding late on Thursday to meet demand from customers.

The astonishing share selling price gains have prompted US regulators to critique the activity as worries mount in excess of the expansion in retail buyers – non-market place experts – coordinating a approach on the net.

The Securities and Trade Commission warned market participants in advance of Friday’s dealing that they must be very careful not to split principles masking the “manipulation” of stocks and that issuers meet up with their compliance prerequisites.

The UK’s Financial Carry out Authority informed Sky News on Thursday that it was monitoring the condition.

The volatility of current times is expected to carry on.

It has gripped the broader marketplaces mainly because hedge cash and many others to have misplaced closely on their positions have been promoting other stocks to include their losses.

The exercise has been blamed for jitters globally in modern days.

It has pitted inventory market pros from the armchair investor, whose quantities have swelled during the coronavirus crisis as they seek to make their funds operate for them at a time of ultra-minimal desire charges.

US politicians are to mount an inquiry amid fears that the tidal wave of investor activism could pose a risk to the economic program.

Even so, some joined criticism of online buying and selling services that restricted small traders buying and selling GameStop and shares in other firms like Nokia and Blackberry – which also observed solid rises in their US-detailed shares on Friday.

Democrat agent Alexandria Ocasio-Cortez said the conclusion to suspend working by Robinhood, arguably the most significant profile zero-commission system, was “unacceptable” and that she would assistance a listening to on why it blocked tiny investors although rich economic establishments “are freely able to trade the stock as they see in shape”.

The CEO of Robinhood – whose company’s intention is to “democratize” investing and has about 13 million consumers – stated it experienced acted “pre-emptively” to safeguard the company and its customers from probable losses.

Vlad Tenev also told CNBC that the go had not been prompted by any hedge fund.

The surge was partly fuelled by persons sharing suggestions on sites this sort of as Reddit – particularly the wallstreetbets board – as very well as personal Facebook groups these types of as “Robin Hood’s Stock Marketplace Watchlist”.

That system was taken down by Fb on Friday which cited violations of its working problems for the move.

1 trader posted screengrabs on Reddit suggesting he had turned an preliminary expense of $53,566 (£39,061) into just one truly worth extra than $25m (£18.2m) at a single issue this 7 days.

Adding to the pleasure of individuals investors – which contains another group on the social media platform TikTok – has been the discomfort of people on the shedding side of the trade.

Brief-sellers are loathed by many personal buyers for the positions they get versus some organizations and, in the process, contributing to falls in their share cost.

Many of these are hedge funds and a variety of them have been caught out terribly by the surge in GameStop shares.

Joy at tweaking the tail of these small-sellers is not, on the other hand, confined to the modest investors on Reddit, Facebook and TikTok.

Elon Musk, who in the past has frequently railed in opposition to hedge funds for driving down the selling price in shares of Tesla, tweeted on Tuesday night: “Gamestonk!!”

Another current tweet of his has been credited for driving up the charge of Bitcoin by 13%.