Turkey fines foreign financial institutions for ‘short offering irregularities’

3 min readTurkey has fined banking institutions including Goldman Sachs, Financial institution of The united states and JPMorgan in excess of alleged irregularities in small promoting just a 7 days following international traders pulled $1.9bn from the country’s stock and bond markets.

The Cash Markets Board reported late on Thursday that 10 securities corporations had positioned orders for small providing without the need of good notification, violating guidelines enacted last July that briefly prohibited these kinds of transactions. The board’s detect did not present even more facts and a spokesman for the regulator could not be arrived at.

Credit Suisse was fined TL7.8m ($1m), when Barclays was fined TL7m and Bank of The us was strike with a TL6.3m fine. JPMorgan and Goldman Sachs need to pay back TL1.2m and TL871,000, respectively. HSBC, UBS, Renaissance, Moon Funds Learn Fund and Wood & Co. had been fined amongst TL188,000 and TL1.4m. The economical corporations both declined to comment or did not react to a request for remark by publication time.

The fines might be tiny but kind aspect of a sample. Very last July, the stock exchange banned Goldman Sachs, JPMorgan, Financial institution of The united states, Barclays, Credit history Suisse and Wood & Co. from small providing shares in publicly traded Turkish organizations for 3 months. The transactions in question occurred past calendar year, Bloomberg noted.

In late March, international investors dumped Turkish shares, bonds and the lira right after President Recep Tayyip Erdogan abruptly fired Naci Agbal, the central bank governor who experienced served just four months in the purpose and was widely credited with restoring assurance soon after a collection of large curiosity-amount rises to stabilise the lira and tame inflation. Alternatively, the president put in an academic and newspaper columnist who shares Erdogan’s unconventional look at that large desire rates drive inflation.

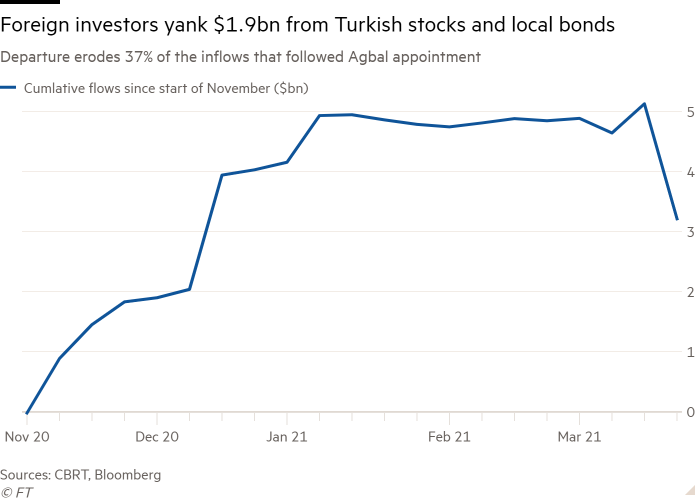

A report produced by the central bank this week underscored the scale of the trader flight prompted by Erdogan’s abrupt firing of Agbal. Foreign investors pulled $814m from the inventory market place and $1.1bn from nearby bonds in the 7 days of March 26, according to facts collated by Bloomberg. The outflow eroded 37 for each cent of the $5.1bn in new dollars that flowed into Turkey given that early November pursuing Agbal’s appointment.

Sahap Kavcioglu, the new central financial institution governor, addressed traders on Thursday, repeating a pledge to preserve restricted monetary policy, according to a few participants who asked not to be named since the meeting was closed to the push.

Questioned about his earlier said sights on the website link concerning desire prices and inflation, Kavcioglu acknowledged that market participants’ concerns ended up “understandable” but they ought to wait around to “judge” him till immediately after April, when the financial coverage committee will keep its upcoming level-environment conference, a single individual on the phone reported.

Yet another man or woman reported he did not truly feel “any far more reassured” following the connect with, when Kavcioglu deferred to a deputy to reply lots of of the concerns requested by investors.

Two contributors on the get in touch with included that they ended up however left in doubt in excess of how substantially sway Kavcioglu would have in environment financial coverage offered deep fears around central financial institution independence.

Yigit Bulut, an financial adviser to Erdogan, mentioned: “The markets like the central lender governor, primarily soon after yesterday’s meeting, when there was true cohesion.”

The lira traded at all-around 8.05 to the US greenback on Friday, more powerful than before the Kavcioglu meeting with traders, but considerably weaker than the TL7.22 stage it traded at ahead of Agbal’s sacking.

Turkish residents slash their overseas exchange deposits by $8.9bn in the week to March 26, a 3.8 per cent drop on the preceding week, in accordance to the central financial institution. Bulut reported this confirmed Turkish citizens had stepped in to support the lira.