Tesla’s bitcoin invest in both of those ‘friend and foe’ as shares enter bear sector

2 min readJeff Sica of Circle Squared Different Investments argues Treasury Secretary Janet Yellen is ‘scared to death’ of bitcoin due to the fact it is found as a risk to the Federal Reserve.

Tesla shares have fallen into a bear sector, down in excess of 20% from the current substantial, and some analysts recommend the firm’s ties to bitcoin are to blame as the forex takes a beating subsequent extra cautious reviews from U.S. Treasury Secretary Yellen.

| Ticker | Stability | Very last | Modify | Transform % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 698.84 | -15.66 | -2.19% |

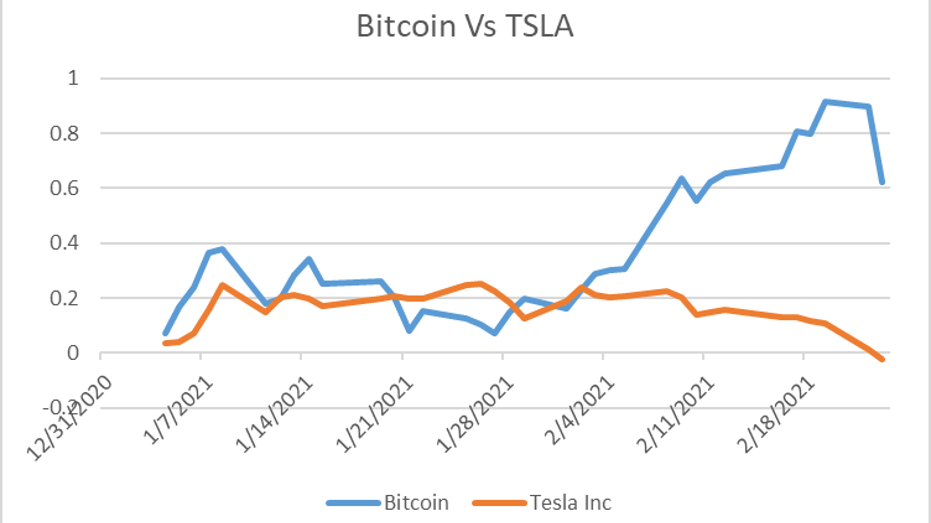

The stock, down all-around 21% from its closing substantial of $883.09 on January 26, has backtracked together with the digital currency. Bitcoin, as of Tuesday, has slid about 17% slipping to $48,170 after hitting its all-time high of $58,332, as tracked by Coindesk.

ELON MUSK Points out TESLA’S $1.5B BITCOIN Buy

Courtesy: Dow Jones Sector Data Team

The electric-car or truck maker’s $1.5 billion expenditure in the forex to diversify its dollars holdings, as explained in a filing with the Securities and Trade Fee last thirty day period, may well be a double-edged sword.

TESLA Purchases $1.5B IN BITCOIN, WILL Commence ACCEPTING FOR Cars

“Investors are setting up to tie Bitcoin and Tesla at the hip. Whilst Tesla on paper manufactured around a $1 billion on Bitcoin in a thirty day period that exceeded all its EV revenue from 2020, the new 48 hour market off in Bitcoin and included volatility has driven some traders to the exits on this name in the close to-term” wrote analyst Dan Ives of Wedbush, who also observed he thinks the transfer was a “strategic 1 for the long-expression.” Ives premiums the inventory a maintain but sees even further gains. “We retain our $950 cost concentrate on and $1,250 bull scenario” he included.

The volatility in bitcoin this week also arrived as Yellen reiterated cautious feedback when asked about the future of a digital forex.

“Bitcoin and I’ve said this prior to — is commonly employed as a transaction mechanism to the extent it can be made use of I panic it can be generally for illicit finance. It truly is an really inefficient way of conducting transactions. And the volume of vitality that’s consumed in processing those people transactions is staggering. But it is a really speculative asset, and you know, I feel folks should beware. It can be incredibly unstable, and I do get worried about opportunity losses that traders in it could experience” said Yellen for the duration of an interview at the New York Instances DealBook DC Plan Job on Monday.

BITCOIN’S Industry Price TOPS $1 TRILLION FOR To start with TIME

Yellen’s remarks followed a clarification from Tesla CEO Elon Musk himself final week on what was powering his firm’s stake in the electronic asset.

“When fiat forex has damaging genuine fascination, only a idiot wouldn’t glance elsewhere,” Musk tweeted final week.