Deglobalisation is boosting foreign exchange volatility

4 min readThe author is world wide head of G10 Forex Solutions Buying and selling at Goldman Sachs, and author of ‘International Exchange — Simple Asset Pricing and Macroeconomic Theory’

Foreign exchange marketplaces have this calendar year been jolted by a unexpected raise in volatility. There are many motives for this, but at the coronary heart of the shift is deglobalisation.

To recognize why, look at very first the reverse. In a hypothetical, flawlessly globalised environment, there would be no boundaries to international trade, meaning products could be developed in one country and transported to the other with no price or friction.

Let us concentrate on Japan and the US in our hypothetical planet, and suppose that every single state makes goods referred to as widgets of similar good quality. In these a globe the real overseas trade rate are not able to deviate from 1.. That is for the reason that if the charge of a Japanese widget expressed in pounds ended up less expensive than a US-developed model, traders in global products marketplaces would acquire far more Japanese widgets, put them on ships and sell them in the US. The traders would go on until eventually the arbitrage possibility is competed away, forcing the genuine overseas trade rate again to 1.. Hence there is small, if any, volatility in the authentic trade amount.

Due to the fact the coronavirus pandemic strike in 2020, the earth we have been going towards resembles our hypothetical earth a lot considerably less. The World wide Offer Chain Pressure index generated by the Federal Reserve Bank of New York actions global transportation expenditures and other supply chain pressures. It has moved to the maximum degrees that we have seen.

This is just a single part of what is broadly remaining labelled “supply constraints”. Correspondingly, we are looking at fairly spectacular variants in the true exchange fee.

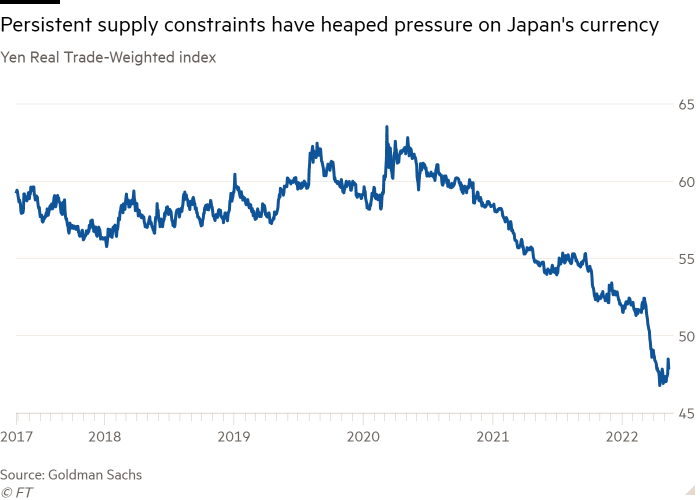

The yen may well weaken and Japan may continue to run with lower inflation than the US. But with transportation expenses so substantial, and with Covid-19 and other offer chain disruptions, it gets extra tough for traders and business enterprise to acquire benefit of a cheap yen exchange amount. With these reduced demand, the yen is far more susceptible. The trade-weighted stage of the yen has weakened by about 10 for every cent in 2022 in real phrases (after accounting for inflation), and by 20 for each cent since the begin of 2020. Our hypothetical environment would not have noticed these types of volatility.

A second supply of the large currency volatility we are suffering from will come from divergence in central financial institution plan rates, which are in change driven by divergent intercontinental economies.

The pandemic-pushed financial collapse in 2020 and vaccine-driven recovery in 2021 were being internationally shared encounters. In the course of this interval, there was broadly no explanation for central financial institutions across designed market place economies to get various coverage paths. But, this year, a divergence has begun.

This is standard after a crisis: economies ought to be expected to react and cope with their respective debt burdens in distinct ways. Nevertheless, the electrical power selling price shock — spurred on by the war in Ukraine — has made even more divergences, with power importers this sort of as Europe, Britain and Japan struggling a detrimental impact, even though strength-neutral nations these types of as the US have fared better.

Marketplaces are pricing in a whole of 250 basis factors of amount rises by the US Federal Reserve in 2022, when compared with 100 basis points from the European Central Lender, 180 foundation points from the Lender of England and potentially none at all from the Lender of Japan.

Even in our hypothetical world, in which genuine overseas trade prices are fixed, these kinds of divergence would trigger volatility in nominal spot rates. The explanation is that much more curiosity level rises carry down inflation expectations, therefore lifting the potential purchasing power of the currency. With the Federal Reserve top the way, it is no surprise that contracts to exchange the euro, sterling and yen at a long term date have all moved significantly in favour of the dollar. And spot prices are investing at even better premiums than regular to these ahead charges due to the fact of bigger US fascination charges.

This has been the lesson from historical past. Overseas trade volatility remained broadly contained relative to what was witnessed in fairness, fascination amount and credit rating marketplaces for the duration of the 2008-10 financial crisis. However among 2011 and 2017, we saw a lot of idiosyncracies, these kinds of as the European sovereign financial debt crisis, Abenomics and the Brexit referendum.

In 2017, currency fluctuations eased. But we are after once more in a interval of macro divergences. Till globalising forces re-arise, the write-up-pandemic environment will continue being one of higher overseas trade volatility.