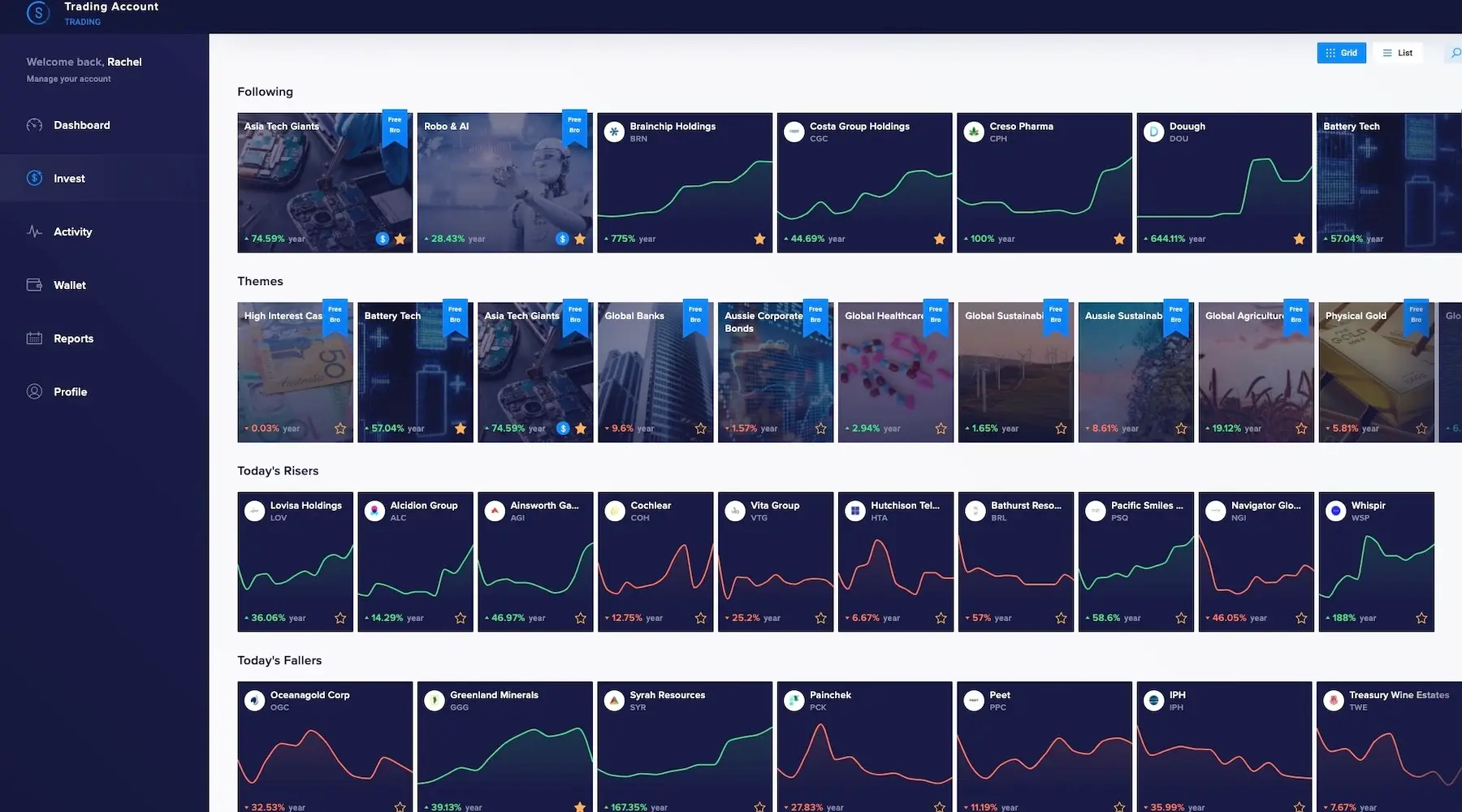

Trading application Superhero launches US shares – how it compares

The Australian share investing platform is supplying $ commission US inventory buying and selling as perfectly as fractional investing starting from currently.

