MicroStrategy And Sq.: Electronic Forex Shares To Invest in

5 min read

BitCoin and electronic currencies are thought of far too risky for most traders. Nevertheless, the earlier pitfalls were being about legality, integrity of the repositories and illicit use. These are fading now and for superior-threat oriented traders, two shares are showing as buys in the recent BitCoin market correction: MicroStrategy Incorporated (NASDAQ:MSTR) and Sq., Inc. (NASDAQ:SQ).

Q1 2021 hedge fund letters, conferences and extra

Worthless Token

Currency is a worthless token that we agree to use to aid transactions, to retail outlet value and as a unit of account. Variations in purchasing ability between currencies are mirrored in the exchange costs and the overseas exchange current market has been a well known location for traders for decades and even additional recently. When funds sector security turned the purpose of global central financial institutions right after the fiscal crisis forex exchange marketplaces have been the only sport in town for traders.

Philip Carret And Warren Buffett: Why Sell If There is Absolutely nothing Improper?

Philip Carret was an trader and founder of Pioneer Fund, one particular of the very first mutual cash in the United States. Carret ran the mutual fund for 55 decades, throughout which time an expense of $10,000 turned $8 million. That suggests he obtained a compound yearly return of practically 13% for his traders. Q1 2021 hedge Examine Much more

Philip Carret was an trader and founder of Pioneer Fund, one particular of the very first mutual cash in the United States. Carret ran the mutual fund for 55 decades, throughout which time an expense of $10,000 turned $8 million. That suggests he obtained a compound yearly return of practically 13% for his traders. Q1 2021 hedge Examine Much more

Gone Electronic

The biggest sport these times has been electronic currencies. Digital forex trade premiums continue to be really risky and thus they fail to deliver the capabilities of a “currency”. Their early attraction was the secrecy of the transaction. But authorities are all about your digital currency transactions now. With the secrecy attribute diminishing digital currencies are a lot less handy in transactions.

Like all currencies, there is remarkable advantage to the issuer. The token is worthless but you can acquire stuff with it which brings on the mindset of “let’s get as quite a few tokens out as possible”. The problem is people today need to concur to acknowledge them on demand. When it will come to the dollar, perfectly, the wool is absolutely more than our eyes as trillions and trillions of tokens are issued and we happily take it.

Value Proposition

To attempt to make electronic currencies far more appropriate and sluggish their issuance BitCoin appeared with the silly proposition that if we waste a lot of strength and computer ability to develop the token the “it will have value”.

A a great deal a lot more interesting early aspect of bitcoin was a cap on the quantity of tokens that can be established. We will lastly have a currency with a set number of tokens. That is incredibly thrilling for a money theorist because no other forex has at any time had a fixed provide. But, in 2015 to 2018 when the trade rate for bitcoin rose 9,500%, the benefit to the issuers (the bitcoin miners) turned so substantial that the preset number of tokens idea was deserted and source exploded. Other token variations appeared and the full volume of tokens rose very well past any supposed set source.

From 2017 to 2019 the greenback exchange fee for bitcoin (improperly referred to as the price in the economical media) trended down and fell 83%. The willingness to maintain currency raises as interest charges slide so when fees of return on currency equivalents (like a bank account) drop to zero so does the incentive to transform currency so at the very least portion of the 1,600% progress in BitCoin considering the fact that 2019 has been a direct end result of the extremely-unfastened revenue procedures all over government-managed currencies.

Digital Currencies Shares to buy?

With the current sharp drop (42%) in the US dollar exchange level for bitcoin it is a excellent time to look for opportunities. Two corporations surface in our most latest update. 1 is trying to make income with a leveraged trading strategy and the other is earning funds by extracting a brokerage distribute.

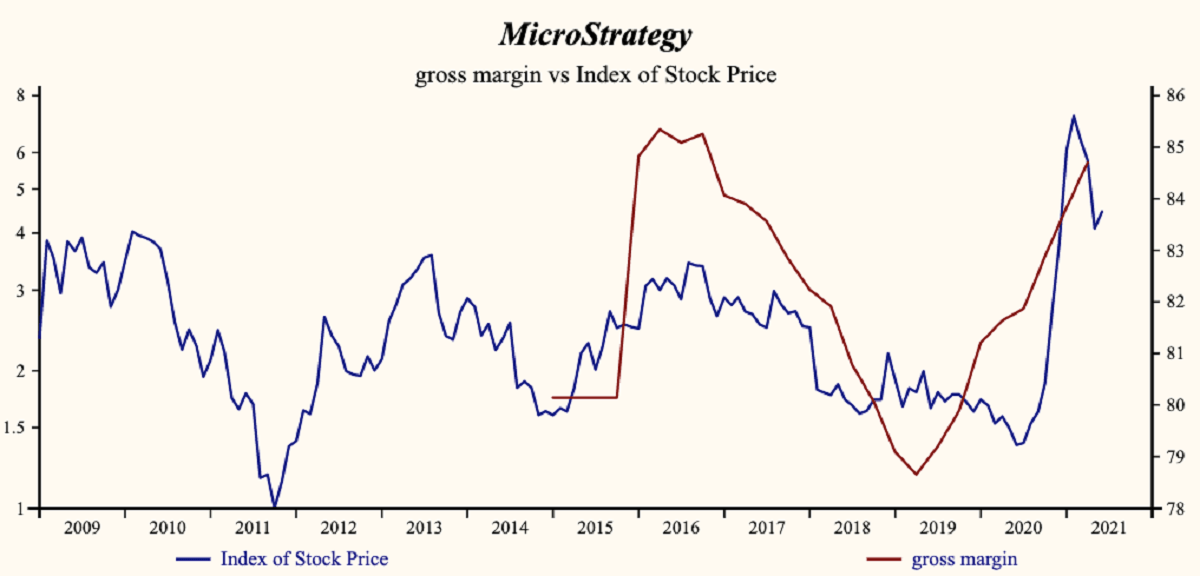

MicroStrategy (MSTR) is a small company computer software enterprise with $485 Million in gross sales past yr. Above the previous three quarters the corporation has spent $2,200 Million to acquire BitCoin. They financed the acquire with the issuance of $1,500 Million in credit card debt (convertible). Their prowess as a trader is drawn into issue following they skipped the recent drop-a single of the steepest drops in the dollar price of BitCoin in its record.

