On modes of funding in India

12 min readIndian Entities may well increase fund by means of different modes permissible beneath the Indian legislation. Some of the prevalent queries in relation to raising resources less than a variety of modes beneath Indian rules are answered down below:

1. Which Indian laws of cash by Indian firms?

Indian business may perhaps increase cash in accordance with provisions of the Indian Corporations Act, 2013 (“Firms Act”). On top of that, shown companies will have to comply with rules and rules framed by Securities and Exchange Board of India (SEBI) in unique SEBI (Listing Obligations and Disclosure Requirements) Laws, 2018 and SEBI (Problem of Cash and Disclosure Demands) Restrictions, 2018.

If the funding is proposed to be lifted from overseas buyers, that is non-residents, then these types of funding need to also be in compliance with Indian foreign exchange legal guidelines in specific Foreign Trade (Non-credit card debt Instrument) Procedures, 2019 (Non-financial debt Rules) and Learn Way on Exterior Business Borrowings, Trade Credits and Structured Obligations.

2. What are diverse modes of funding a corporation beneath India regulations?

A enterprise may well be funded by funds infusion as a result of membership to share money of the enterprise or by personal debt. Cash infusion may be undertaken via equity shares, choice shares, quasi-equity instruments or share warrants. Financial debt funding may perhaps be endeavor by means of loans, borrowings and personal debt devices such as bonds and debentures.

3. What are the modes however which a Limited Liability Partnership can be funded?

A constrained liability partnership (“LLP”) is a partnership included less than the Restricted Legal responsibility Act, 2008. The partners of an LLP can fund the LLP by way of infusion of cash contribution in the LLP. The distinct ways in which a husband or wife of the LLP can lead in an LLP are:

(i) Monetary contribution

(ii) Tangible movable or tangible immovable property

(iii) Agreements to contribute home or money

(iv) Intangible property

(v) Contracts for products and services performed or to be carried out

(vi) Promissory notes

4. What are fairness shares and rights connected to these shares?

An equity share, commonly known as standard share and denotes component possession of the corporation. The key options of an equity shares are:

(i) Right to vote in shareholders meeting. Unless the fairness shares have differential voting rights, one particular equity share is equivalent to a single vote.

(ii) Ideal to acquire dividend declared by the board of directors.

(iii) Limitation of legal responsibility to the extent of their expense.

(iv) In scenario of liquidation of the organization, the equity shareholders have a proper to take part in the liquidation proceeds.

5. Can a company concern fairness shares with differential rights?

Below the Organizations Act go through with applicable procedures, both private and community organizations are suitable to challenge equity share with differential rights topic to selected circumstances as approved under the Organizations Act, 2013 and appropriate policies. Even further, stated businesses issuing equity share with differential rights would also want to comply with restrictions framed by SEBI.

Some of the essential disorders which a company desires to comply with for issuance of shares with differential rights are:

(i) Content articles of affiliation of the company need to authorizes the concern of fairness shares with differential rights.

(ii) Concern of shares with differential rights is licensed by an standard resolution passed at a common conference of the shareholders. If equity shares of a business are detailed on a identified inventory exchange, the concern of these kinds of shares shall be permitted by the shareholders via postal ballot.

(iii) Voting ability in respect of shares with differential legal rights of the business shall not exceed seventy-4 per cent of whole voting electricity together with voting electrical power in regard of fairness shares with differential legal rights issued at any point of time.

6. What are desire shares?

Desire shares are those people shares whose holders are entitled to a preferential ideal of payment of dividend and compensation of share capital in the event of winding up of the organization. Critical capabilities of desire shares are as follows:

(i) Choice shareholders do not love any voting rights other than on matters which instantly impact the legal rights of choice shareholders, resolutions for the winding up of the company or for the compensation or reduction of the fairness or choice share funds. Desire shareholders will have the correct to vote on all resolutions if the dividend in regard of their shares has not been paid for a constant period of time of two several years or much more.

