Here’s Why It Is Wise to Hold Mid-The usa Apartment (MAA) Stock Now

Amid favorable in-migration traits of positions and domestic formations in the Sunshine Belt sub-marketplaces, Mid-America Condominium Communities MAA, also recognized as MAA, is possible to witness development in desire and rent. Having said that, elevated source, particularly in city submarkets, could impede this expansion momentum in the future interval.

Markedly, the residential REIT’s portfolio is perfectly diversified in conditions of marketplaces, submarkets, product or service kinds and rate details which will most likely enable the corporation deal with any financial downturn. Moreover, a higher-excellent resident profile has resulted in reliable rent assortment general performance, even amid the pandemic.

Further more, the Sunlight Belt space has been a lot less afflicted amid the coronavirus mayhem. Instead, the pandemic has accelerated employment shifts and populace inflow into the company’s marketplaces, as renters look for more company-welcoming, reduced-taxed and reduced-density towns. These favorable lengthier-time period secular dynamic developments are raising the desirability of its marketplaces. Amid this, MAA is nicely poised to seize restoration in demand from customers and leasing as in contrast to the highly-priced coastal market.

Additionally, the company’s reliable balance sheet, with very low leverage and sufficient availability beneath its revolving credit rating facility, enables it to navigate by way of any unfavorable externalities. Backed by an in-spot at-the-current market equity share providing software, MAA is properly poised to supply attractively-priced money from the equity markets. It also generates 95.3% unencumbered net operating money (NOI), which provides scope for tapping added secured personal debt cash if demanded. In addition, it enjoys investment grade ratings of BBB+/BBB+ and a steady outlook from Typical and Poor’s, and a optimistic outlook from Fitch Rankings, respectively, which renders the company’s favorable entry to credit card debt.

In addition to, MAA continues to carry out its 3 inner expenditure packages — inside redevelopment, property repositioning initiatives and Intelligent Household installations. The programs will support the company seize upside probable in rent advancement, generate accretive returns and increase earnings from its present asset foundation in late 2021 and 2022.

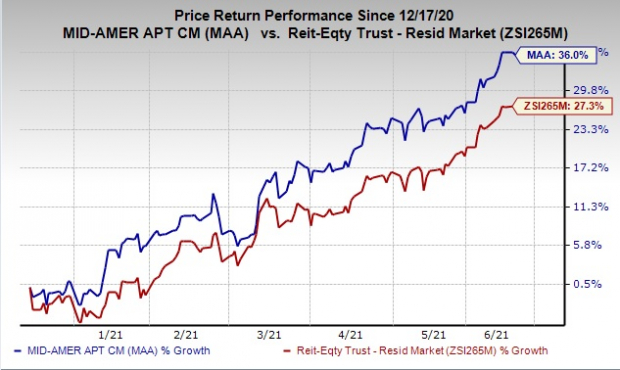

Shares of this Zacks Rank #3 (Maintain) organization have rallied 36% above the past six months outperforming the business’s expansion of 27.3%. Also, the Zacks Consensus Estimate for 2021 resources from operations (FFO) for each share moved up marginally more than the previous thirty day period.

Picture Supply: Zacks Financial investment Exploration

Picture Supply: Zacks Financial investment Exploration

Nevertheless, new provide of residential attributes has been high for the earlier handful of decades. This large provide adversely impacts landlords’ ability to desire additional rents and success in lesser absorption, notably at condominium communities situated in urban sub-markets. This is probably to put pressure on rental rates and erode earnings expansion in the close to expression.

In addition, an extensive growth pipeline will increase the company’s operational hazards by exposing it to development charge overruns, entitlement delays and lease-up dangers. Moreover, growing genuine estate taxes could possibly inflate costs and harm the bottom line in the times to arrive.

Crucial Industry Picks

A several much better-ranked REIT stocks are outlined under:

BRT Flats Corp.’s BRT Zacks Consensus Estimate for 2021 cash from operations (FFO) for each share moved up 6.1% above the earlier thirty day period. The enterprise now athletics a Zacks Rank of 2 (Purchase). You can see the total list of today’s Zacks #1 Rank shares in this article.

Bluerock Household Progress REIT, Inc.’s BRG Zacks Consensus Estimate for the latest-year FFO for each share moved 3.1% north in a month’s time. The firm carries a Zacks Rank of 2 at existing.

RPT Realty’s RPT FFO per share estimate for the ongoing 12 months has been revised upward by 3.7% above the earlier thirty day period. The company carries a Zacks Rank of 2, at present.

Note: Everything relevant to earnings offered in this compose-up represent cash from functions (FFO) — a extensively utilized metric to gauge the effectiveness of REITs.

Zacks’ Leading Picks to Funds in on Synthetic Intelligence

In 2021, this entire world-changing technology is projected to deliver $327.5 billion in profits. Now Shark Tank star and billionaire investor Mark Cuban says AI will build “the world’s initially trillionaires.” Zacks’ urgent distinctive report reveals 3 AI picks traders have to have to know about these days.

See 3 Artificial Intelligence Shares With Intense Upside Potential>>

Simply click to get this cost-free report

MidAmerica Apartment Communities, Inc. (MAA): Free Stock Examination Report

Bluerock Household Development REIT, Inc. (BRG): Totally free Inventory Analysis Report

BRT Apartments Corp. (BRT): Totally free Inventory Examination Report

RPT Realty (RPT): Cost-free Inventory Assessment Report

To read this article on Zacks.com click on listed here.

Zacks Financial commitment Research

The views and opinions expressed herein are the views and views of the author and do not necessarily reflect these of Nasdaq, Inc.