Tech giants’ progress overshadowed by regulatory pitfalls, ad challenges

5 min readHuge tech’s meteoric increase in 2021 could before long appear crashing down to Earth amid the specter of new world wide web restrictions and alterations to the digital promoting landscape, analysts say.

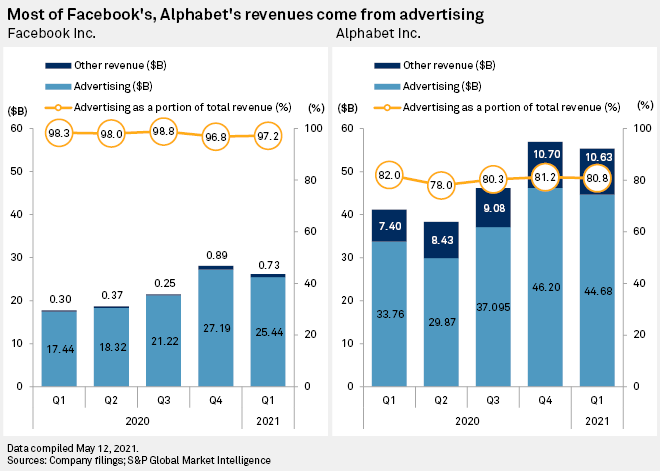

Important tech and social media corporations Fb Inc., Apple Inc. and Alphabet Inc.-owned Google LLC handily beat analysts’ forecasts in the initially quarter and ongoing to increase their vital organization segments. Fb and Google posted double-digit yr-around-year development in their marketing enterprises, whilst Apple sent earnings that have been run not just by the legendary Iphone, but also by some of its much less-flashy segments — Mac computers and providers.

The companies’ seemingly boundless progress, nonetheless, has not absent unnoticed by U.S. lawmakers and regulators, who keep on boosting questions about their enterprise procedures and search for to rein in their current market affect. At the identical time, there are escalating worries within the industry about the effect of Apple’s most recent operating system privacy update, which requires applications to seek out users’ authorization to gather and share information. Analysts alert the risk of looming regulation and Apple’s iOS14 update are two headwinds that major tech gamers are unlikely to prevail over anytime quickly.

Facebook executives on an April earnings call said that even though Apple’s new privateness alter is still in its early levels, the business expects the update to add to amplified advert concentrating on headwinds in the existing quarter. Less than the privateness change, Apple customers will have to decide-in in advance of applications and advertisers can use Apple product identifiers to enable goal adverts and track how productive they are.

Eric Seufert, an impartial analyst and marketing and advertising approach specialist who operates cell promotion trade site Mobile Dev Memo, beforehand forecast that Facebook could consider a 7% revenue hit as marketers spend fewer on advertisements and as far more iOS users choose out of making it possible for Fb to gather their facts.

“The harm to Facebook’s earnings prompted by Apple’s new privacy plan will be material,” Seufert wrote, declaring that he expects the world-wide ordinary Facebook opt-in charge to assortment from “30% in a greatest-scenario circumstance to 10% in a worst-situation situation.”

Fb documented whole income of $26.17 billion for the just-finished interval, up 48% from $17.74 billion a year back. Promoting revenue for the quarter grew 46% 12 months over calendar year to $25.44 billion.

On the regulatory front, Fb faces two independent antitrust lawsuits from the U.S. Federal Trade Commission and 48 lawyers common from across the U.S. that allege, between other factors, that the firm has engaged in anticompetitive conduct. The lawsuits referred to as for a slew of likely remedies — from divestitures to demanding Facebook to obtain acceptance for long run M&A.

Meanwhile, Google is experiencing with an antitrust go well with from the U.S. Justice Section and 11 states alleging the company unlawfully preserved monopolies in common look for and lookup promotion. Promotion revenues in Alphabet’s principal Google section climbed to $44.68 billion in the just-finished quarter, up from $33.76 billion in the identical time period a calendar year ago.

Apple also has come beneath fireplace from lawmakers and regulators for charging a 30% fee to app builders, which critics claim has resulted in less selections and larger rates for buyers. The company is battling Epic Online games Inc. in a court docket battle aimed at figuring out whether Apple’s insurance policies have resulted in an Apple monopoly more than the digital payments landscape, as Epic alleges.

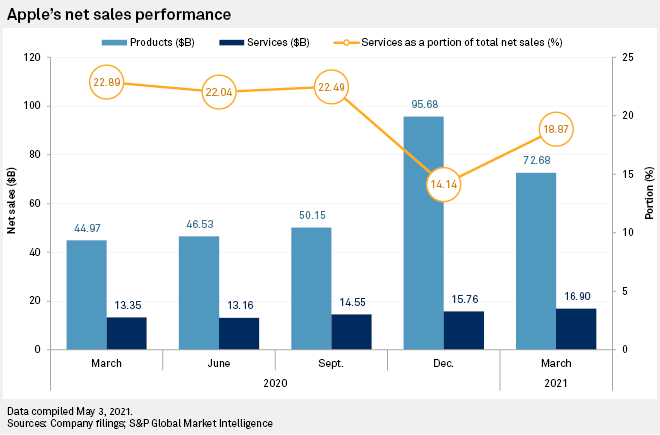

The App Retail outlet is bundled in just Apple’s broader expert services organization, which also contains Apple New music, video providers and cloud choices. Even though Apple does not give unique product sales figures for the Application Keep, internet profits in the company’s services enterprise came to $16.90 billion for the March quarter and comprised about 19% of Apple’s complete net profits in the interval.

Rather than company breakups, Daniel Morgan, a senior portfolio manager at financial company company Synovus, expects regulators to impose extra boundaries on significant tech’s principal business enterprise functions, this sort of as limiting Facebook and Google’s advert monitoring abilities, comparable to Apple’s most current privacy alterations.

“You may perhaps see some form of curtailment where by they appear in and say you guys can not do that, you have to open [your businesses] up,” Morgan mentioned in an interview. “I consider that’d be a single of the much easier kinds to at first deal with as opposed to likely just after a important break up.”

In a January notice, Kevin Rippey, who at the time was an analyst with Evercore ISI, mentioned he considers Facebook’s battle with Apple to be a bigger hazard for the business than authorities regulation, noting Zuckerberg’s assistance of Congress having a more energetic position in crafting new polices is a beneficial. The CEO in January urged federal government officers to established clearer policies all over privacy and written content moderation, indicating people matters are “incredibly tricky for a non-public firm to stability” on its have.

Regardless of regulatory hazards and advertising issues, some analysts stay bullish on huge tech’s long run expansion likely.

Wedbush Securities analyst Daniel Ives in a new report stated he expects significant tech players to lead the electronic transformation in areas these kinds of as cloud computing, following-technology 5G wireless engineering and cybersecurity, which he considers to be a $2 trillion market place chance more than the future decade.

“Having a stage back again, our bullish look at of tech shares more than the many years is predicated on our multi-yr thesis that the digital transformation tale throughout the customer and business ecosystem is nonetheless in the early innings of playing out,” Ives explained.

John Petrides, a portfolio supervisor at Tocqueville Asset Administration, agreed, noting in emailed remarks: “FAANG as a team all posted good earnings benefits and the fundamentals of the group continue to glance strong.”

The so-named FAANG shares, which consist of Facebook, Apple, Amazon.com Inc., Netflix Inc. and Google, are generally tracked with each other because of to their impact on U.S. marketplaces.