Missed corner of inventory sector features protection from bond-marketplace volatility

2 min readPayne Capital senior wealth adviser Courtney Dominiguez and Moody’s Analytics Cash Marketplaces main economist Jon Lonski talk about the vulnerability in the marketplace and the overall economy reopening.

Traders wary of increasing bond yields and the return of inflation that has been missing considering that the 2008 money disaster may well obtain defense in 1 corner of the inventory-marketplace: the utilities and client staples sectors.

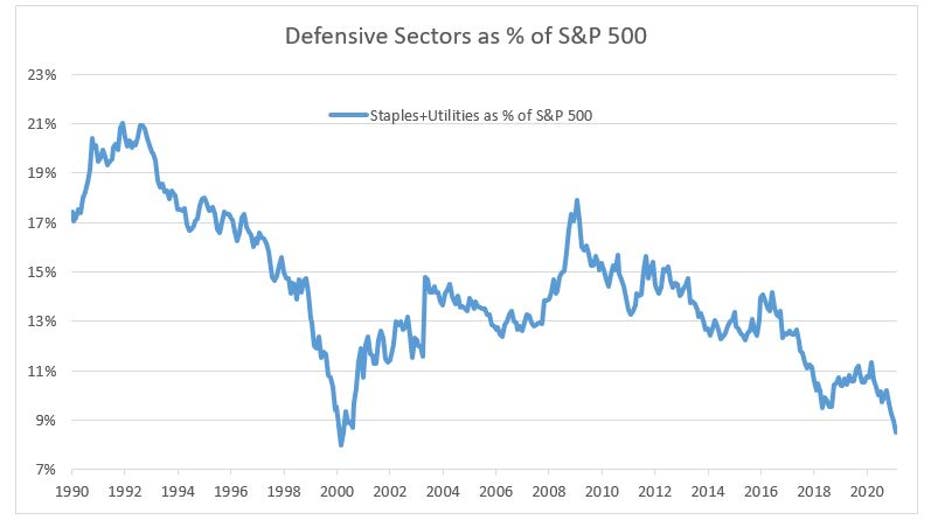

Each are generally defensive sectors and make up a mixed 9% of the S&P 500’s $33.27 trillion market cap, the lowest considering the fact that the 2000 dotcom bubble.

“If macro boom consensus right then yields up another 50-100bps = better volatility = defensives good market hedge” in the to start with 50 percent of this calendar year, wrote Michael Hartnett, main expenditure strategist at Lender of The united states.

NASDAQ IN CROSSHAIRS AS DOT-COM BUBBLE THREATENS REPEAT

In the 2nd fifty percent of the yr, defensives will prove to be a “good macro hedge as international PMI’s & US shopper paying out peak,” he additional.

The 10-12 months Treasury generate has climbed 72 basis details this yr, closing at a 13-thirty day period substantial of 1.63% on Friday.

The sharp increase in the benchmark yield has appear amid investor fears that the unparalleled amount of money of fiscal and monetary stimulus that has been unleashed to fight the financial slowdown brought on by COVID-19 will deliver back inflation.

Congress has previously accepted virtually $5 trillion of COVID-19 relief, which includes the most recent round of stimulus that will deliver $1,400 checks to the the vast majority of Americans. In addition, the Federal Reserve minimize desire charges to close to zero and pledged to invest in an endless quantity of belongings to aid the economy.

President Biden is organizing another restoration deal that could tackle infrastructure, local weather transform and other promises that he built on the campaign trail.

Economists surveyed by FactSet be expecting U.S. gross domestic to mature 6.3% in the next quarter as the stimulus cash would make its way by the economy. That following expanding at an envisioned 4.4% rate through the initially 3 months of the year.

The strong development, and the opportunity for inflation that comes together with it, have Wall Street analysts forecasting a further increase in bond yields as the pace of the economic recovery slows down in the back again 50 percent of the yr.

GET FOX Business enterprise ON THE GO BY CLICKING Here

Deutsche Financial institution strategists led by Francis Yared forecast the 10-yr produce will get to among 2% and 2.25% just before yearend and suggests the industry will likely rate in a higher than 50% chance that the Federal Reserve will exit its low desire-price routine right before the 2022 midterm election.

Better desire fees, nonetheless, ordinarily spell difficulty for the utilities and purchaser staples sectors that offer greater dividends, allowing for them to conduct