(ii) A company are unable to issue irredeemable desire shares. Corporation might redeem its choice shares only on the phrases on which they were being issued.

7. What are diverse sorts of choice shares?

Desire shares can be categorised as below:

(i) Redeemable Desire Shares – Redeemable preference shares are these shares which are redeemed or repaid immediately after the expiry of a stipulated interval

(ii) Cumulative and Non-cumulative Desire Shares – Cumulative preference shares have further characteristics which permit the preference shareholders to assert unpaid dividends of the years in which dividend could not be paid owing to insufficient gain. The holders of non-cumulative desire shares will get desire dividend if the organization earns adequate profit, but they do not have the ideal to assert unpaid dividend which could not be paid out thanks to insufficient income.

(iii) Participating and Non-participating Preference Shares – Participating choice shareholders are entitled to share the surplus earnings of the company in addition to choice dividend. Nonparticipating desire shareholders are not entitled to share surplus profit and surplus property like taking part choice shareholders.

(iv) Convertible Preference Shares – The holders of convertible choice shares are presented an solution to transform total or part of their holding into equity shares after a specific period of time. Convertible choice shares may possibly be compulsorily convertible or optionally convertible preference shares.

8. Is there any valuation needed to be undertaken for issuance of convertible preference shares?

Issuance of convertible choice shares expected a valuation report by a registered valuer possibly:

(i) Upfront at the time when the supply of convertible choice shares is built or

(ii) At the time, which shall not be earlier than thirty days to the date when the holder of convertible preference shares turns into entitled to use for equity shares.

9. What is a share warrant?

Share warrant is an choice issued by the enterprise that gives the warrant holder a proper to subscribe fairness shares at a pre-determined value on or after a pre-determined time period. The warrant holder partly pays the premium for the selection which he bought and partially pays the rate for the share that in the long run will get allotted to him if he physical exercises the alternative.

10. What is a convertible observe?

Convertible take note is an instrument issued by a commence-up firm acknowledging receipt of funds to begin with as financial debt, repayable at the solution of the holder, or which is convertible into this sort of variety of equity shares of that business, inside a period not exceeding 5 yrs from the day of situation of the convertible notice, on incidence of specified occasions as for every other terms and ailments agreed and indicated in the instrument.

11. What is a debenture?

Debenture is an instrument acknowledging a debt to the firm. It incorporates a agreement for reimbursement of principal soon after a specified interval or at intervals or at the solution of the corporation and for payment of coupons at specified fascination premiums. This amounts to borrowing of monies from the holders of debentures on these kinds of conditions and circumstances issue to which the debentures have been issued. Debenture features debenture inventory, bonds or any other instrument of the company evidencing a debt, irrespective of whether constituting a cost on the assets of the organization or not.

12. What are diverse sorts of debentures?

Debentures can be classified as under:

(i) Convertible Debentures – These debentures appear with an possibility of converting the entire or element of the amount of money of the debentures into equity shares, after a specified period. Convertible debentures may be completely convertible into fairness shares or partly convertible into equity shares.

(ii) Non-Convertible Debentures – These debentures are not convertible into equity shares

(iii) Secured Debentures – Debentures which are secured by possibly a set demand or a floating charge on the assets of the business are referred to as secured or mortgage debentures

(iv) Unsecured Debentures – Debentures which are not secured by a set demand or floating cost on assets

13. What are disorders for issuance of secured debentures?

Issuance of secured debentures less than Organizations Act is subject matter to certain situations less than policies framed less than the Corporations Act. For a debenture to represent a secured debenture less than Businesses Act, the subsequent problems are essential to be glad:

(i) The date of redemption of secured debentures ought to not exceed 10 decades from the date of issue.

(ii) The security for this sort of debentures will be demand on the houses or assets of the enterprise or its subsidiaries or its holding enterprise or its associates firms and the safety deal with should really have a worth which is adequate for the thanks compensation of the sum of debentures and curiosity.

