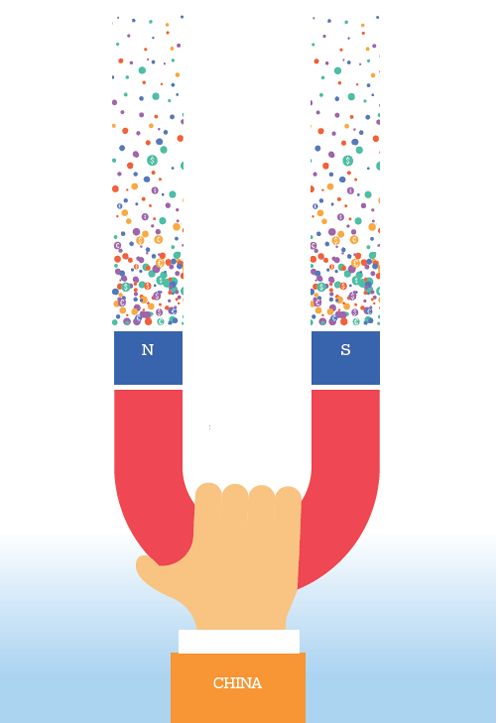

Global investors pursue RMB-denominated belongings

7 min read

Experts persuade more opening of money marketplaces

With RMB-denominated fiscal assets a lot more desirable than ever to world wide traders, experts are saying that China should keep on to steadily open up its fiscal marketplaces.

Most economies around the globe are still paralyzed by the coronavirus pandemic, and commodity rates a short while ago surged to document highs.

Economic belongings such as RMB-denominated kinds, which can deliver steady returns, are being chased by traders around the world, but inflation has turn out to be a significant component in diluting gains.

In April, holdings of RMB bonds by overseas establishments rose thirty day period-on-thirty day period by 64.86 billion yuan ($10.16 billion).

These kinds of establishments favor the treasury bond issued by the central authorities in China. In April, their holdings of this kind of bonds rose by 51.74 billion yuan month-on-thirty day period, according to China Central Depository and Clearing Co.

Economical situations have continued to boost in the United States, the eurozone and the United Kingdom, in accordance to analysis by Moody’s Investors Company, when these kinds of ailments in emerging markets have recovered to their historic ordinary. Plan assist and the progress built with rolling out of COVID-19 vaccines have boosted these situations.

In addition to the attraction of financial property, foreign capital inflows to China’s money marketplaces have been induced by the widening gap amongst yields of Chinese treasury bonds and these issued in the US.

The Chinese currency has received more than 10 percent versus the US greenback more than the past calendar year, buoyed by the financial rebound from the pandemic and money inflows from overseas. It a short while ago arrived at highs very last observed in May well 2018, but this speedy appreciation is anticipated to be quick-lived, since market place forces will consequence in a two-way fluctuation of the trade price.

According to professionals, the greater participation of international capital in China’s money markets will not change in the brief and medium expression.

Zhong Hong, vice-president of the Lender of China’s study institute, reported foreign buyers will keep on to obtain RMB-denominated assets this year, although there may possibly still be some uncertainties and fluctuations in the world-wide current market.

These investors are attracted by China’s sound economy and its reasonably stable interest and exchange costs, in contrast with individuals somewhere else in the earth, Zhong said.

Quotas option

Fang Xinghai, vice-chairman of the China Securities Regulatory Commission, explained Chinese regulators would take steps to continue to keep the money current market secure all through additional opening-up, and avoid large-scale fluctuations, which can be prompted by cross-border capital flows.

He included that one possibility is to use quotas to command day by day southbound and northbound buying and selling as a result of the Shanghai, Shenzhen and Hong Kong stock connect applications.

“In the event of international money coming in and resulting in big fluctuations in the inventory market place, we can quickly cease investing,” Fang mentioned all through a panel discussion at the Boao Forum for Asia in April.

“We also have steps to reduce the current market currently being influenced by main fluctuations, which can final result from large inflows and outflows of overseas money,” he extra.

At the conclude of March, foreign money accounted for about 5 percent of China’s inventory current market, he mentioned, introducing that in comparison, the proportion of Chinese stocks in significant worldwide indexes continues to be very reduced.

As international capital floods more and more into the domestic stock market place, it is participating in a additional critical part in pricing shares. The point that such money is predominantly held by institutional traders implies it can add to industry stability, Fang claimed.

He added that economical regulators are thinking of even more growing the proportion of Chinese stocks in main world-wide markets and expanding the scale of inclusion to catch the attention of extra overseas capital.

Xuan Changneng, deputy head of the State Administration of International Exchange, or Harmless, mentioned reasonable internet inflows of cross-border investments in securities-mainly in shares and bonds-have been taken care of so significantly this calendar year, in line with the typically secure problem on foreign exchanges.

