West Pharmaceutical (WST) Hits 52-Week Large: What is actually Driving It?

4 min readShares of West Pharmaceutical Companies, Inc. WST attained a new 52-7 days large of $365.98 on Jul 2, before closing the session marginally reduced at $365.74.

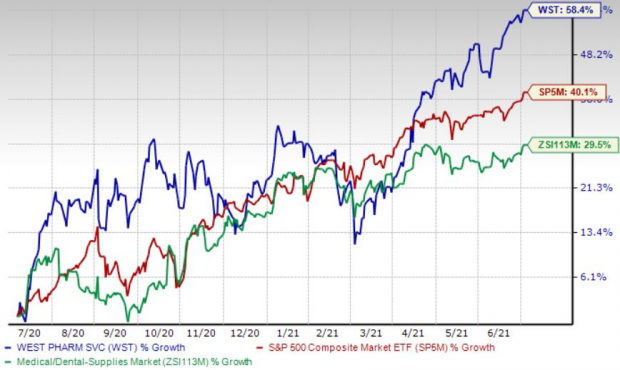

Shares of the organization have attained 58.5% in the past calendar year as opposed with the industry’s 29.5% advancement and the S&P 500’s 40.1% rise.

The enterprise is witnessing an upward trend in its stock selling price, prompted by its robust proprietary items enterprise. West Pharmaceutical’s strong efficiency in the 1st quarter of 2021 and its prosperous implementation of pandemic initiatives also buoy optimism. Nevertheless, details security breaches and international trade fluctuations are major downsides.

Graphic Source: Zacks Financial commitment Analysis

Graphic Source: Zacks Financial commitment Analysis

Let’s delve deeper.

Crucial Progress Motorists

Strong Proprietary Products and solutions Section: West Pharmaceutical’s proprietary products business, which proceeds to exhibit sustained power and is an critical contributor to the company’s top line, is increasing market sentiments. In the first quarter of 2021, web gross sales at this section recorded a stable uptick, in which high-worth products and solutions (“HVP”) represented a bigger share of segmental sales and produced double-digit organic product sales expansion, led by sturdy shopper demand from customers.

Profitable Implementation of Pandemic Initiatives: West Pharmaceutical’s efforts to retain customers’ rely on in the enterprise elevate optimism. Aside from guaranteeing the very well currently being and protection of group members throughout the world, the organization properly continued the producing and offer of components to its consumers. West Pharmaceutical also enabled vaccine makers to secure their sensitive biomolecules with reliable options. Expansion to existing web-sites was made and staff were being deployed to cater to the predicted need for the pandemic-connected factors.

Solid Q1 Outcomes: West Pharmaceutical’s superior-than-envisioned results in first-quarter 2021 buoy optimism. The corporation proceeds to achieve from equally its segments – Proprietary Merchandise and Agreement-Made Merchandise – which have been contributing to the top line for fairly some time. Growth in both equally margins is a beneficial. Further more, the company’s HVPs continue on to push larger margins. Also, it proceeds to see robust uptake of HVP components, which incorporate Westar, FluroTec, Visualize and NovaPure offerings, together with Daikyo’s Crystal Zenith. A raised 2021 outlook is also encouraging.

Downsides

Details Stability Breaches: West Pharmaceutical’s systems and networks, along with those people of its shoppers, suppliers, services providers and banking institutions, have and may well develop into the focus on of cyberattacks and information and facts safety breaches in foreseeable future. Failure to comply with rules or protect against the unauthorized accessibility, launch and/or corruption of the company’s or its customers’ confidential details can final result in economical losses and also damage its status.

Forex trading Woes: West Pharmaceutical’s small business is uncovered to overseas currency exchange rate fluctuations. It is envisioned that revenue from worldwide operations will go on to account for a considerable part of the company’s whole sales in long term. West Pharmaceutical also incurs forex transaction threats when the firm alone, or just one of its subsidiaries, enters into a obtain or gross sales transaction in a currency other than that entity’s local currency.

Zacks Rank & Other Key Picks

Now, West Pharmaceutical carries a Zacks Rank #2 (Acquire).

A handful of other major-rated shares from the broader professional medical house are Veeva Programs Inc. VEEV, AMN Health care Solutions Inc AMN and Countrywide Vision Holdings, Inc. EYE.

Veeva Systems’ extensive-time period earnings advancement fee is estimated at 15.8%. The organization presently carries a Zacks Rank #2. You can see the entire list of today’s Zacks #1 Rank (Robust Obtain) stocks here.

AMN Healthcare’s very long-time period earnings advancement price is believed at 6.5%. It at the moment flaunts a Zacks Rank #1.

National Vision’s lengthy-expression earnings progress amount is estimated at 23%. It at the moment sports a Zacks Rank #1.

Zacks Names “Single Ideal Decide to Double”

From hundreds of shares, 5 Zacks industry experts each individual have chosen their favorite to skyrocket +100% or much more in months to come. From all those 5, Director of Research Sheraz Mian hand-picks 1 to have the most explosive upside of all.

You know this corporation from its past glory times, but couple of would count on that it’s poised for a monster turnaround. Clean from a prosperous repositioning and flush with A-record celeb endorsements, it could rival or surpass other the latest Zacks’ Stocks Established to Double like Boston Beer Corporation which shot up +143.% in a small more than 9 months and Nvidia which boomed +175.9% in a person year.

Absolutely free: See Our Top Inventory and 4 Runners Up >>

Click on to get this cost-free report

AMN Healthcare Products and services Inc (AMN): Absolutely free Inventory Investigation Report

West Pharmaceutical Providers, Inc. (WST): Totally free Inventory Analysis Report

Veeva Units Inc. (VEEV): Cost-free Inventory Evaluation Report

National Vision Holdings, Inc. (EYE): Absolutely free Inventory Assessment Report

To browse this post on Zacks.com click on listed here.

Zacks Financial commitment Analysis

The sights and views expressed herein are the views and viewpoints of the writer and do not necessarily replicate people of Nasdaq, Inc.