(iii) The corporation will be demanded to appoint a debenture trustee to guard the curiosity of the debenture holders.

(iv) The company will be required to make a debenture redemption reserve. In a business proposed to listing its debentures on Indian inventory exchanges then the security made to secure these types of debentures must be sufficient to make sure a 100% stability include.

14. What are kinds of instruments can be issued to non-citizens underneath the overseas immediate financial commitment coverage of India?

The pursuing fairness instruments are identified less than Non-debt Procedures which can be issued by an Indian corporation (private, community, mentioned and unlisted):

(i) Equity shares

(ii) Totally and compulsorily convertible debentures

(iii) Thoroughly and compulsorily convertible desire shares

(iv) Partly paid out equity shares. These shares really should be thoroughly identified as up in 12 months or as specified by the Reserve Bank of India. More, at the very least 20- five per cent of the whole thing to consider quantity (including share quality, if any) should really be paid out up-entrance.

(v) Share warrants. Share warrants can be issued by a organization in accordance with regulations framed by the Securities and Trade Board of India. Additional, at minimum 20-5 for each cent of the consideration shall be received upfront and the equilibrium amount of money within eighteen months of the issuance of share warrants.

(vi) Convertible notes can be issued by an Indian start out-up corporation for an amount of INR 2,500,000 or more in a single tranche.

15. Does investment by non-residents in a corporation by means of equity instruments have to have governing administration approval?

Are there any limits on the styles of organizations a nonresident can expense in? Financial investment by non-resident is permitted under the automated route without prior acceptance of the Authorities in all things to do/ sectors as specified in the Non-financial debt Procedures. Some of sectors in which financial investment is allowed up to 100% of the shares cash of the organization beneath computerized route are airports, greenfield prescription drugs, on line social media platforms, wholesale investing and so forth. Further more, expenditure by non-resident in activities not coated less than the automatic route demands prior acceptance of the Authorities.

International direct investment in the subsequent sectors is not permitted:

(i) Lottery business enterprise and gambling and betting routines.

(ii) Chit cash

(iii) Nidhi firm

(iv) Investing in transferable improvement rights

(v) True estate small business or construction of farmhouses excluding progress of townships, development of household or commercial premises, road or bridges and Authentic Estate Investment Trusts (REITs)

(vi) manufacturing of cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes.

(vii) Activities or sectors not open to private sector expenditure

(viii) International technological innovation collaborations in lottery small business and gambling and betting actions.

International Trade (Non-credit card debt Instrument) Guidelines, 2019 prescribes selected limitations and problems for foreign direct financial commitment in sure sectors.

16. Is there any restriction on price tag at which equity instruments can be issued by providers to non-people?

Financial investment by non-inhabitants in a business are topic to pricing tips. The cost of the equity devices of a enterprise issued to a non-resident shall not be considerably less than:

(i) The valuation of fairness devices finished as for each any internationally approved pricing methodology for valuation on an arm’s duration foundation duly qualified by a chartered accountant or a service provider banker registered with the SEBI or a practising price tag accountant, in case of an unlisted company or

(ii) The price tag worked out in accordance with the SEBI suggestions in scenario of a listed enterprise or in scenario of a business going through a delisting course of action as for every the Securities

17. Can fairness instruments issued to non-citizens have optionality clauses and fastened returns at the time of exit?

Equity devices issued to non-resident can include optionality clauses these types of as put solution for exit issue to a least lock-in time period of 1 (a single) or additional, if recommended for a particular sector.

Non-residents can’t be issued fairness devices which supplied a fixed return on exit.

18. Is subscription to fairness devices by non-citizens in providers essential to be noted to governmental authorities?

Sort Overseas Currency-Gross Provisional Return (FC-GPR) has to be filed with the Reserve Bank of India inside of thirty days from the date of situation of fairness instruments of a company to a person resident outdoors India.

