Goldman (GS) in Murky Waters More than Speculative Spanish Trades

4 min readNow engulfed in 2020’s heightened scandal linked to the multibillion-greenback 1Malaysia Development Bhd (1MDB), Goldman Sachs GS is now struggling with another complaint as Europe’s most significant wine exporter, J. Garcia Carrion SA, has sued the former around manipulation of forex trades, summarizing its situation versus the bank to the Fiscal Perform Authority (FCA) in the U.K. The news was described by Bloomberg.

The criticism filed by legal professionals for J. Garcia Carrion, charges that Goldman Sachs Global “incited the sale of unauthorized speculative derivatives unconnected to J. Garcia Carrion’s enterprise, with obscure implicit fees, and with no regard to the pertinent regulation relating to speaking challenges and the quantity of the client’s company.”

The grievance asserts that Goldman Sachs built major bucks at the Spanish firm’s expenditure in its dealings with the firm’s previous chief economic officer, Felix Villaverde, who has been accused together with his son, of duping the business enterprise. Villaverde’s law firm declined to comment.

In accordance to people today acquainted with the subject, J. Garcia Carrion has estimated the derivatives mispricing to be of to these an extent that Goldman Sachs could have booked gains truly worth virtually $25 million on the trades underneath problem. However, as for each them, J. Garcia Carrion has recognized losses aggregating to 2.5 million euros amongst 2019 and September 2020 on individuals trades.

J. Garcia Carrion has summoned on other European regulators to examine on the trades and in a assertion issued this 7 days explained that the banking companies “involved, these types of as BNP Paribas and Goldman Sachs Global, have not complied with the applicable banking regulation, so these information have been notified to the Bank of Spain and will also be notified to their respective European regulators.”

Previously this January, J. Garcia Carrion sued Goldman Sachs in the U.K. over the sale of foreign-exchange derivatives, which was aspect of the broader scenario involving rates on its previous finance director moving into into unauthorized trades with several banks, this kind of as BNP Paribas SA BNPQY and Deutsche Bank AG DB.

Spokespeople for the FCA, Deutsche Financial institution and BNP Paribas have all declined to remark.

Goldman Sachs, which is contesting the claims and has declined all allegations, had now submitted a lawsuit in opposition to J. Garcia Carrion in the U.K. in September 2020, in order to retrieve $6.2 million that the Spanish firm owed it, as for each a courtroom filing. The lender famous in a assertion, “For several years J. Garcia Carrion S.A. profited without criticism from its use of Fx derivatives with Goldman Sachs to regulate its global forex publicity. The company’s refusal to make the payments thanks below the transactions in 2020 on the foundation that these transactions were being mysterious to it and have been outside of its potential and authority was unjustifiable and remaining us with no selection but to start authorized proceedings to recuperate the sum owed.”

Base Line

Despite the fact that Goldman Sachs has fixed very a number of litigation issues, it continue to faces probes and queries from a number of federal businesses, and a number of overseas governments for its firms performed in the course of the pre-disaster time period. As a consequence, the company’s lawful bills are predicted to remain elevated, which could possibly partly impede its bottom-line expansion in the close to expression.

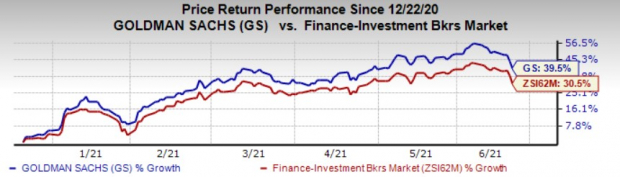

Shares of the organization have acquired 39.5% in the past 6 months, outperforming the 30.5% rally of the industry.

Image Source: Zacks Investment decision Study

Image Source: Zacks Investment decision Study

Goldman Sachs presently carries a Zacks Rank #3 (Keep). You can see the full listing of today’s Zacks #1 (Potent Purchase) Rank shares here.

Street In advance

Buying and selling in the international trade (Fx) market place garners considerable revenues for banking institutions at a quite reduced chance. Nevertheless, a lack of oversight in the Fx industry assisted banking companies quickly manipulate rates as early as December 2007.

Even so, conducts of banking companies are now remaining very carefully watched by various anti-rely on bodies, ensuing in heightening lawful hassles for the wrongdoers. While significant banks proceed to cooperate with pending litigations, their financials are hit by mounting lawful charges arising from settlements and rising provisions to meet likely statements.

Lately, Brazil’s biggest exporters, this sort of as Vale SA and Suzano SA, appealed in a lawsuit for 19 billion reais ($3.77 billion) from Itau Unibanco Keeping SA ITUB and 4 other significant banking institutions on grounds of alleged manipulation of the Brazilian Real (R$).

Infrastructure Stock Boom to Sweep The us

A large force to rebuild the crumbling U.S. infrastructure will soon be underway. It is bipartisan, urgent, and inescapable. Trillions will be used. Fortunes will be produced.

The only concern is “Will you get into the ideal shares early when their growth probable is biggest?”

Zacks has produced a Exclusive Report to assistance you do just that, and these days it’s cost-free. Find out 7 exclusive businesses that glimpse to attain the most from development and repair service to roads, bridges, and properties, moreover cargo hauling and strength transformation on an pretty much unimaginable scale.

Obtain Free of charge: How to Revenue from Trillions on Paying out for Infrastructure >>

Click to get this free of charge report

The Goldman Sachs Group, Inc. (GS): Free Inventory Investigation Report

Deutsche Lender Aktiengesellschaft (DB): Absolutely free Inventory Examination Report

Itau Unibanco Keeping S.A. (ITUB): Absolutely free Stock Examination Report

BNP Paribas SA (BNPQY): Totally free Inventory Assessment Report

To browse this post on Zacks.com click on here.

Zacks Financial commitment Investigate

The sights and views expressed herein are the sights and viewpoints of the author and do not essentially replicate those people of Nasdaq, Inc.