Japan Inc wary of the sliding yen

4 min readAs Canon kicked off Japan’s corporate earnings period in late April with an enhance to its yearly financial gain advice, chief government Fujio Mitarai welcomed the yen’s sharp decrease as “a massive plus” for the printer maker.

Canon has been one of the most important beneficiaries as the Japanese forex fell by means of ¥130 towards the dollar just times ahead of its effects came out. The yen’s tumble has designed it less expensive to export the business office devices it tends to make in Japan although boosting gains earned overseas.

Other huge Japanese export names this kind of as Sony, Toyota and Nintendo have completed even greater, churning out document revenue in spite of Covid-19 disruptions. But what was extensive a blessing for corporate Japan is suddenly turning into a danger as the yen’s amazing fall to a multi-10 years lower coincides with a surge in commodity selling prices sparked by Russia’s invasion of Ukraine.

The Japan Iron and Steel Federation has warned that the yen’s tumble offers “a risk for Japan’s brands for the initially time”. Noting that companies import uncooked components to make and promote goods in Japan, Tadashi Yanai, outspoken chief executive of Uniqlo proprietor Rapidly Retailing, has declared that “the weak yen has no benefit whatsoever”.

That is not quite the scenario. Financial institution of Japan governor Haruhiko Kuroda argues that a weak yen continues to be broadly optimistic for the Japanese economic climate inspite of the troubles it will cause, especially for more compact corporations dependent on imports of gasoline and raw resources.

But even for big exporters, the rewards of a weaker yen have waned compared with a ten years ago, when organizations warmly welcomed then-prime minister Shinzo Abe’s attempts to generate the currency lessen by way of aggressive monetary easing.

“Before Abenomics, the yen was far too robust so the shift from ¥80 to ¥110 was welcomed. And a weak yen was practical to take care of deflation,” stated Kazuo Momma, government economist at Mizuho Analysis Institute.

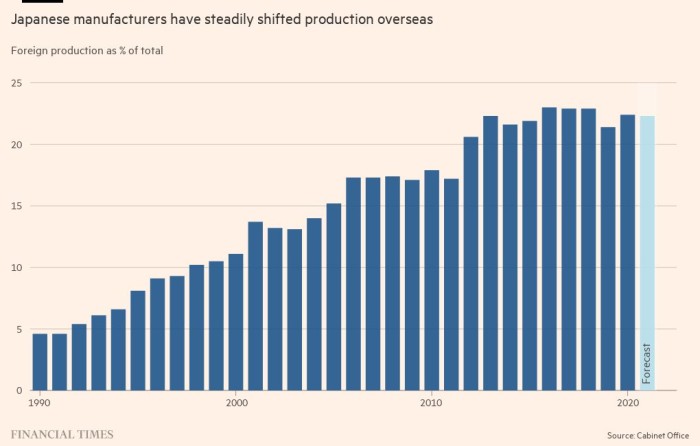

Japanese carmakers and other brands have shifted creation overseas to decrease their exposure to currency volatility given that getting punished by a powerful yen in the wake of the global economic crisis in 2008. The ratio of abroad output amongst Japanese brands rose to an believed 22 per cent in the final fiscal 12 months from 17 for each cent in fiscal 2007, according to cupboard office environment facts.

“If anyone tells me that ¥130 [against the dollar] is superior news for you, I will say it is not good news and it’s not poor information because . . . we have vegetation all more than the planet,” Ashwani Gupta, Nissan’s main working officer, reported in an interview. “I believe we will say that everything between ¥116 and ¥122 can make our functions the most successful globally.”

The frequent use of hedges to protect from swings in overseas exchange rates also implies Japanese businesses can’t reduce export price ranges quickly in line with a weakening of the yen. Moritaka Yoshida, president of Toyota supplier Aisin, explained responding was even trickier when the forex moves as significantly as when the yen dropped from ¥114 against the dollar in early March to ¥130 by the conclusion of April.

An additional vital variation from the Abenomics period is the inflationary stress now squeezing homes. The yen’s drop has accelerated the world rise in commodity costs, making anything from petrol to bread and veggies a lot more pricey since Japan is a internet importer of oil and meals.

For Toyota, “an unprecedented” rise in uncooked material and logistics charges will wipe ¥1.45tn ($11bn) from its operating profits for the fiscal year by means of to March 2024, much outweighing ¥195bn in forex-related gains. Even contemplating the group’s conservative trade rate forecast of ¥115 to the dollar, as opposed with ¥128 on Wednesday, its prices from climbing metal and aluminium charges are not likely to be offset by a weaker yen.

Toyota generates a third of its cars and trucks in Japan, in comparison with fewer than 20 per cent for Nissan and Honda. That can make it a greater beneficiary of the weaker yen, but analysts explained Japan’s premier carmaker was at a downside to worldwide rivals when it came to passing on the larger cost of uncooked products to shoppers.

“Raising price ranges for finished products is not popular in Japan,” mentioned Takaki Nakanishi, an automotive analyst. “It is fairly simpler for all those that make abroad to raise merchandise prices to tackle the improve in expenses in the course of the production system.”

The chip scarcity and other provide constraints have also prevented companies from growing production from their crops. That has minimized the trickle-down influence of the weaker yen, which comes when companies decrease in the source chain benefit as export giants spend in factories at property to grow capacity.

“The upcoming has develop into unsure due to the Ukraine disaster,” said Wakaba Kobayashi, economist at Daiwa Institute of Investigate. “So whilst exporters are benefiting from the weak yen, they stay hesitant to make capital investments.”

Even now, longtime Japan watchers this kind of as Nissan’s Gupta are convinced the weaker yen will be very good for the economic climate as a full if it can sooner or later assist achieve the government’s prolonged-said intention of sustained domestically created inflation.

“We are viewing Japan graduating from deflation. This is wonderful news,” Gupta explained. “Of system it was pushed a lot more by the value facet, but I imagine we’re acquiring into a cycle when it will be pulled by the individuals.”

More reporting by Antoni Slodkowski