Turkish bank shares, lira dive amid fallout from central financial institution governor sacking

Turkey’s benchmark bank index traded a lot more than 9% lower on Tuesday as markets reacted to Turkish President Recep Tayyip Erdoğan’s surprise dismissal of the central bank governor.

The sacking of Naci Ağbal at the weekend sparked widespread providing of area stocks and the lira, with lender shares amongst individuals to consider a hit. The Borsa İstanbul AS’s Liquid Banks index, which consists of Türkiye İş Bankası AŞ, Türkiye Vakıflar Bankası TAO, Türkiye Halk Bankası AŞ, Akbank TAŞ, Yapı ve Kredi Bankası AŞ and Türkiye Garanti Bankası AŞ, closed 9.89% lessen on Monday at 1,206.37, and had fallen to 1096.03 at noon Istanbul time on Tuesday.

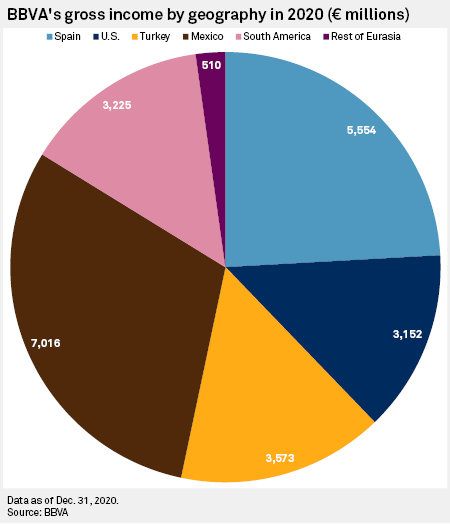

Garanti’s dad or mum business Banco Bilbao Vizcaya Argentaria SA shut 8.7% decrease on Monday. The Spanish lender’s Turkish functions accounted for 16% of team gross money in 2020.

“The difficulties in Turkey have been prolonged jogging. This is one particular in a line of risky challenges in Turkey that have come up in recent yrs,” Benjie Creelan-Stanford, financial institution analyst at Jefferies, instructed S&P World-wide Current market Intelligence. “From a BBVA perspective exclusively, the points to bear in head are that the subsidiary is self-funded and the capital sensitivity of the team is fairly constrained in that there is a purely natural hedging in place but they do actively hedge [foreign exchange] hazard as very well.”

“For what it is well worth, in conditions of our assumptions, we are embedding conservative forecasts going forward for Turkey because of those people aforementioned threats, in terms of the underlying fundamentals and also the currency assumptions that we are utilizing. We have Turkish profits down 20% in 2023 as opposed to 2020 for BBVA,” he said.

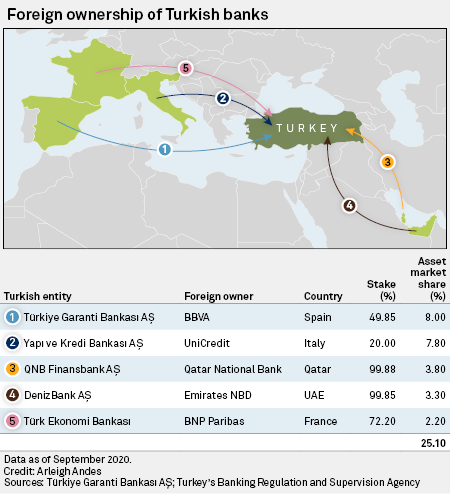

BBVA, together with UniCredit SpA, ING Groep NV and Qatar Countrywide Lender (QPSC), are among the international loan companies with Turkish property.

The lira was at 7.78 to the U.S. dollar on Tuesday, paring losses following trading at 8.39 to the dollar over the weekend, while the lira’s renewed slide will take its losses versus the dollar over the previous decade to about 80%.

Erdoğan replaced Ağbal with Şahap Kavcıoğlu on Saturday, which adopted Thursday’s 200-basis-position enhance in the benchmark interest amount to 19%.

“You are not able to improve the central lender governor from a hawkish just one to a dovish just one without the need of markets anticipating a elementary plan change,” reported For each Hammarlund, chief rising markets strategist at Sweden’s SEB.

“Except the central bank troubles a credible statement committing to making use of fascination fees to combat inflation and to stabilize the lira, the 8.51-8.52 [to the dollar] level will be examined if not in the following few of times then in just the up coming few of weeks.”

Hammarlund believes the authorities and central bank are taking measures to assistance the lira these kinds of as applying the swap market place to obtain lira and pressuring condition-owned banking companies to get lira and provide pounds.

“They never have substantially in reserves, so their ammunition is very minimal, and they can only do this for a small time period,” he mentioned.

Unorthodox sights

Erdoğan appointed Ağbal in November 2020, firing his predecessor after the lira fell to a record low compared to the dollar. Ağbal’s replacement, Kavcıoğlu, is an economist and previous member of parliament for Erdoğan’s AK Occasion, in accordance to the point out-operate Anadolu Company. In February he wrote a newspaper column in which he claimed charge hikes indirectly trigger inflation to increase, Day by day Sabah documented. That see, which is opposite to typical financial imagined, is one Erdoğan has touted himself.

“It appears that no far more amount hikes are on the horizon for Turkey,” stated Jeffrey Halley, a senior industry analyst at currency trade firm Oanda.

As investors offer off their Turkey assets, Halley warned Kavcıoğlu’s appointment would “choke off” overseas financial investment flows, thereby increasing domestic borrowing expenses even if the central lender does not hike rates.

Should really Turkey are unsuccessful to raise prices even more, the nation “will either have to burn by way of its currency reserves to defend the lira, as overseas investors will search at the developments negatively, or new forex controls are on the way,” explained Halley.

Inflation targets

Kavcıoğlu, in a created assertion, stated the regulator’s primary goal was to attain a long term reducing of inflation.

In response to the pandemic, Turkey’s central lender slashed fascination fees to 8.25% in May perhaps 2020, extending cuts from mid-2018’s peak of 24% and introducing several steps to greater support the ailing overall economy.

These price reductions prompted corporate and personal customers to increase their borrowing, with state banking institutions in particular aggressive in growing their financial loan textbooks beneath Turkey’s Credit rating Promise Fund.

But the central financial institution then hiked prices — to 10.25% in September, 15.% in November and 17% in December prior to final week’s most up-to-date raise — which sapped desire for new loans but bolstered the lira.

The central bank had hiked costs to check out to control inflation. Once-a-year inflation hit 15.6% in February, its optimum degree since mid-2019. Meals price ranges ended up up 18.4% year in excess of yr. Yearly inflation is forecast to drop to 10.5% in March.