Primer on issuance of worker Stock Choices

6 min readWorker Inventory Options (“ESOPs”) is one particular of the powerful techniques of incentivizing staff of an business all in excess of the earth. For early stage / startup organizations, granting of ESOPs is a desired possibility to employ, retain and reward senior level workers as nicely new talent.

This primer focuses on the regulatory framework governing implementation and grant of ESOPs by providers in India

1. Are ESOPs controlled less than Indian legislation?

Issuance of ESOPs by an Indian company has to be in accordance with the provisions of Providers Act, 2013 (“Organizations Act”) and regulations together with, the Firms (Share Money and Debenture) Regulations, 2014. Furthermore, issuance of ESOPs by Indian shown providers are regulated by the rules framed and executed by the Securities and Trade Board of India (“SEBI”), which includes the SEBI (Share Dependent Personnel Rewards) Regulations, 2014 (“SEBI (SBEB) Laws”).

Ordinarily, a business when building ESOP ideas may prescribe added conditions and disorders.

2. Are there any limitations on styles of workers to whom a organization may possibly difficulty ESOPs beneath Indian legislation?

A firm can challenge ESOPs to long-lasting employees- whether doing the job in India or outside the house India, administrators of the firm, workers of a subsidiary enterprise in or outdoors India or of the keeping organization of such subsidiary enterprise.

Nevertheless, a business (other than a start off-up business) are unable to challenge ESOPs to the adhering to individuals:

- Promoters of the corporation

- Directors whose shareholding exceeds 10% (ten) percent of the equity share money of the company. For the uses of calculating the director’s shareholding, the shareholding of this kind of director’s family and indirect shareholding as a result of a overall body corporate is also taken into consideration.

- Unbiased directors.

A organization which is identified as a start off-up by the Section for Advertising of Marketplace and Inside Trade (“DPIIT”) might situation ESOPs to promoters and administrators whose shareholdings exceed the abovementioned 10% (10) % threshold.

3. Is a organization expected to acquire any approvals for issuance of ESOPs?

A corporation need to attain approval of its shareholders by way of passing a unique resolution. Particulars of complete selection of ESOPs granted, eligible staff and appraisal approach of these kinds of staff, vesting period of time and circumstances, exercising value and components, exercise process and rate, lock-in time period, disorders less than which the ESOPs will lapse and so forth. are necessary to be specified in the explanatory statement to the detect for convening the shareholders’ assembly.

Issuance of ESOPs by a enterprise to employees’ resident exterior India will demand extra compliance with the provisions of the Foreign Trade Management Act, 1999 and the guidelines and rules issued thereunder. If a organization proposes to problem ESOPs to a particular person resident exterior India whose expense is issue to governmental acceptance less than the Foreign Exchange Management (Non-Financial debt Instruments) Policies, 2019, then issuance of this kind of ESOPs will also require governmental acceptance.

4. What are the legal rights available to an ESOP holder? Does an ESOP holder have the identical legal rights of as a shareholder?

An ESOP holder has the proper but not the obligation to physical exercise the ESOP after these kinds of ESOP is vested. At the time the ESOPs are vested, the ESOP Holder has a right to subscribe to the fundamental equity shares of the organization at a long term day and at a pre-determined price tag.

Vesting implies completion of the approach by which an worker turns into suitable or entitled to obtain the profit beneath the ESOP granted to him / her by the corporation. The enterprise may possibly at its sole discretion prescribe disorders for vesting of the ESOP these types of as time-period or general performance ailments.

An ESOP Holder is not at par with shareholders of a corporation. An ESOP Holder will not be entitled to added benefits enjoyed by shareholders these as the proper to receive dividend, suitable to vote or any other rights right until fairness shares are issued to the ESOP Holder pursuant to exercise of the ESOP.

5. Are ESOPs transferable?

ESOPs granted to staff members are not transferable to any other person. ESOPs can be exercised only by workers to whom the ESOPs have been granted. Nonetheless, in the celebration of the dying or long lasting incapacity of the staff, the ESOP could, if permitted below the ESOP scheme (“ESOP Scheme”), vest with his / her authorized heirs or nominees.

6. Can ESOPs be pledged, hypothecated, mortgaged, encumbered?

ESOPs granted to personnel are not able to be pledged, hypothecated, mortgaged, encumbered, alienated in any manner.

7. Can quantities paid out by workforce at the time of grant of ESOPs be forfeited?

The firm may well forfeit amounts compensated by an staff at the time of grant of ESOP in circumstance this kind of worker fails to exercising the ESOP within just the physical exercise period.

8. Can the amounts paid out by staff members at the time of grant of ESOPs be refunded?

The quantities payable by workforce at the time of grant of ESOPs may be refunded if the selections are not vested thanks to non-fulfillment of problems relating to vesting as for every the ESOP Plan.

9. What are the implications on ESOPs granted to an employee on his / her everlasting incapacitation and termination / resignation?

In situation an staff suffers a permanent incapacity though in employment, all solutions granted to him / her as on the day of long-lasting incapacitation, shall vest in him / her on that day.

In the celebration of resignation / termination of work, all alternatives not vested in the worker as on that day shall expire. Having said that, the worker can work out the ESOPs granted to him / her which are vested within the specified time period, subject to the phrases and disorders of the ESOP Scheme.

