Stocks conquered COVID-19 but new headwinds arise

4 min readRosecliff Funds CEO Mike Murphy, Stifel chief economist Lindsey Piegza and Delos Money Advisors chief financial investment strategist Andrew Smith give perception into the markets, the Federal Reserve, the rate of oil and financial recovery in the U.S.

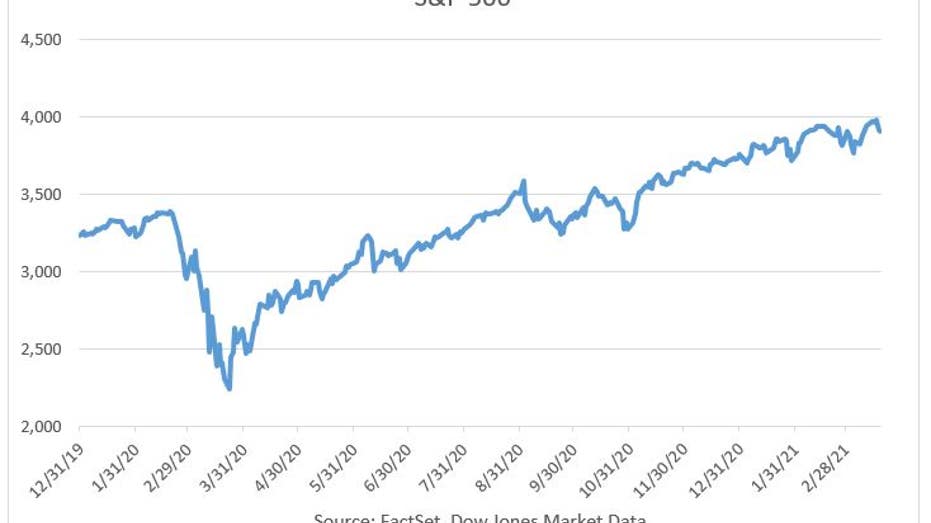

The S&P 500 has appear roaring back again from the depths of its COVID-19 induced selloff, but the index faces new headwinds as the U.S. financial restoration kicks into a better equipment.

The benchmark index has rallied 75% from its Mar. 23 low through Friday, eclipsing its pre-pandemic peak by 16%. The restoration is the swiftest in inventory-industry background from a selloff of that magnitude.

“You can’t maintain this detail down,” reported Anthony Saliba, CEO of the Chicago-based mostly Matrix Execution Team, an executing broker-supplier that specializes in choices and equities. “It’s like a seaside ball in the pool.”

The modern inflation concerns have stoked concerns that expansion stocks have gotten much too high priced as valuations have stretched nicely over and above their historic norms.

The S&P 500’s price tag-to-earnings ratio for the trailing 12 months sits at 26.44 compared to its 20-year common of 17.24. Its selling price-to-book ratio was 4.19 versus a 2.85 ordinary, according to FactSet information.

CORONAVIRUS NO For a longer period Most important Stress FOR FUND Administrators

The Federal Reserve’s extremely-loose monetary policy and unparalleled amounts of fiscal stimulus have furnished prime disorders for each individual inventory-market dip to be acquired.

The Fed, in buy to overcome the sharpest economic slowdown of the article-Earth War II period, reduce interest charges to near zero and pledged to get an unlimited quantity of property to guidance the financial system. In addition, Congress has accepted just about $6 trillion of COVID-19 aid, which incorporates $3,400 in checks to most Individuals.

30-7 per cent of Major Avenue traders program to plow a “large chunk” of the not too long ago authorized $1,400 checks, for Us residents earning $75,000 per yr or less, directly into the inventory current market, according to a new survey carried out by German financial institution Deutsche Lender.

“Because there’s nowhere else to put your cash, it can be created a level of frothiness in the current market that anytime you see large valuations, you are going to typically see bubbles effervescent up in distinctive areas,” mentioned Joe Duran, head of Goldman Sachs Own Monetary Administration.

