Obtain this dip in Apple, Microsoft and these other tech shares prior to they’re out of arrive at, claims analyst

It has been a negative week for technologies shares. The Nasdaq tumbled 2.7% on Wednesday and fell a additional 2.1% on Thursday.

So buy the dip in advance of tech stocks go at least 25% increased this year, suggests veteran tech analyst Daniel Ives of expense organization Wedbush in our simply call of the working day.

“The possibility-off trade for tech has been a distressing 1 for tech investors this week as worries close to higher valuations, bubble fears, rotation trade, soaring yields and a emphasis on reopening performs take centre phase,” Ives mentioned.

But, according to Ives, the electronic transformation is just receiving begun and will very last a range of several years among the corporations in cloud, cybersecurity, e-commerce and 5G. These subsectors are the life of the tech social gathering, with customer and business demand from customers catalyzing a “multiyear growth boom” forward, the analyst said.

Nevertheless collaboration-computer software groups like Zoom

ZM,

Microsoft Groups, Slack

Operate,

and Citrix

CTXS

will see “moderating growth” into 2022, many chief executives have told Wedbush that 30% to 40% of staff could keep on being working remotely in some type. This will prompt organizations to “rip the Band-Assist off and go aggressive” with cloud transformations, Ives reported.

See: Analysts say Zoom can proceed to thrive in a vaccinated entire world

Buyers should really use the existing marketplace weak spot to make sure that the pursuing organizations are in their portfolios, according to Ives: Apple

AAPL,

Microsoft

MSFT,

digital document specialist DocuSign

DOCU,

AI pioneer Nuance

NUAN,

and cybersecurity groups Zscaler

ZS,

Palo Alto

PANW,

and SailPoint

SAIL.

Across the broader sector, Wedbush predicts that tech shares will go at the very least 25% upward in the upcoming year. That will be driven by massive names Fb

FB,

Amazon

AMZN,

Apple, Netflix

NFLX

and Google mother or father Alphabet

GOOGL

GOOG,

as perfectly as cloud and cybersecurity stocks, regardless of the modern selloff, Ives said.

A lot more broadly, Ives mentioned that Uber

UBER

and Lyft

LYFT

— “disruptive tech restoration names” — continue being Wedbush’s preferred “reopening plays,” with profitability on the horizon and a huge surge in food stuff shipping and delivery.

Don’t skip: Lyft stock surges toward greatest price ranges due to the fact 2019 soon after ideal 7 days for rides of the pandemic

And while tech regulation is a extensive-term danger, “it nonetheless continues to be a Goldilocks ecosystem for tech shares with the Biden administration,” in accordance to Wedbush. Ives sees President Joe Biden as probable to ramp down tensions in the “Cold Tech War” brewing in between the U.S. and China, as very well as encourage cybersecurity initiatives.

Market bears will arrive out of hibernation to alert investors that the tech growth and bull rally is above, Ives said. Wedbush thinks this is “a golden option to have the secular tech winners for the next 12 to 18 months at persuasive valuations supplied some of these selloffs.”

The markets

Shares continued Wednesday’s massive slide

DJIA

SPX

COMP

to shift go further into the crimson on Thursday. European shares

Uk:UKX

DX:DAX

FR:PX1

have been mixed but typically decreased though big Asian indexes

JP:NIK

HK:HSI

CN:SHCOMP

tumbled a lot more than 2%.

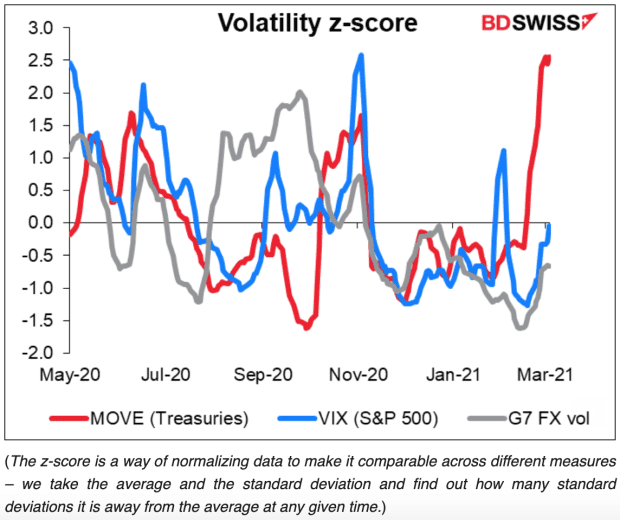

The chart

If you assume bonds have been bumpier than usual…you’d be appropriate. Our chart of the day, from Marshall Gittler at BDSwiss, exhibits just how volatile the Treasury industry is right now. Gittler charts the Move index, which is like the bond sector version of the VIX index for stocks. Volatility in stocks is around usual though international trade is a little calmer than regular.

Random reads

Tahltan female from Northern Canada bakes moose head that appears to be like intense, tastes phenomenal, and feeds a relatives.

A passenger flight turned all over in Sudan when a stowaway cat attacked the pilot.

Need to have to Know commences early and is current until the opening bell, but sign up listed here to get it sent once to your electronic mail box. The emailed variation will be sent out at about 7:30 a.m. Eastern.

Want extra for the working day in advance? Signal up for The Barron’s Everyday, a morning briefing for traders, including distinctive commentary from Barron’s and MarketWatch writers.