10. What are the compliances recommended under the Corporations Act for adoption of ESOP?

A organization is required to file the subsequent e-Forms with the Registrar of Corporations: e-Sort MGT-14 in just 30 (30) times from day of passing a board resolution for situation of ESOPs (except private restricted corporations) e-Kind MGT-14 inside 30 (thirty) days of passing unique resolution for issuance of ESOP and e-Type PAS-3 within just 30 (thirty) days of allotment of equity shares pursuant to exercise of ESOPs.

In addition, the business is needed to disclose information of ESOPs in its directors’ report and maintain statutory registers for ESOPs in accordance with Companies Act.

11. Is a company essential to make any filings with the Reserve Lender of India for issuance of ESOPs to persons resident outdoors India?

In circumstance of issuance of ESOPs to staff members who are people outdoors India, these business will have to file with the Reserve Financial institution of India: (a) Variety ESOP within just 30 (thirty) times of this kind of issuance and (b) file Form FC-GPR inside 30 (30) days of issuance of equity shares additional to ESOPs.

12. What the added compliances to be undertaken by a listed enterprise below SEBI (SBEB) Laws?

(i) The compensation committee of the detailed entity shall be accountable for formulating in-depth conditions and conditions of the ESOP Scheme, and for administration and superintendence of the ESOP Plan.

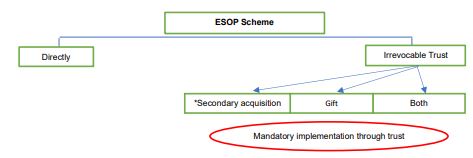

(ii) A outlined business may carry out the ESOP Plan in the adhering to method:

*’Secondary acquisition’ signifies an acquisition of current shares of the business by the rely on as a result of a identified inventory trade for money consideration.

In situation of implementation of ESOP Scheme by a have confidence in, SEBI might specify minimal provisions to be provided in a belief deed which together with any modifications shall be mandatorily submitted with the inventory trade wherever the company’s shares are outlined. The subsequent people can’t be appointed as trustees: (a) director, (b) crucial managerial staff, (c) promoter of the enterprise / holding / subsidiary / associate company, (d) relative of such director, critical managerial personnel, promoter or (e) people beneficially keeping 10% (ten) percent or extra of the paid out-up share funds of the enterprise

(iii) The trustee need to assure that proper shareholders’ approvals have been sought so as to permit implementation of the ESOP by trust and undertake secondary acquisition.

(iv) Secondary acquisition in a economical year shall not exceed 2% (two) percent of the paid-up share money as at the finish of the former financial 12 months.

(v) The limit of overall variety of equity shares underneath secondary acquisition held by a believe in with respect to ESOP Scheme shall not exceed 5% (5) p.c. These restrictions are dependent on the paid out-up share money as at the conclusion of the fiscal year promptly preceding the 12 months in which shareholders’ approval was sought for these kinds of secondary acquisition.

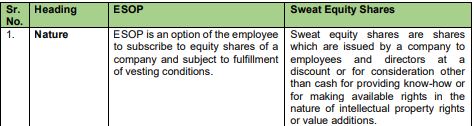

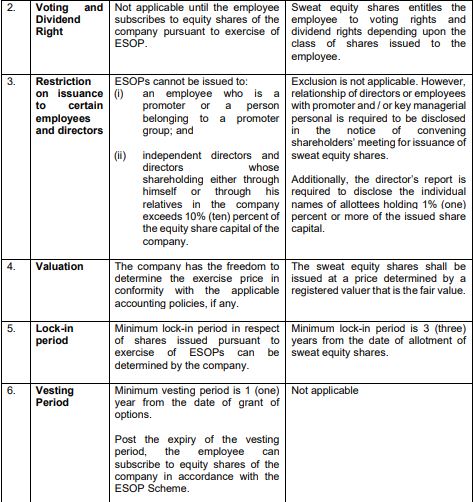

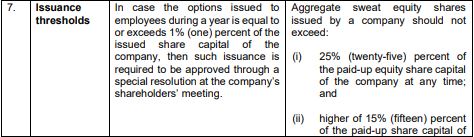

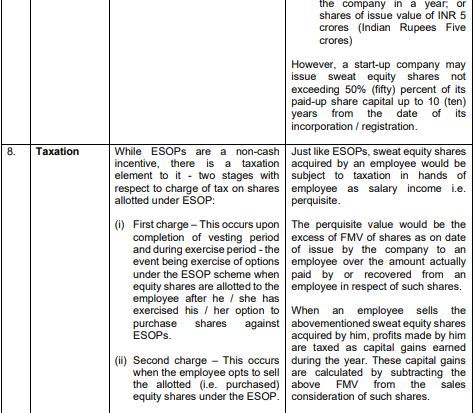

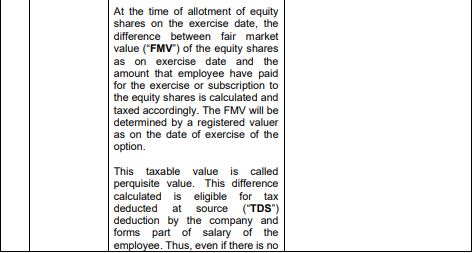

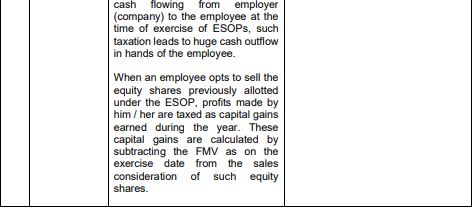

13. What are the variations involving an ESOP and sweat equity shares?