Here’s what key voices from the world of business and markets told CNBC-TV18 today

3 min read

3 years ago

Talia Koe

Market

Updated : 2021-02-09 18:59:24

Here is what market gurus and industry captains said about the near-term trajectory on Feb 9, 2021.

On Balaji Amines: Even though there is no antidumping, the product has become short supply from China and other countries. We are in a position to operate this product for more than 40-45 percent. We expect this to continue as the consumption growth for this product has gone to more than 70,000 tonne in the country. We are the only manufacturer having only 30,000 tonne capacity. Today we are in a position to export few products to China. If this continues there is a good opportunity for the Indian companies including Balaji Amines. We have taken up the expansion – one greenfield expansion commencing from next month. Catch the conversation here.

On JSW Energy: Prices of merchant power have improved and now they are in the region of Rs 3-.3.20 per day average and peak power prices are hovering around Rs 6. But the merchant power prices will continue to remain under pressure because you are seeing more and more renewable participation and penetration which is happening. So that is where we see lower merchant prices and that trend will continue. However, we have been focusing on more long term PPAs. During the quarter also, we increased our long-term PPA portfolio to 82 percent and we have also done a long-term tie-up which will be completed in the next financial year wherein our long-term PPA portfolio will increase to 87 percent. With that our Maharashtra unit will be completely long-term tied up and only the Vijaynagar unit will remain which we expect in the next 24 months we will be able to tie up. So, we will be overcoming this volatility in the next 24 months timeframe. Catch the conversation here.

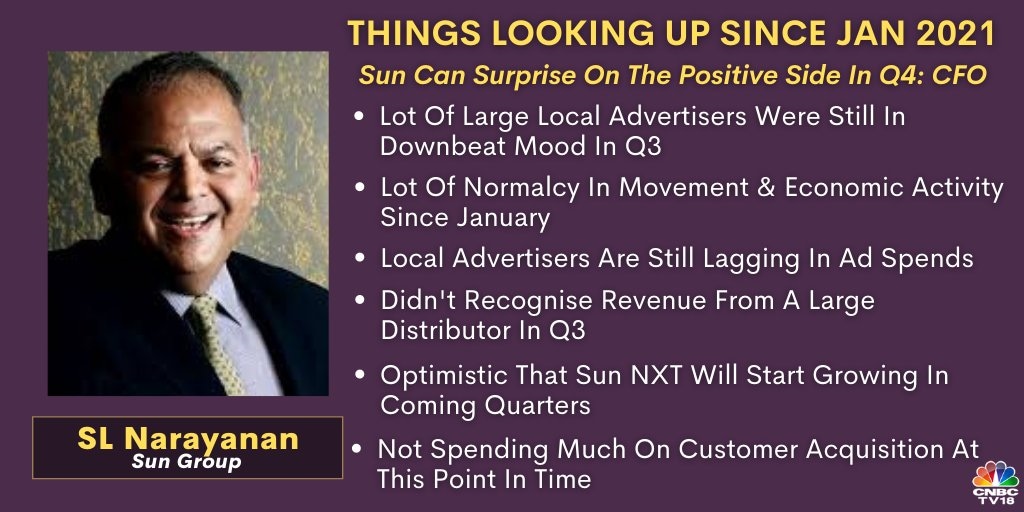

On Sun TV: This quarter beginning from January, things are looking up. If the economy grows at 14 percent nominal as what the budget document forecasts, we will have a surprise on the positive side this year. At this point in time we are not spending much on customer acquisition because we don’t want to build an OTT at a significant upfront investment. The margins on our OTT business are far superior to the regular linear TV thing. Catch the conversation here.

On banks: Banks still remain one of our preferred sectors and in our view, it’s at the start of multi-year upcycle as far as gross domestic product (GDP) growth and even corporate earnings are concerned. In fact, for a long-term investor, we still continue to recommend the better quality well run private sector banks. They may do well in absolute terms but in relative terms, in our view, they are likely to underperform. Catch the conversation here.

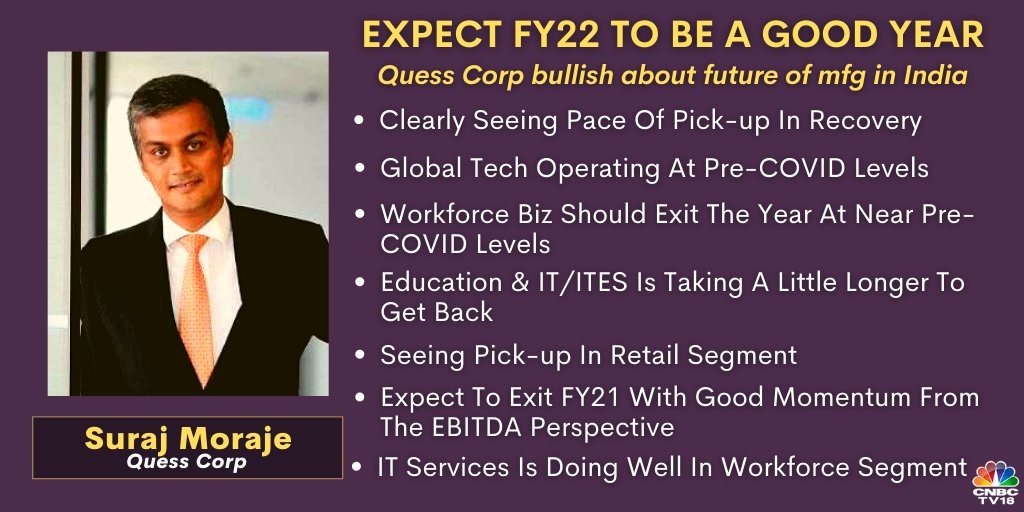

On Quess Group: We started turning business trajectory around the middle of Q2 last year. So, if you take Q1 as a deep drop, Q2 as a slightly less drop, in Q3 we are halfway back up to the previous highs of Q4 both in terms of headcount and revenue. If you normalize for the two businesses which have been hit hard still by COVID, the training and skill development business, and the food business, our EBITDA is flat year-on-year (YoY). So, we are quite pleased with the rate of the recovery overall. We do think there are some ways to go, but we are clearly seeing the pace of recovery picking up and that is encouraging. Catch the conversation here.