West Pharmaceutical (WST) Hits 52-Week Significant: What is actually Driving It? – July 6, 2021

4 min readShares of West Pharmaceutical Providers, Inc. (WST – Free Report) reached a new 52-week large of $365.98 on Jul 2, right before closing the session marginally lessen at $365.74.

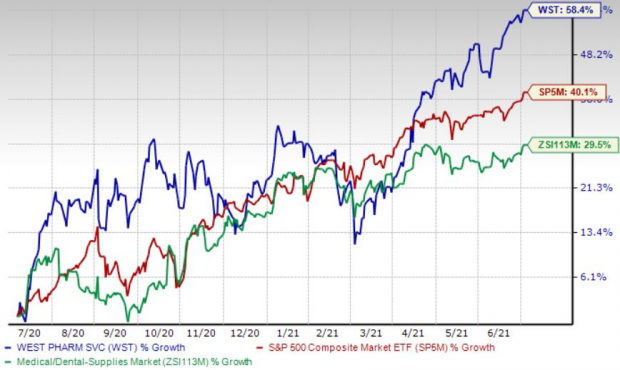

Shares of the company have acquired 58.5% in the earlier 12 months in comparison with the industry’s 29.5% advancement and the S&P 500’s 40.1% rise.

The firm is witnessing an upward development in its inventory rate, prompted by its strong proprietary merchandise company. West Pharmaceutical’s good general performance in the initial quarter of 2021 and its thriving implementation of pandemic initiatives also buoy optimism. However, information and facts security breaches and international trade fluctuations are main downsides.

Graphic Resource: Zacks Financial investment Investigation

Graphic Resource: Zacks Financial investment Investigation

Let us delve deeper.

Crucial Progress Motorists

Sturdy Proprietary Merchandise Section: West Pharmaceutical’s proprietary items company, which carries on to show sustained toughness and is an crucial contributor to the company’s prime line, is increasing current market sentiments. In the to start with quarter of 2021, web revenue at this section recorded a solid uptick, where high-value items (“HVP”) represented a larger sized share of segmental gross sales and created double-digit organic and natural product sales expansion, led by robust purchaser desire.

Prosperous Implementation of Pandemic Initiatives: West Pharmaceutical’s efforts to sustain customers’ belief in the company raise optimism. Aside from ensuring the nicely being and protection of group users all over the world, the enterprise properly continued the production and provide of elements to its clients. West Pharmaceutical also enabled vaccine makers to guard their sensitive biomolecules with reliable options. Enlargement to existing internet sites was designed and staff ended up deployed to cater to the anticipated demand for the pandemic-associated elements.

Solid Q1 Effects: West Pharmaceutical’s improved-than-predicted effects in to start with-quarter 2021 buoy optimism. The corporation proceeds to obtain from both its segments – Proprietary Products and Agreement-Manufactured Items – which have been contributing to the best line for quite some time. Expansion in the two margins is a optimistic. Further, the company’s HVPs go on to travel increased margins. On top of that, it continues to see robust uptake of HVP factors, which consist of Westar, FluroTec, Envision and NovaPure offerings, alongside with Daikyo’s Crystal Zenith. A raised 2021 outlook is also encouraging.

Downsides

Info Security Breaches: West Pharmaceutical’s devices and networks, alongside with people of its prospects, suppliers, service companies and banking institutions, have and may grow to be the concentrate on of cyberattacks and details safety breaches in upcoming. Failure to comply with laws or avert the unauthorized accessibility, launch and/or corruption of the company’s or its customers’ private data can final result in monetary losses and also harm its name.

Forex trading Woes: West Pharmaceutical’s business is uncovered to foreign forex exchange charge fluctuations. It is predicted that revenue from worldwide operations will keep on to account for a significant part of the company’s overall revenue in potential. West Pharmaceutical also incurs forex transaction hazards when the company itself, or one of its subsidiaries, enters into a invest in or gross sales transaction in a forex other than that entity’s local forex.

Zacks Rank & Other Vital Picks

At the moment, West Pharmaceutical carries a Zacks Rank #2 (Acquire).

A couple of other best-rated shares from the broader clinical area are Veeva Units Inc. (VEEV – Free Report) , AMN Health care Products and services Inc (AMN – Free of charge Report) and National Eyesight Holdings, Inc. (EYE – No cost Report) .

Veeva Systems’ prolonged-phrase earnings progress fee is believed at 15.8%. The enterprise presently carries a Zacks Rank #2. You can see the full record of today’s Zacks #1 Rank (Solid Purchase) stocks below.

AMN Healthcare’s long-term earnings expansion amount is believed at 6.5%. It presently flaunts a Zacks Rank #1.

Nationwide Vision’s long-term earnings advancement rate is approximated at 23%. It currently athletics a Zacks Rank #1.

Zacks Names “Single Very best Pick to Double”

From 1000’s of shares, 5 Zacks industry experts each and every have decided on their favourite to skyrocket +100% or a lot more in months to come. From all those 5, Director of Research Sheraz Mian hand-picks one particular to have the most explosive upside of all.

You know this business from its previous glory days, but handful of would be expecting that it is poised for a monster turnaround. Refreshing from a thriving repositioning and flush with A-checklist celeb endorsements, it could rival or surpass other new Zacks’ Shares Established to Double like Boston Beer Company which shot up +143.% in a tiny far more than 9 months and Nvidia which boomed +175.9% in one 12 months.

Free of charge: See Our Prime Stock and 4 Runners Up >>