Inflation fears tamp down marketplaces even with newest US stimulus | Organization and Economic climate News

3 min readShare marketplaces turned combined on Monday as the United States Senate passage of a $1.9 trillion stimulus invoice augured perfectly for a lot quicker worldwide economic advancement, but also put new strain on Treasuries and tech shares with lofty valuations.

The upbeat economic news ongoing with information showing that China’s exports surged 155 per cent in February as opposed with a calendar year before when substantially of the economic system shut down to struggle the coronavirus.

“With the Senate’s passage, we count on progress momentum to accelerate and forecast international [gross domestic product] advancement will surge to a 7.5 % annualised level in the middle quarters of the year,” mentioned JPMorgan economists in a observe.

“Every $1 trillion of fiscal stimulus provides around $4-$5 to [earnings per share], implying 6-7 percent upside for the remainder of the yr.”

Nonetheless, analysts also predicted a sharp acceleration in inflation, stoked in component by the most recent spike in oil charges, which was pushing up bond yields and creating firm share price ranges more high priced in relation to their underlying earnings, especially in the significant-tech house.

That saw US Nasdaq futures reverse early gains to slip 1. percent, dragging S&P 500 futures down .2 %.

MSCI’s broadest index of Asia-Pacific shares outside the house Japan adopted with a slide of .5 per cent, while Chinese blue chips get rid of .9 p.c.

Japan’s Nikkei clung to a obtain of .2 p.c, while EUROSTOXX 50 futures were being still up .8 p.c and FTSE futures .9 per cent in late Asian, early European trade.

Equity investors had taken heart from US data demonstrating nonfarm payrolls surged by 379,000 jobs very last month, whilst the jobless amount dipped to 6.2 p.c in a positive indicator for incomes, shelling out and corporate earnings.

US Secretary of the Treasury Janet Yellen tried out to counter inflation worries by noting the legitimate unemployment level was nearer 10 p.c and there was however a great deal of slack in the labour current market.

A supportive US income source

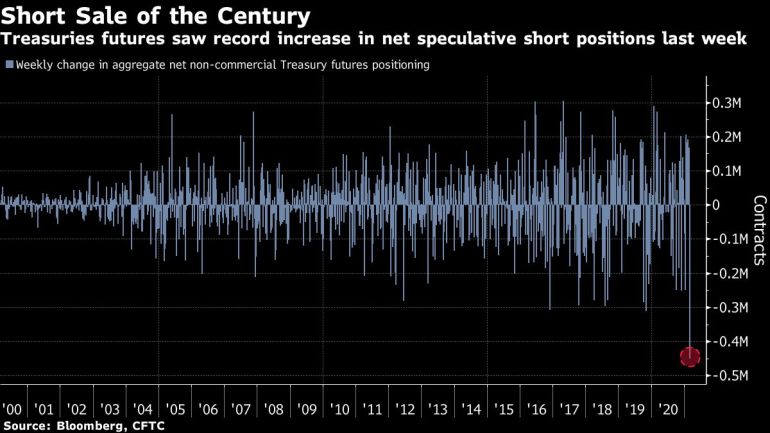

Nonetheless yields on US 10-yr Treasuries still strike a one-calendar year substantial of 1.625 p.c in the wake of the info and stood at 1.59 per cent on Monday. Yields greater by a significant 16 basis factors for the week, though German yields dipped 4 basis points.

The European Central Bank satisfies on Thursday amid communicate it will protest the recent increase in eurozone yields and maybe mull ways to restrain even more raises.

The diverging trajectory on yields boosted the dollar on the euro, which fell away to a 3-month lower of $1.1892 and was last pinned at $1.1904.

BofA analyst Athanasios Vamvakidis argued the potent mix of US stimulus, faster reopening and increased consumer firepower was a clear optimistic for the greenback.

“Including the existing proposed stimulus package and even further upside from a second-half infrastructure monthly bill, full US fiscal support is six moments larger than the EU restoration fund,” he reported. “The Fed is also supportive with US cash provide increasing two situations speedier than the Eurozone.”

The dollar index – a gauge of the US currency against a basket of other major international currencies – duly shot up to amounts not viewed since late November and was past at 92.057, well previously mentioned its the latest trough of 89.677.

It also attained on the small-yielding yen, achieving a 9-month large of 108.63, and was previous switching palms at 108.41.

The leap in yields has weighed on gold, which provides no mounted return, and remaining it at $1,705 an ounce and just above a nine-thirty day period small.

Oil prices ended up up the greatest degrees in far more than a calendar year immediately after Yemen’s Houthi forces fired drones and missiles at the heart of Saudi Arabia’s oil business on Sunday, boosting fears about manufacturing. The Saudi facilities did not endure any major destruction.

Rates experienced by now been supported by a determination by OPEC and its allies not to improve source in April.

Brent climbed $1.44 a barrel to $70.80, when US crude rose $1.36 to $67.45 per barrel.