One of the most tough complications in finance appropriate now is figuring out the essential economic worth of cryptocurrencies. And the earlier week has complex this further more.

For several cryptocurrency buyers, the value of Bitcoin is centered on the fact it is artificially scarce. A challenging cap on “minting” new coins indicates there will only at any time be 21 million Bitcoin in existence. And contrary to nationwide currencies these as the Australian greenback, the charge of launch for new Bitcoin is slowing down around time.

Dogecoin, a cryptocurrency that will take its name and logo from a Shiba Inu meme that was well-known various years back, does not have a cap. Released in 2013, there are now 100 billion Dogecoin in existence, with as a lot of as five billion new cash minted every single 12 months.

But how can a currency with a seemingly unlimited provide have any price at all? And why did Dogecoin’s price tag instantly surge extra than 800% in 24 hrs on January 29?

At the time of publication, the “memecoin” was truly worth about A$5.6 billion on the stockmarket.

A lengthy-running joke introduced to existence

Dogecoin is a person of the original “altcoins”: cryptocurrencies unveiled in the number of yrs just after the pseudonymous Satoshi Nakamoto initially released Bitcoin into the wild.

From a technological perspective, Dogecoin is not incredibly progressive. Like a lot of early altcoins, it’s based mostly on the first source code of Bitcoin.

Or more technically, it is based mostly on Litecoin, which in convert was centered on Bitcoin — but with some tiny modifications these types of as faster transactions and the removing of the offer cap. But Dogecoin is significantly much more fascinating when witnessed via a cultural lens.

The cryptocurrency was established by software program engineers Billy Markus and Jackson Palmer — while Palmer, an Australian, has considering the fact that walked away from the task. They branded it with the Doge meme partly to be funny, but also to distance it from Bitcoin’s then questionable standing as a currency for illicit transactions.

Now, Dogecoin has outlasted pretty much all the early by-product altcoins and has a flourishing community of traders. In 2014, Dogecoin holders sponsored the Jamaican Bobsled Group. Shortly following, they sponsored a NASCAR driver.

Elon Musk, the world’s richest male, is amongst the cryptocurrency’s large-profile advocates. In December very last calendar year, a tweet from Musk sent Dogecoin’s selling price soaring.

Collectivism qualified prospects to creative imagination

Reddit threads proclaim Dogecoin’s price as a new world-wide currency. Musk himself shared a very similar sentiment a several times in the past.

Speaking on the application Clubhouse, he claimed: Dogecoin was built as a joke to make entertaining of cryptocurrencies, but fate enjoys irony. The most ironic consequence would be that Dogecoin gets to be the currency of Earth in the foreseeable future.

But Dogecoin is most effective imagined of as a cultural item, rather than a fiscal asset. The truth is handful of cryptocurrency people maintain it as a major expenditure or to use in regular transactions. As an alternative, to possess Dogecoin is to take part in a lifestyle.

Men and women purchase it since it is enjoyment to have, is inherently amusing and arrives with a welcoming and satisfying neighborhood experience.

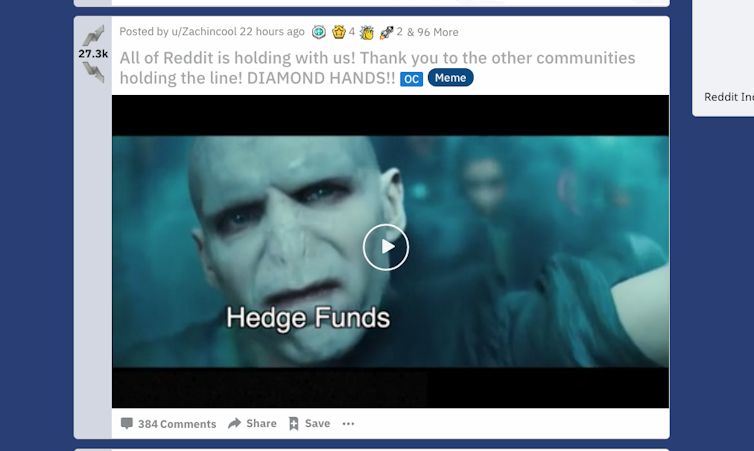

If we start pondering of the cryptocurrency as a cultural product, past week’s unexpected jump in Dogecoin’s value makes perception. The improve came just after a meme-centric local community managed to travel the share price of videogame retailer GameStop from US$20 to US$350 in mere times.

This swarm behaviour was compared with anything witnessed in advance of — and it frightened world wide fiscal marketplaces.

One particular particularly intriguing aspect of the Reddit discussion board r/WallStreetBets — which coordinated the assault on the hedge fund that had properly bet on GameStop’s share selling price slipping — was how several buyers were being acquiring exciting.

It’s no surprise exercise encompassing Dogecoin has a similar vibe it was intended to be enjoyable suitable from the get started.

Doge: icon of the web

Some people today take part in economic marketplaces as a sort of use — that means for amusement, leisure and to expertise neighborhood — just as a great deal as they do for investment.

Cultural belongings these as Dogecoin are really hard to systematically worth when when compared to monetary assets, a little bit like how we do not have a essential theorem for pricing artwork.

Almost by definition, the need for a memecoin will fluctuate as wildly as online lifestyle itself does, turning cultural bubbles into financial bubbles. RMIT professor and crypto-ethnographer Ellie Rennie phone calls these “playful infrastructures”.

By inspecting Dogecoin intently, we can discover a great deal about the interplay of engineering, society and economics.

![]()

Moreover, cryptocurrencies are extraordinarily assorted. Some are created for compact payments or to be resilient holders of value. Other individuals safeguard financial privateness or act as an internal token to regulate smart contracts, provide chains or electrical energy networks.

Underneath the hood, Bitcoin and Dogecoin glimpse just about particularly the identical. Their code differs in only a couple parameters. But their economic features are almost totally opposite.

Bitcoin is a kind of “electronic gold” adopted as a secure hedge against political and economic uncertainty. Dogecoin, on the other hand, is a meme individuals include to their electronic wallet simply because they consider it’s humorous. But in an open up digital overall economy, memes go marketplaces.

![]()