Ignored CORNER OF Stock Sector Delivers Security FROM BOND-Sector VOLATILITY

Development shares like Peloton Interactive Corp., which saw its shares surge by 369% from the March 2020 very low, had been the biggest beneficiaries of the so-named stay-at-property trade that boosted shares of providers that benefited most as individuals sheltered at dwelling for the duration of the pandemic.

| Ticker | Safety | Previous | Change | Improve % |

|---|---|---|---|---|

| PTON | PELOTON INTERACTIVE, INC. | 108.31 | +5.57 | +5.42% |

But those people high-flying stocks have occur beneath force as of late as bond yields have surged when investors fret over the probability that the seemingly unlimited wave of stimulus will carry back again inflation that has been absent considering the fact that ahead of the 2008 economical crisis.

In addition to the stimulus that has now been approved, Democrats have begun to pave the way for an infrastructure bill that could expense up to $4 trillion. There’s also the prospective for education and health care charges, equally with price tags in the trillions.

Rising inflation problems have brought on the 10-12 months Treasury generate to soar by 80 foundation factors this 12 months to 1.71%, where by it is holding in the vicinity of its best level due to the fact January 2020.

US OIL PRODUCERS COULD Shock SAUDI ARABIA, RUSSIA

Economists say the chance of trillions extra in investing is possible to gas an even sharper increase in bond yields.

The 10-year generate will access 2% “by the end of the fiscal year” as the government readies more stimulus steps to be applied in the new fiscal 12 months begging Oct. 1, said Sri Kumar, president of Santa Monica, California-based Sri-Kumar World-wide Tactics.

The the latest inflation problems have stoked concerns that progress stocks have gotten too pricey as valuations have stretched well past their historic norms.

The S&P 500’s rate-to-earnings ratio for the trailing 12 months sits at 26.44 in contrast to its 20-12 months typical of 17.24. Its cost-to-ebook ratio was 4.19 versus a 2.85 common.

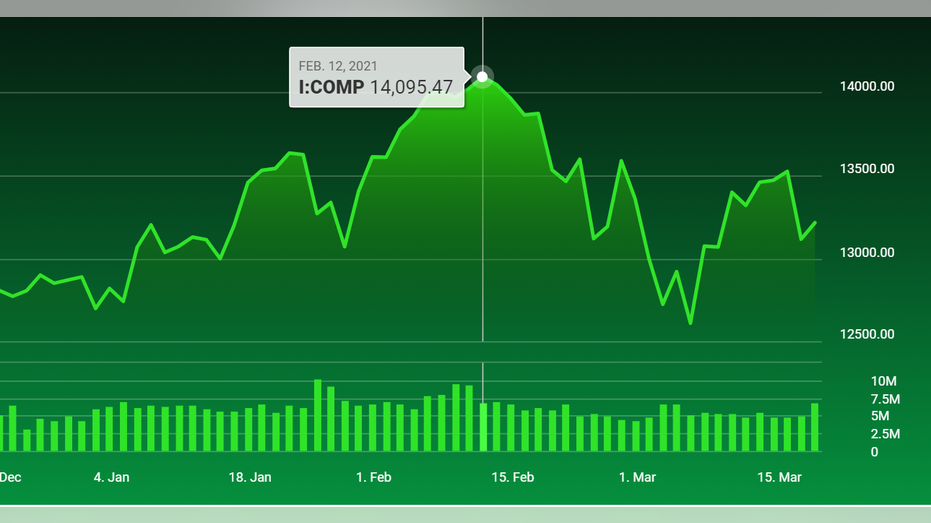

Previously investors have started to flee progress stocks and rotate into worth and smaller-cap names that have lagged during the pandemic. The promoting pushed the tech-major Nasdaq Composite down as substantially as 11% from its February peak before approximately halving its losses.

Kumar anxieties that as inflation fears continue to rise, the mounting bond yields will cause the tech selloff to seep into the broader stock market place. He thinks the recent outperformance from price will, “but only in the feeling that price falls fewer than advancement.”

Goldman’s Duran warns that the latest level of valuations indicates there is a 75% probability for a selloff of at the very least 10%, but he continues to be undeterred in his bullish outlook for stocks.

GET FOX Organization ON THE GO BY CLICKING Here

“There is frothiness, there is no denying that,” he said. “But we have a ton of good fundamentals driving it [the market] as very well.”

Still, Duran states traders need to be conscious of their exposure to the current market. He suggests buyers consider the maturity of their bonds in the occasion that costs carry on to rise. They really should also not neglect to rebalance their portfolios in favor of price over progress.

“There’s a good deal of good explanations to be optimistic,” he claimed.