John Waldron, president and main functioning officer of The Goldman Sachs Group, reported pilot initiatives supplying improved cost-free convertibility of foreign exchange have been introduced just lately in Beijing and Shenzhen, Guangdong province.

He said these projects show the ideal course for economical opening-up, and the opening of money companies is fantastic news for numerous international-funded enterprises moving into China.

On May 6, in the hottest transfer to support the opening-up of China’s financial sector, the People’s Financial institution of China-the central bank-released new thorough rules for the proposed Larger Bay Region Cross-Boundary Wealth Administration Hook up. The guidelines include quotas for citizens of the GBA to make specific money investments.

Prosperity Administration Connect is a pilot plan aimed at encouraging residents of the GBA, which includes nine towns in Guangdong, alongside with Hong Kong and Macao, to make cross-boundary investments in prosperity administration products and solutions, or WMPs, supplied by banks in the GBA.

The proposed mixture quota of 150 billion yuan and a restrict of 1 million yuan per man or woman for cross-boundary WMP investments in the GBA is especially noteworthy.

Sonny Hsu, vice-president and senior credit officer at Moody’s Traders Services, mentioned the proposed principles are constructive news for the asset administration units of banking companies on the Chinese mainland, Hong Kong and Macao.

“Nonetheless, the banks’ likely earnings from the plan will be restricted, as northbound and southbound investments are in the beginning capped at 150 billion yuan,” Hsu included.

Analysts said the hook up plan, if implemented, will mark a additional step towards convertibility of the renminbi under the money account.

A pilot place has also been established in the southern province of Hainan. On April 9, Safe and other monetary regulatory departments jointly issued a established of new guidelines to further strengthen opening-up of the money sector at Hainan Free of charge Trade Port.

These policies permit specified institutional traders to freely send out funds, each incoming and outgoing, by adopting required solutions, and to make investments under specified quotas. Meanwhile, foreign trade registration processes have been simplified.

Joe Yizhou He, controlling director of Australian Capital Equity, has witnessed China’s accelerated fiscal opening-up since regulators announced a sequence of insurance policies in 2018.

These actions included lifting the foreign possession cap for financial institutions and asset administration providers, managing domestic and foreign capital similarly and allowing for some economical establishments to established up branches and subsidiaries at the very same time.

“To day, coverage implementation has been economical,” claimed He, who is performing on developing a renminbi investment entity at Hainan Free of charge Trade Port via the Skilled Overseas Limited Partnership program.

“The exclusive procedures in Hainan can facilitate overseas investment into China, as the application technique and current market entry demands have been simplified, and a higher stage of overall flexibility is supplied in comparison with other regions in China,” He claimed.

China’s capital marketplaces, in individual, have seasoned further reform and even more opening-up.

“With China’s inventory markets turning out to be far more welcoming to the light-asset new economic climate sector, I have found extra business owners in this sector pick the A-share market as their IPO (preliminary community giving) location,” He explained.

Policy help

While overseas cash was launched into the A-share current market nearly two decades back, there has been an acceleration in current many years pursuing the start of the Shanghai-Shenzhen-Hong Kong Stock Connect System. The acceleration was boosted when MSCI Indexes, which measure stock market place general performance in a specific location, included China stocks in 2018.

In the non-public equity market place, quite a few international investors, who have a hold out-and-see perspective, are anticipated to make more RMB-denominated immediate expenditure because of to the arrival of policies to further open up the economic industry.

“From my knowledge, the foreign exchange guidelines so significantly assist the totally free conversion of a specific quantity of income that we acquired in China, and there are mainly no obstructions in undertaking so,” He mentioned.

As China has quickly controlled the pandemic, overseas investors have demonstrated enhanced self esteem and optimism toward the country’s marketplaces.

In addition to the secondary stock and bond marketplaces, they are paying out a lot more notice to fairness investment, particularly in modern and higher-tech organizations, in accordance to gurus.

Australian Cash Equity is seeking investment chances in highly developed fields such as the electronic financial system, new existence and engineering innovation.

On April 20, President Xi Jinping said in a keynote speech shipped by way of movie connection to the opening ceremony of the Boao Discussion board for Asia Annual Convention that China would proceed to build Hainan Free of charge Trade Port and new methods for a higher-common open economic climate.

“China will just take an active section in multilateral cooperation on trade and investment decision, totally employ the Foreign Expense Regulation and its supporting guidelines and restrictions, slice more the detrimental record on overseas expenditure, proceed to create the Hainan No cost Trade Port, and produce new devices for a increased-normal open economic system,” he stated.

“All are welcome to share in the extensive possibilities of the Chinese market,” the president reported.

Waldron, from Goldman Sachs, reported that if China continues to increase regulations and rules in the financial sector in compliance with worldwide standards, and makes certain unrestricted access for overseas expenditure, the state can anticipate to attract far more international buyers and institutions.

The measures taken will further bolster world wide investors’ confidence in the Chinese market, he mentioned.