- Superhero is now featuring both Australian and US shares

- $ fee on US shares, $5 flat cost on ASX stocks

- US stocks can be traded in fractions alternatively than entire shares

- The platform has chosen Finclear and Apex Corp for brokerage solutions

Australian reduced-price share trading system Superhero is offering US stocks and ETFs to customers starting up from right now.

Superhero has also verified it will be applying Finclear as its ASX execution broker after cancelling its deal with OpenMarkets. It has partnered with Apex Clearing Company to control its US brokerage, custodian and execution companies.

Superhero very first launched in September final yr with $5 brokerage on ASX shares and free of charge trades on ETFs. These days it has all around 80,000 shoppers and options to release a superannuation product sometime this calendar year.

The choice to offer US shares comes as hundreds of Australians began trading on the inventory current market in the last 12 months. According to exploration from Superhero, 39% of men and women aged 18-45 are now invested in Australian shares even though 17% keep US shares.

“The past couple several years have found a genuine change towards investing in both of those Australian and U.S. shares, particularly from individuals aged in their mid twenties to mid forties,” Superhero co-founder and CEO John Winters claimed currently.

How does it evaluate?

On fees on your own, Superhero is one of the least expensive costing share investing platforms on the market place.

Along with its $5 flat price for ASX stocks ($ for ETFs), Superhero is scrapping the brokerage cost for US shares. This implies you pay no transaction rate to purchase or provide US shares. It also rates no every month account price and no inactivity payment.

According to Finder details, this update marks Superhero as the most inexpensive broker for each Australian and US inventory investing on the exact platform.

Brokers offering $ fee US shares (*on trades of $1000)

|

Superhero |

$ |

$5 stocks, $ ETFs |

US$.50 per AUD$100 |

|

IG |

$ |

$8 |

.70% |

|

CMC Markets |

$ |

$11 |

.60% |

|

Stake |

$ |

Not out there |

US$.70 for every AUD$100 |

|

eToro |

$ |

Not offered |

.50% |

Superhero is comparatively negligible on buying and selling features, on the other hand it does offer you actual-time Forex transfers, restrict orders, portfolio monitoring and thorough tax reporting.

In certain, the system stands out many thanks to it low minimum amount financial investment of $100 required to trade ASX stocks, in contrast to the standard $500 minimum amount. By also supplying fractional shares, buyers will be equipped to invest smaller sized amounts than numerous other regular brokers can provide.

How does it function?

There are now all around half a dozen brokers that present $ fee US stock buying and selling. Nonetheless this would not suggest it truly is cost-free. Instead of spending a broker fee, investors pay a foreign exchange cost to transform AUD to USD.

To swap AUD to USD on Superhero, you can expect to be billed a overseas trade charge of US$.50 for each and every AUD$100 transferred.

All Australian share trading platforms need to companion with a US brokerage to act as a custodian. Superhero has partnered with Apex Clearing Corporation to control and execute its US brokerage products and services, while FinClear is its ASX custodian.

Dwell US inventory charges will also be out there by means of the application. It has partnered with US trade NASDAQ to offer you this services.

The developing level of popularity of US inventory investing has spurred a range of regional on the net brokers to raise their market providing. In December very last year, SelfWealth also released US stock investing alongside with its ASX providing. Meanwhile, CMC Marketplaces and IG also scrapped brokerage charges on world wide shares last 12 months, becoming a member of eToro and Stake as $ fee brokers.

On the lookout for a minimal-charge on the internet broker to invest in the inventory sector? Assess share trading platforms to start investing in shares and ETFs.

Disclaimer: This details should not be interpreted as an endorsement of futures, shares, ETFs, CFDs, options or any distinct company, service or featuring. It really should not be relied upon as expenditure guidance or construed as providing suggestions of any kind. Futures, shares, ETFs and solutions buying and selling includes significant threat of decline and hence are not proper for all traders. Buying and selling CFDs and foreign exchange on leverage comes with a larger threat of dropping funds rapidly. Past effectiveness is not an indicator of long term effects. Take into account your possess situations, and attain your own tips, before building any trades.