Stocks plunge as surging bond yields rattle investors

3 min readSenior market strategist for LPL Financial Ryan Detrick discusses growth vs. value and his investing tips.

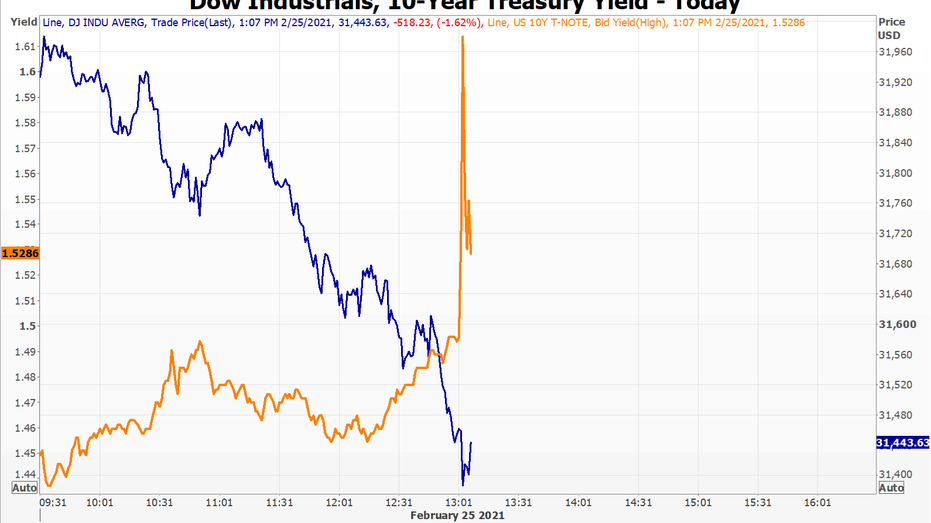

Selling picked up in U.S. equity markets Thursday afteroon as traders weighed continued improvement of the economy and a sharp rise in bond yields.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 31316.41 | -645.45 | -2.02% |

| SP500 | S&P 500 | 3817.53 | -107.90 | -2.75% |

| I:COMP | NASDAQ COMPOSITE INDEX | 13082.958834 | -515.01 | -3.79% |

The Dow Jones Industrial Average tumbled over 500 points, or 1.56%, before paring some of those losses. The S&P 500 and the Nasdaq Composite were lower by 2.16% and 3.23%, respectively.

The heavy selling comes as the 10-year yield climbed 15 basis points to 1.53%, its highest level in a year. Wall Street strategists have worried a rise to the 1.5% area would be troublesome for stocks as that is the level where the 10-year yield would match the dividend yield of the S&P 500.

The benchmark 10-year yield has climbed 62 basis points this year as fixed-income investors have fretted over the idea that the unprecedented amount of fiscal and monetary stimulus and the reopening of the U.S. economy could bring back inflation that has been missing since the 2008 financial crisis.

Their fears were heightened further Thursday as durable goods orders excluding transportation rose 1.1% month over month in January, exceeding the 0.7% growth that analysts surveyed by Reinfitiv were anticipating, and initial jobless claims fell to 730,000 last week from a downwardly revised 841,000 the week prior.

WEEKLY JOBLESS CLAIMS DROP BUT REMAIN ELEVATED

A second estimate for fourth-quarter gross domestic product showed the U.S. economy expanded at a robust 4.1% annual pace, up from the initial 4% print.

BIDEN, PELOSI, SCHUMER PUSH $1.9T STIMULUS AS DEBT, DEFICIT BALLOON TO EYE-POPPING AMOUNTS

This as the House of Representatives readies for a vote, possibly Friday, on President Biden’s $1.9 trillion COVID-19 relief package.

WHY GAMESTOP SHARES SOARED 104% WEDNESDAY

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GME | GAMESTOP | 126.52 | +34.82 | +37.97% |

In stocks, GameStop Corp. shares continued to soar after doubling on Wednesday following news that Chief Financial Officer Jim Bell was forced out by Ryan Cohen, the founder of online pet food supplier Chewy, whose venture capital firm has amassed an almost 10% stake. The New York Stock Exchange forced several trading halts due to volatility.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMC | AMC ENTERTAINMENT HOLDINGS INC | 8.09 | -1.02 | -11.18% |

| BBBY | BED BATH & BEYOND INC. | 26.44 | -0.94 | -3.43% |

| KOSS | KOSS | 21.48 | +3.04 | +16.47% |

Other stocks that were recently subject to short-squeezes, including Bed Bath & Beyond Inc., AMC Entertainment Holdings Inc. and Koss Corp. were also trading sharply higher.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 674.30 | -67.72 | -9.13% |

Elsewhere, Tesla Inc. informed workers that it will temporarily halt production of its Model 3 sedan at its Freemont, California, plant, Bloomberg reports, citing a person familiar with the matter.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BBY | BEST BUY | 102.85 | -10.39 | -9.18% |

In earnings, Best Buy Co. reported mixed quarterly results and warned that comparable sales could fall as much as 2% in the current fiscal year as demand slows from pandemic-induced levels.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BUD | ANHEUSER-BUSCH INBEV | 60.00 | -5.18 | -7.95% |

Anheuser-Busch InBev posted better-than-expected earnings and revenue, but margins were pressured as the company used more higher-priced single-use cans as at-home consumption increased during the pandemic.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DOM | n.a. | n.a. | n.a. | n.a. |

Domino’s Pizza missed on earnings and revenue as same-store sales growth slowed to 11.2% from 17.5% in the prior quarter. The pizza chain projects global retail sales growth of 6% to 10% over the next two to three years.

In commodities, West Texas Intermediate crude oil ticked up 11 cents to $63.33 per barrel while gold fell $25.90 to $1,772 an ounce.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

European markets were lower across the board with Britain’s FTSE 100 down 0.11%, France’s CAC 40 weaker by 0.24% and Germany’s DAX 30 sliding 0.69%.

In Asia, China’s Shanghai Composite index rose 0.59%, Hong Kong’s Hang Seng index advanced 1.2% and Japan’s Nikkei 225 gained 1.67%.