This is a excellent substantial-hazard selection for an investor who believes the in ever escalating greenback price of BitCoin. Evidence so considerably is that the company does not intend to trade BitCoin. At minimum they missed the most crucial advertising chance due to the fact December 2017. Their reference to Bitcoin as a electronic asset is preposterous. It is no a lot more an asset than the dollar in your wallet is. The latest pattern on Wall Avenue to describe BitCoin as an asset and even more bizarre-digital currencies as an asset-class is self-serving.

Substantial Threat Decision

The enterprise has by now booked a $190 Million loss on the situation and the shares are down 50% while Bitcoin is down 42% (the MSTR fall is a modest drop given the MSTR leverage of the bitcoin position). This is your high-possibility decision and the shares can be anticipated to carry out as nicely as bitcoin and better provided the leverage.

Minimal Chance Preference

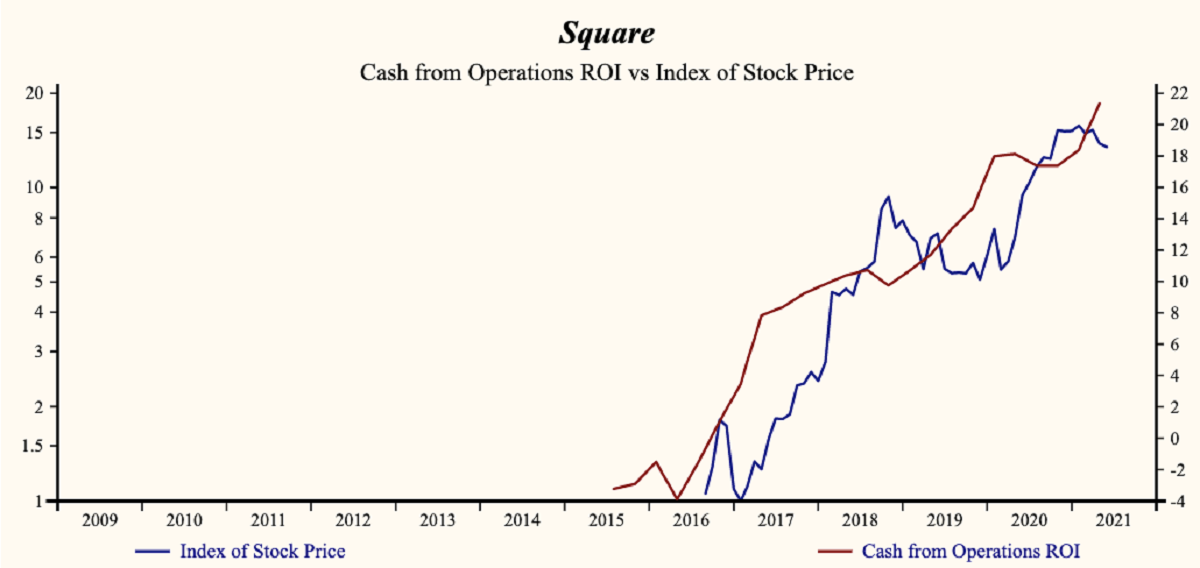

The other company that referenced digital currencies in its financial statements is Square (SQ). The corporation is 10 instances even bigger than MSTR and BitCoin acquire is considerably more compact at $170 Million. This business has emerged as a broker in digital currencies. You can now open up a digital currency account (a wallet) sponsored by nicely financed community enterprise. The company is performing as a broker. A broker (incredibly rare in contemporary situations) buys the token and sells it into consumer Wallets at a top quality (the distribute is now about 8%). This is a a great deal reduced danger small business and achievement will be more a operate of the volume of trade than the greenback exchange rate.

Square (SQ) is the greater decision for reduced hazard buyers if the digital forex place remains unstable. Larger supporters will sustain the quantity of transactions and Sq. will make revenue gathering a spread on the rising speculative quantity. If the bitcoin trade fee stabilizes and it gets more helpful as a favored currency to facilitate transactions, Sq. will make funds on the expanded transaction volume. Speculators can buy MSTR. Substantial risk-oriented expansion buyers must get SQ.

Are Digital Currencies Sustainable?

Electronic currencies will not come to be broadly acceptable right up until trade fees are a lot more steady and that stability will make them a lot much more unexciting for a trader. For the volume of trade in bitcoin to transfer outside of speculation and into adoption as a forex it ought to turn into far more stable. Trustworthy and steadiness will facilitate transactions. BitCoin is recognized a bit extra broadly a short while ago but continue to you cannot obtain a Tesla or in other phrases functions as a retail outlet of price. Holders of bitcoin not long ago have seen the benefit drop 42% as digital currencies attempted to be adopted as a worldwide device of account. No organization way however but they will satisfy stiff resistance from governments who are unwilling to give up the profit as a forex issuer).