19. Who are Foreign Portfolio Investors (FPI)? What varieties of instruments can PFI’s devote in?

FPIs are non-resident investors who are registered in accordance with the provisions of the SEBI (Foreign Portfolio Buyers) Polices, 2014.

FPIs may perhaps obtain or sell equity instruments of an Indian enterprise which is stated or to be shown on a recognised inventory exchange in India.

The overall keeping by each FPI or an investor team, shall be fewer than 10 % of the total compensated-up equity funds on a thoroughly diluted foundation or less than 10 percent of the paid-up price of each individual sequence of debentures or choice shares or share warrants issued by an Indian enterprise and the full holdings of all FPIs set with each other, which includes any other direct and oblique international investments in the Indian enterprise permitted underneath these regulations, shall not exceed 24 per cent of paid out-up fairness money on a absolutely diluted basis or compensated up price of just about every collection of debentures or preference shares or share warrants.

20. Can a non-resident resident spend in an LLP? Are there any disorders demanded to be satisfied for financial commitment by a non-resident in an LLP?

A non-resident can make investments in an LLP by means of money contribution or acquisition or transfer of financial gain share topic to subsequent essential conditions:

(i) Financial investment in an LLP is permitted only in sectors which are under 100 % computerized route and exactly where there is no international immediate investment linked overall performance circumstances. Some of these sectors are on line social media purposes, information and facts technological innovation enabled services, financial investment advisory providers and so forth.

(ii) Investment decision in a LLP both by way of cash contribution or by way of acquisition or transfer of financial gain shares, really should not be considerably less than the honest price worked out as for each any valuation norm which is internationally accepted or adopted as for every industry apply and a valuation certification to that impact shall be issued by the Chartered Accountant or by a practising Price Accountant or by an accredited valuer from the panel managed by the Central Govt.

21. Is cash contribution in LLPs by non-citizens needed to be reported to governmental authorities?

The LLP getting overseas investments is essential to file Form LLP (I) with the Reserve Financial institution of India in 30 days from the day of receipt of thought for cash contribution and acquisition of earnings shares.

22. What are the ailments required to be happy by a organization for raising loans and borrowings from outdoors India?

Beneath Indian overseas exchange regulations, a business can increase financial loans and borrowings from human being resident exterior India in the variety of exterior professional borrowings (“ECBs”) as for each the Master Route – Exterior Business Borrowings, Trade Credits and Structured Obligations.

ECBs can be elevated as simple vanilla loans, Foreign Currency Convertible Bonds (FCCBs), non-convertible, optionally convertible, or partly convertible preference shares or debentures. ECBs can be raised possibly in overseas currency or Indian Rupees.

23. Is governmental approval needed for availing financial loans below ECBs framework?

Less than the automatic route, Indian organizations which are qualified to increase ECBs, can increase up to USD 750 million or equal per money yr. Further more, Indian providers raising monies earlier mentioned USD 750 million or equal would prior acceptance of Reserve Lender of India is needed prior to mortgage can be availed.

24. What is the Minimum amount Average Maturity Period (MAMP) for ECBs?

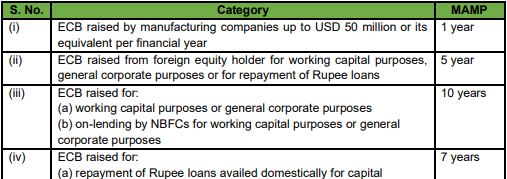

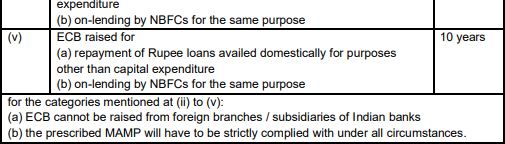

MAMP for ECB will be 3 decades. On the other hand, for the particular groups outlined beneath, the MAMP will be: